superrific

Master of the ZZLverse

- Messages

- 12,022

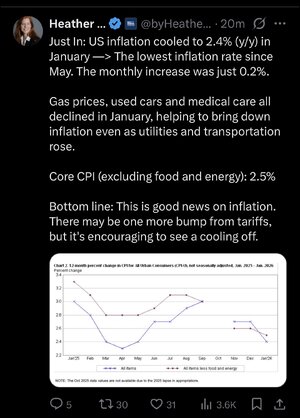

1. When we talk about job creation, it's indeed that -- job creation. If a person retires and another person takes that job, it counts as no job growth.Not an economist here, but ... I thought I heard at some point that in a good economy, hiring SHOULD be in the neighborhood of 200,000 jobs per month to support new entrants into the job market and to replace those retiring. 30,000 per month sounds like somebody's not getting the job done. Or perhaps somebody's (ICE? CBP?) getting a bad job done way too well.

2. The necessary job growth to support new entrants is basically "number of people entering the labor market - number of people retiring" as that nets you the total increase in job seekers.

3. It isn't 200K any more. It's probably more like 100, 110K. But it's more than what we are seeing now.

4. Deportations do affect the number of jobs necessary to create -- a deportation is someone who leaves the work force and is essentially a retiree.

5. But the tell is not only the paucity of job creation; it's the paucity of the hiring.