It’s the TACO trade.Wowza. Checked my retirement accounts, 529s and investment accounts as today is 6/1 and May was insane. I had no idea it was the best month in 30 years. I guess having a lot of unstable months ahead of it led to a great performance.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 5K

- Views: 213K

- Politics

superrific

Master of the ZZLverse

- Messages

- 12,416

Not quite. It was the best **May** since 1990. It was the best month since . . . November 2023.Wowza. Checked my retirement accounts, 529s and investment accounts as today is 6/1 and May was insane. I had no idea it was the best month in 30 years. I guess having a lot of unstable months ahead of it led to a great performance.

- Messages

- 2,551

How’s that YTD looking?Wowza. Checked my retirement accounts, 529s and investment accounts as today is 6/1 and May was insane. I had no idea it was the best month in 30 years. I guess having a lot of unstable months ahead of it led to a great performance.

JCTarheel82

Inconceivable Member

- Messages

- 2,522

HintonJamesHeel

Esteemed Member

- Messages

- 727

I said it was after a lot of bad months but the s&p is green for the year so that’s a positive.How’s that YTD looking?

- Messages

- 5,217

Consumers Are Financing Their Groceries. What Does It Say About the Economy?

Increased use of “buy now, pay later” loans may signal shifting consumer habits, but could also be a troubling sign of financial stress.

Consumers Are Financing Their Groceries. What Does It Say About the Economy?

Increased use of “buy now, pay later” loans may signal shifting consumer habits, but could also be a troubling sign of financial stress....

Mrs. Hodge, 29, is hardly alone. Nearly a quarter of consumers using buy now, pay later loans finance groceries, up from 14 percent a year ago, according to a recent LendingTree survey. And it’s not just groceries; more Americans are using these loans to pay for recurring monthly bills, such as electricity, heat, internet and streaming services like Hulu.

Consumers can break up gasoline purchases into installments or pay for the burrito or burger order delivered to their home in bite-size pieces. People are going on social media to share tips on how to use the short-term financing even for rent.

While some borrowers say the loans are a useful way to manage cash flow, others say the increased use of buy now, pay later plans for day-to-day essentials is a troubling sign that more consumers are financially stressed.

- Messages

- 1,042

Wall Street stocks end higher on Nvidia, trade talks hopes

https://www.reuters.com/business/us-stock-futures-dip-investors-await-trade-negotiations-2025-06-03/

Trade talks hopes??

ChileG

Inconceivable Member

- Messages

- 3,159

If Trump had done nothing with tariffs and just stayed the course, do you think the S&P would be looking worse, better, or significantly better?I said it was after a lot of bad months but the s&p is green for the year so that’s a positive.

- Messages

- 41,458

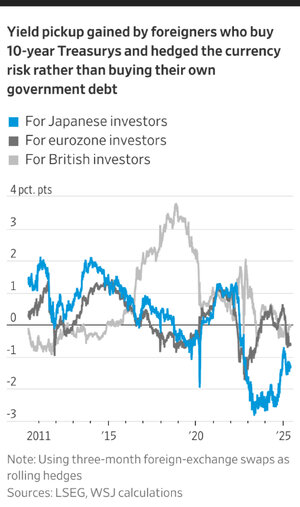

Global Investors Have a New Reason to Pull Back From U.S. Debt

After hedging currency risk, foreign investors no longer make money buying American bonds

“Foreign investors have plenty of reasons to be wary of U.S. government debt at the moment. Now there is another: They can often receive better returns buying bonds in their own countries.

The risk of a weaker U.S. dollar and the cost of protecting against that risk, are making American assets less attractive around the world. That comes at a bad time for the U.S. Treasury market, which is already contending with a darkening U.S. budget picture and the trade war….”

- Messages

- 8,287

Your boy is talking about bringing everything back to the US then this.Thanks, but is that all we’ve got on why this is bad? Was expecting a little more substance from the board that knows for sure what’s best for everybody and everything.

I am not sure, economically, if thus is bad, but how is this the America First that trump keeps selling?

- Messages

- 8,287

All over the place. I'm finally back positive YTD.How’s that YTD looking?

- Messages

- 8,287

And what do you attribute that to?I said it was after a lot of bad months but the s&p is green for the year so that’s a positive.

Is it the great economy of trump or is it that they are factoring in TACO and not overreacting to the bullshit he spews daily?

HintonJamesHeel

Esteemed Member

- Messages

- 727

I think the economy is so strong. Trumps madness has made everything underperform to what it likely would be if he had never started with the Liberation Day craziness.And what do you attribute that to?

Is it the great economy of trump or is it that they are factoring in TACO and not overreacting to the bullshit he spews daily?

Bigs23

Inconceivable Member

- Messages

- 3,096

A couple of horrific months.Wowza. Checked my retirement accounts, 529s and investment accounts as today is 6/1 and May was insane. I had no idea it was the best month in 30 years. I guess having a lot of unstable months ahead of it led to a great performance.

Bouncing back below where you were 2 months ago isn’t a W.

- Messages

- 8,287

I read this a few days back, this is crazy.

Consumers Are Financing Their Groceries. What Does It Say About the Economy?

Increased use of “buy now, pay later” loans may signal shifting consumer habits, but could also be a troubling sign of financial stress.www.nytimes.com

Consumers Are Financing Their Groceries. What Does It Say About the Economy?

Increased use of “buy now, pay later” loans may signal shifting consumer habits, but could also be a troubling sign of financial stress.

...

Mrs. Hodge, 29, is hardly alone. Nearly a quarter of consumers using buy now, pay later loans finance groceries, up from 14 percent a year ago, according to a recent LendingTree survey. And it’s not just groceries; more Americans are using these loans to pay for recurring monthly bills, such as electricity, heat, internet and streaming services like Hulu.

Consumers can break up gasoline purchases into installments or pay for the burrito or burger order delivered to their home in bite-size pieces. People are going on social media to share tips on how to use the short-term financing even for rent.

While some borrowers say the loans are a useful way to manage cash flow, others say the increased use of buy now, pay later plans for day-to-day essentials is a troubling sign that more consumers are financially stressed.

Having to finance the basic necessities of life isn't a good sign.

I thought trump was going to drop prices dat one? I guess this is that pain that we got instead....

HintonJamesHeel

Esteemed Member

- Messages

- 727

It is. Go back and look at the commentary after Liberation Day.A couple of horrific months.

Bouncing back below where you were 2 months ago isn’t a W.

- Messages

- 8,287

Not fully following.I think the economy is so strong. Trumps madness has made everything underperform to what it likely would be if he had never started with the Liberation Day craziness.

I believe the economy was much better if trump would have not started his tariff BS. are you saying the same?

Bigs23

Inconceivable Member

- Messages

- 3,096

I think he’s saying trump’s dumb ass has artificially slowed growth which in reality is a huge loss.Not fully following.

I believe the economy was much better if trump would have not started his tariff BS. are you saying the same?

- Messages

- 8,287

So it's a win since it didn't end up as bad as predicted? Money wise I was on a much better path before trumponomics started.It is. Go back and look at the commentary after Liberation Day.

Bigs23

Inconceivable Member

- Messages

- 3,096

It’s not. He has nullified what otherwise would have been a profitable period. He screwed up a fool proof situation.It is. Go back and look at the commentary after Liberation Day.

Share: