- Messages

- 24,843

I posted this in the Current Events thread but it really struck a chord with me due to some recent personal experiences:

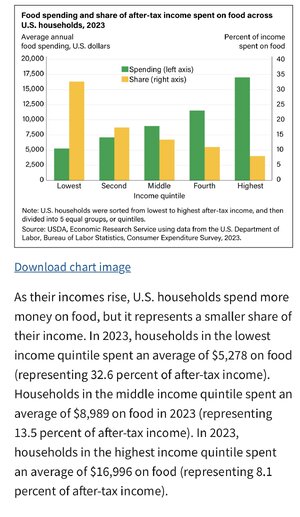

Just this past Sunday, I stopped at a grocery store I had not previously visited in a less well off part of my county on my way home from the mountains to grab a few things for the week. It is a very nice Ingles. But by some coincidence there were two different families circling the aisles at the same time I was and I couldn’t help but overhear both families having separate pressure due to grocery prices.

One family had their kids with them and were more in a constant put that back, everything costs so much you only get one treat and then the parents were huddled in the meat aisle talking about how they could save on meat to get something for the kids.

The other was a couple having a tense back and forth about their grocery list and prices. Several times the guy picks up something and loudly declares how expensive it is and the wife retorts with some version of see, I keep telling you, we can’t get a week’s groceries on this budget. I keep telling you I can’t afford this And that, we have to make do.

I’ve also heard repeatedly from elderly relatives how shocking grocery prices are for a few bags of food.

I know the data shows that wages have also increased dramatically. And I know the working class is always struggling to meet monthly budgets and pay all the bills. That was my family for a long time when I was a kid. For years I kept a running tally of the $$ in our cart because we had a very fixed budget that had to be stretched and plenty of times my mom made me double check my total and then had to go back through the cart and either put stuff back or trade down to a cheaper option. I learned basic division very early to help sort out the price per unit of different size packages and got a calculator for one Christmas (when a handheld calculator was still expensive, at least to us) to share with my mom not just for school (when we were still doing basic grade school multiplication tables and math so I didn’t even need a calculator) but also to help with the grocery tallies and for my mom balancing the checkbook before going grocery or clothes shopping.

