superrific

Master of the ZZLverse

- Messages

- 12,420

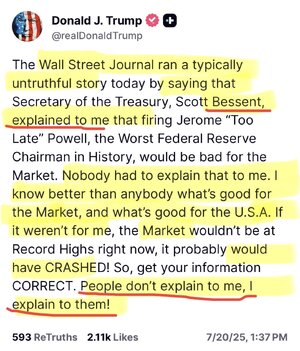

I was thinking about this more last night. What we saw yesterday was a surge in **retail sales.** We have also seen less impact on inflation than we thought, but inflation is also about retail sales.I'm not nearly as economically literate as a bunch of people here but I feel exactly the same way. It feels like there's just a massive disconnect right now between the markets, the real time data, and the projections of future growth by the experts. I'm not complaining, as it's great for investment accounts, but I just don't see a credible explanation for this being sustainable.

So we know that businesses are basically putting off expansion plans amidst the uncertainty. Which should cause a collapse in demand in business investment. So production that was geared to the B2B market gets directed to retail, which spikes retail sales and keeps inflation down at that level because there's a glut.

If this is the story, then GDP will come in at less than what the retail numbers might suggest, and it would also cause GDP to shrink in the medium term as well (or shrink relative to the 2010-2024 long term growth trend).