This isn't going to be terribly responsive but not completely off topic. First, contractors are a lot more competitive than collusive and pricing ranges are so different what he said wouldn't really happen directly. It would more likely manifest as upselling. That was my experience in 40 years of carpentry and such.

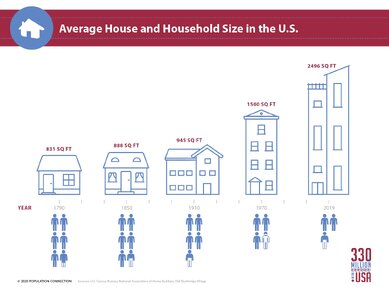

Some of the current costs are going to come down. The question will be if they are passed along. Both technology and green energy prices will decrease effectively as they continue to mature. I have no idea why people seem to be blind to how much new tech and new code requirements have added to home costs. I'll bet my son's new house has 3 miles of speaker and computer network wiring , solar batteries and a computer room that would run a small business. Of course , much of that is excessive and he knew it but even adjusted for inflation, he could have bought a three bedroom house for that money in 1968.

Also, in 68, you may or may not have had to have any insulation, any form of heat, any solid sheathing or an enclosed foundation.