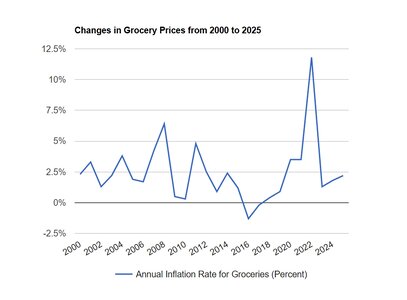

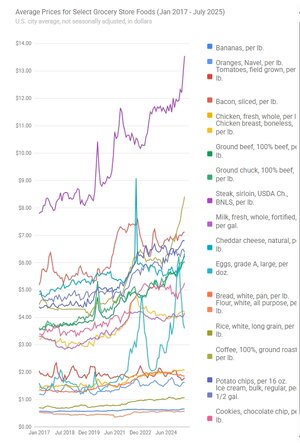

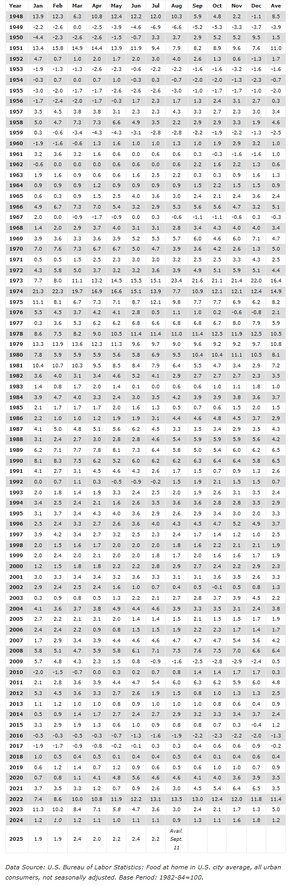

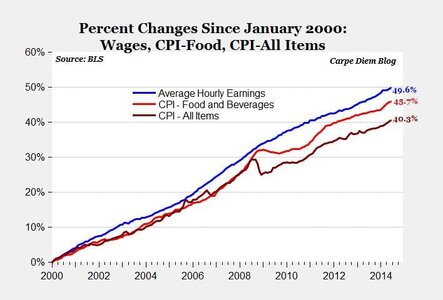

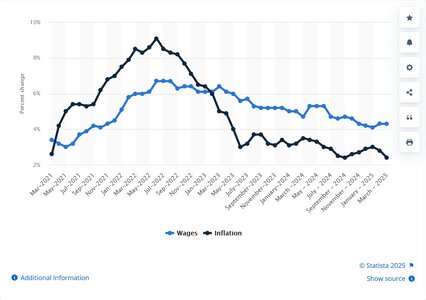

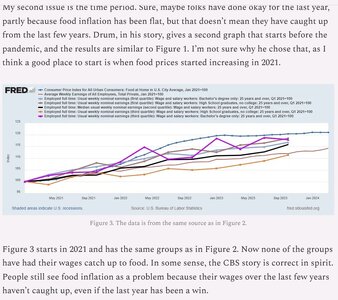

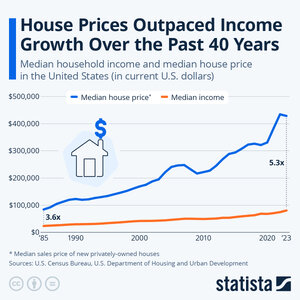

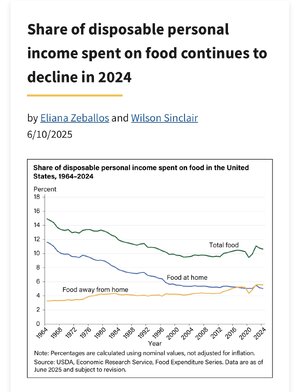

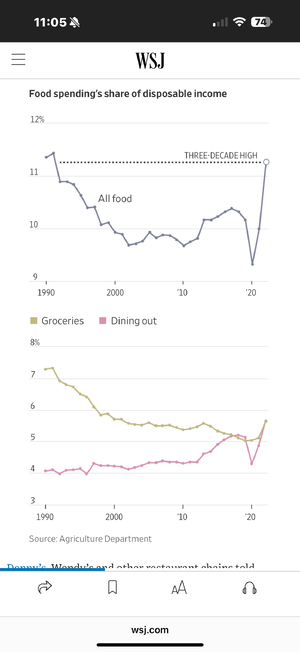

But I’ve also been insulated from any pain of grocery costs for decades now, and I admit I seem too focused on macroeconomic data that suggests that wages and grocery costs are historically out of whack, but a lot of Americans are individually having a very different experience (maybe because the historic cost of housing is high now, which is pressuring everything else?).

Anyway, we’ve played political football with egg prices, which had external but seasonal inflationary pressures from bird flu resulting in wild price swings, but it seems there is something more serious afoot. And grocery prices seem to be a flashpoint for working class Americans.

But what can be done?

Just this past Sunday, I stopped at a grocery store I had not previously visited in a less well off part of my county on my way home from the mountains to grab a few things for the week. It is a very nice Ingles. But by some coincidence there were two different families circling the aisles at the same time I was and I couldn’t help but overhear both families having separate pressure due to grocery prices.

One family had their kids with them and were more in a constant put that back, everything costs so much you only get one treat and then the parents were huddled in the meat aisle talking about how they could save on meat to get something for the kids.

The other was a couple having a tense back and forth about their grocery list and prices. Several times the guy picks up something and loudly declares how expensive it is and the wife retorts with some version of see, I keep telling you, we can’t get a week’s groceries on this budget. I keep telling you I can’t afford this And that, we have to make do.

I’ve also heard repeatedly from elderly relatives how shocking grocery prices are for a few bags of food.

I know the data shows that wages have also increased dramatically. And I know the working class is always struggling to meet monthly budgets and pay all the bills. That was my family for a long time when I was a kid. For years I kept a running tally of the $$ in our cart because we had a very fixed budget that had to be stretched and plenty of times my mom made me double check my total and then had to go back through the cart and either put stuff back or trade down to a cheaper option. I learned basic division very early to help sort out the price per unit of different size packages and got a calculator for one Christmas (when a handheld calculator was still expensive, at least to us) to share with my mom not just for school (when we were still doing basic grade school multiplication tables and math so I didn’t even need a calculator) but also to help with the grocery tallies and for my mom balancing the checkbook before going grocery or clothes shopping.

But I’ve also been insulated from any pain of grocery costs for decades now, and I admit I seem too focused on macroeconomic data that suggests that wages and grocery costs are historically out of whack, but a lot of Americans are individually having a very different experience (maybe because the historic cost of housing is high now, which is pressuring everything else?).

Anyway, we’ve played political football with egg prices, which had external but seasonal inflationary pressures from bird flu resulting in wild price swings, but it seems there is something more serious afoot. And grocery prices seem to be a flashpoint for working class Americans.

But what can be done?

Last edited: