I.M.F. Raises U.S. Economic Forecast as Other Regions Lag

It is projecting 2.7 percent growth for 2025. But uncertainty about pending Trump policies looms over the global economic trajectory.

“… The I.M.F. projects 2.7 percent U.S. economic growth in 2025 in its latest World Economic Outlook report, up from an estimate of 2.2 percent. That stands in stark contrast to reduced growth projections for the euro area, which the fund attributed in large part to weakness in the manufacturing sector and heightened political uncertainty.

“The big story is the divergence between the U.S. and the rest of the world,” Pierre-Olivier Gourinchas, the I.M.F.’s chief economist, said on a call with reporters this week. “We have stronger potential output growth in the U.S. compared to prepandemic, and we have weaker potential growth in other areas, like the euro area or China.”

New economic forecasts released by the fund on Friday build on its

analysis in October, which showed that concerns about a postpandemic global contraction appear to have been averted, even though growth remains sluggish in many countries. Economists at the I.M.F. expect global output to grow 3.3 percent this year and next, according to the updated report, slightly above the fund’s previous projections.

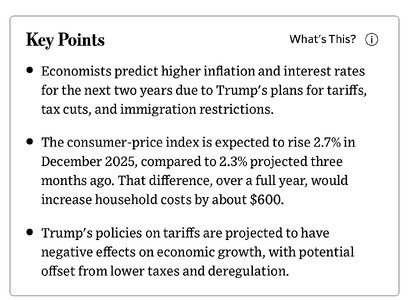

… Looser fiscal policy, including tax cuts, could boost U.S. growth in the short term, the I.M.F. said in its report. “In the near term, the risks could increase the divergence between the U.S. and the rest of the world that is already underway,” Mr. Gourinchas added.

But the fund warned that expansionary measures could disrupt markets and the economy in the longer run. And while potential deregulation under President-elect Donald J. Trump could spur investment and short-term growth, the I.M.F. said an “excessive” rollback of regulations could eventually create “boom-bust dynamics” for the United States, with spillover effects elsewhere. …”