Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 5K

- Views: 211K

- Politics

- Messages

- 40,969

lawtig02

Legend of ZZL

- Messages

- 5,853

- Messages

- 3,619

I read a read a report, or maybe saw an interview a couple years ago, that stated for every graduate we have from a trade school (plumbers, welders, masons, HVAC techs, etc) 5-10 age out.

There will be increasing demand for these jobs... unless Trump just completely tanks the country.

- Messages

- 4,043

At this point do we really need job creation for real people when AI can perform the jobs ?

The positive is AI don't need no stinkin' vacation or sick leave days, family leave, retirement plan, OSHA protection, Social Security, or health insurance...

WINNING !

The positive is AI don't need no stinkin' vacation or sick leave days, family leave, retirement plan, OSHA protection, Social Security, or health insurance...

WINNING !

Depends on the owners of the AI. I asked a bot to be snarky and use pirate language and it got way more annoying than someone feeling like they're entitled to affordable healthcare, food and shelter.At this point do we really need job creation for real people when AI can perform the jobs ?

The positive is AI don't need no stinkin' vacation or sick leave days, family leave, retirement plan, OSHA protection, Social Security, or health insurance...

WINNING !

- Messages

- 40,969

Oh yeah, POTUS and his team should be held to a much higher standard than us ordinary joes and janes.True, but one would think the President of the United States shouldn't share in that confusion.

- Messages

- 40,969

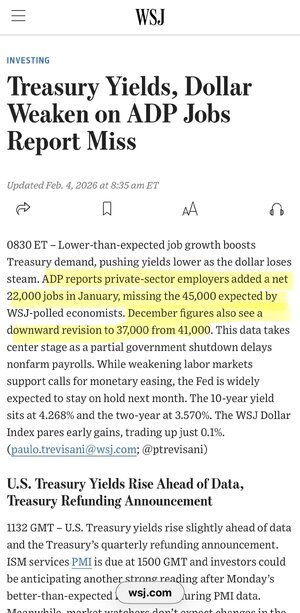

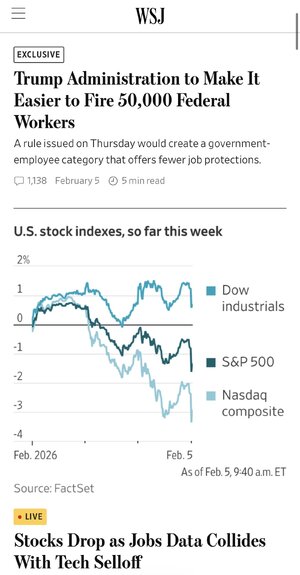

Of course, to a point a weaker U.S. dollar is not inherently bad (cost/benefit). And a weaker dollar is a stated policy goal of many folks on the Trump economic team, so they may see this as evidence that their plans are working.

But the typical corresponding benefits of a weak dollar are not in evidence — for instance, it should lead to a tourism boom from foreigners wanting to take advantage of the weak dollar to visit the USA, but other related policies are depressing foreign tourist visits to the USA.

It does appear to be helping the foreign earnings of multinational corporations — though that is something of a paper benefit unless the earnings are actually repatriated and converted to U.S. dollars (which potentially creates unwanted tax liabilities).

And we have seen growth in U.S. exports in 2025.

But a weaker dollar also creates domestic inflationary pressure due to increased costs of imports, particularly in the construction and electronics industries (that’s before adding on tariffs). A weaker dollar makes it a lot harder to get back to the pre-COVID fed target of 2% inflation — and other policies that undercut typical benefits of a weaker dollar (like immigration policies depressing foreign tourism) create a lot of negative pressure on domestic small businesses that don’t rely on exports and on domestic consumers.

- Messages

- 40,969

Of course, to a point a weaker U.S. dollar is not inherently bad (cost/benefit). And a weaker dollar is a stated policy goal of many folks on the Trump economic team, so they may see this as evidence that their plans are working.

But the typical corresponding benefits of a weak dollar are not in evidence — for instance, it should lead to a tourism boom from foreigners wanting to take advantage of the weak dollar to visit the USA, but other related policies are depressing foreign tourist visits to the USA.

It does appear to be helping the foreign earnings of multinational corporations — though that is something of a paper benefit unless the earnings are actually repatriated and converted to U.S. dollars (which potentially creates unwanted tax liabilities).

And we have seen growth in U.S. exports in 2025.

But a weaker dollar also creates domestic inflationary pressure due to increased costs of imports, particularly in the construction and electronics industries (that’s before adding on tariffs). A weaker dollar makes it a lot harder to get back to the pre-COVID fed target of 2% inflation — and other policies that undercut typical benefits of a weaker dollar (like immigration policies depressing foreign tourism) create a lot of negative pressure on domestic small businesses that don’t rely on exports and on domestic consumers.

In any event, I saw the impact of a weaker dollar and tariffs when ordering a gift for my mom from France yesterday — I had not noticed the FX rate had moved the dollar that low against the Euro.

- Messages

- 3,068

Yeah, the Euro conversion is ugly.In any event, I saw the impact of a weaker dollar and tariffs when ordering a gift for my mom from France yesterday — I had not noticed the FX rate had moved the dollar that low against the Euro.

- Messages

- 4,043

Of course, to a point a weaker U.S. dollar is not inherently bad (cost/benefit). And a weaker dollar is a stated policy goal of many folks on the Trump economic team, so they may see this as evidence that their plans are working.

But the typical corresponding benefits of a weak dollar are not in evidence — for instance, it should lead to a tourism boom from foreigners wanting to take advantage of the weak dollar to visit the USA, but other related policies are depressing foreign tourist visits to the USA.

It does appear to be helping the foreign earnings of multinational corporations — though that is something of a paper benefit unless the earnings are actually repatriated and converted to U.S. dollars (which potentially creates unwanted tax liabilities).

And we have seen growth in U.S. exports in 2025.

But a weaker dollar also creates domestic inflationary pressure due to increased costs of imports, particularly in the construction and electronics industries (that’s before adding on tariffs). A weaker dollar makes it a lot harder to get back to the pre-COVID fed target of 2% inflation — and other policies that undercut typical benefits of a weaker dollar (like immigration policies depressing foreign tourism) create a lot of negative pressure on domestic small businesses that don’t rely on exports and on domestic consumers.

The problem is that in the past Trump relied on his national security adviser to inform him about the nuances regarding the dollar. Unfortunately he is not in the administration to offer Trump his advice this time around.

The Trouble With Trump's 3 a.m. Phone Call

The president pondered a reasonable economics question—but who he reportedly dialed for answers raises questions of its own.

Trump Called General at 3AM to Ask Whether Strong Dollar is Good

Trump Called General at 3AM to Ask Whether Strong Dollar is Good

Last edited:

- Messages

- 40,969

Share: