Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Grocery Prices | SNAP benefits

- Thread starter nycfan

- Start date

- Replies: 390

- Views: 10K

- Politics

- Messages

- 1,147

ol tv con don

- Messages

- 2,953

On which planet are grocery prices down? The prices that were killing the middle class a year ago are much higher now.

MOUNTAINH33L

Iconic Member

- Messages

- 1,070

MAGA Planet!On which planet are grocery prices down? The prices that were killing the middle class a year ago are much higher now.

- Messages

- 39,917

AMERICA’S GROCERY LIFELINE IS FRAYING

Inflation and tariffs are hitting canned food just when the most vulnerable Americans need to stock up.“… Canned foods have been a lifeline in lean times because they’re long-lasting, generally nutritious, and, most of all, cheaper than their fresh counterparts—largely because the necessary materials could be imported reliably and cheaply.

Canning requires a special type of metal called tin-mill steel, which the U.S. imports from Canada, Germany, the United Kingdom, and the Netherlands, Tom Madrecki, vice president of supply-chain resiliency at the Consumer Brands Association, told me. Tin-mill steel is unwieldy and fragile, he said, and less valuable than steel meant for cars and machinery. So U.S. steel manufacturers have deprioritized making it.

As a result, the U.S. produces only about 20 percent of the tin-mill steel used by domestic can manufacturers, Scott Breen, the president of the Can Manufacturers Institute, a trade group, told me.

“We have no choice but to import the other 80 percent,” he said.

Since Trump’s first term, those imports have been subject to a 25 percent tariff; in June, it rose to 50 percent for steel coming from most countries.

Trump’s tariffs are meant to stimulate American manufacturing, but the U.S. is simply not equipped to produce enough tin-mill steel: Since 2018, the nation’s 12 plants have dwindled to three, and there’s no sign of further investment, Breen said.

The administration has not yet heeded the canning industry’s calls for a tariff exemption on tin-mill steel.

Trade negotiations with Canada, which involved metal tariffs, recently disintegrated. (The U.S. also imports roughly $2 billion worth of canned food a year, Breen said—about 10 percent of the national supply. According to the Can Manufacturers Institute, nearly a quarter of that food comes from China, which negotiated a 47 percent average tariff on imports that Trump announced yesterday morning.)“

- Messages

- 39,917

I posted this in current events, but for completeness here:

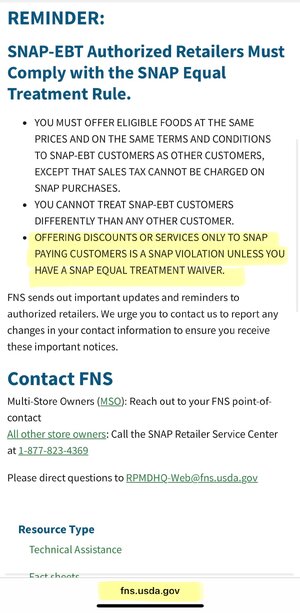

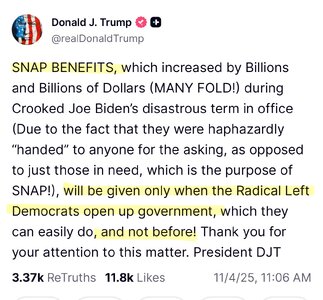

It appears that the Trump Administration has reinterpreted a SNAP rule prohibiting stores that accept SnAP from offering discounts to customers who pay in cash (so charging SNAP recipients more for the same groceries than cash-paying customers) to also mean that grocery stores cannot offer discounts to SNAP recipients now while SNAP benefits are withheld of delayed during the shutdown.

www.newsweek.com

www.newsweek.com

“The U.S. Department of Agriculture (USDA) has told grocery stores not to give special discounts to around 42 million Americans who use food stamps.

… USDA emailed grocery stores around the country telling them not to offer special discounts or deals to SNAP recipients amid the freeze, warning that doing so would violate the program’s “Equal Treatment Rule.”

That rule requires stores to sell eligible food items to SNAP-EBT customers at the same prices and under the same conditions as other shoppers.

The email said: “Offering discounts or services only to SNAP-eligible customers is a SNAP violation unless you have a SNAP equal treatment waiver.” …”

It appears that the Trump Administration has reinterpreted a SNAP rule prohibiting stores that accept SnAP from offering discounts to customers who pay in cash (so charging SNAP recipients more for the same groceries than cash-paying customers) to also mean that grocery stores cannot offer discounts to SNAP recipients now while SNAP benefits are withheld of delayed during the shutdown.

SNAP update: USDA tells grocery stores not to give discounts to customers

The USDA told grocery stores not to give SNAP recipients special discounts as benefits remain unpaid amid the government shutdown.

SNAP Update: USDA Tells Grocery Stores Not to Give Discounts to Customers [who use SNAP]

“The U.S. Department of Agriculture (USDA) has told grocery stores not to give special discounts to around 42 million Americans who use food stamps.

… USDA emailed grocery stores around the country telling them not to offer special discounts or deals to SNAP recipients amid the freeze, warning that doing so would violate the program’s “Equal Treatment Rule.”

That rule requires stores to sell eligible food items to SNAP-EBT customers at the same prices and under the same conditions as other shoppers.

The email said: “Offering discounts or services only to SNAP-eligible customers is a SNAP violation unless you have a SNAP equal treatment waiver.” …”

- Messages

- 39,917

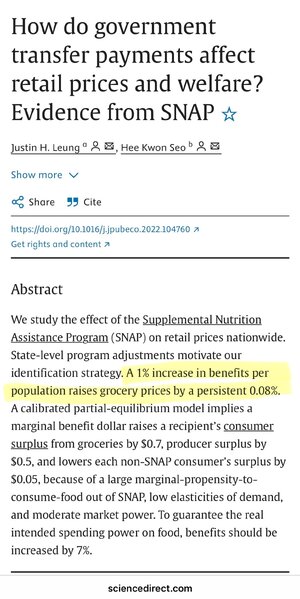

Also, here is a economist’s blog post refuting (a) MAGA claims that SNAP is to blame for grocery inflation and (b) Democratic claims about the multiplier benefit of SNAP — I offer it mostly as a pretty good quick summary on competing claims about the impact of SNAP:

economistwritingeveryday.com

economistwritingeveryday.com

Bad Claims About Food Stamps (SNAP)

One of the likely effects of the federal government shutdown is that recipients of SNAP benefits (what used to be officially called “food stamps,” a term still used by the general publi…

- Messages

- 39,917

- Messages

- 39,917

“… We estimate that a 1% increase in benefits per population causes a moderate and persistent increase in grocery-store prices of 0.08%. The effect is stronger in counties with higher SNAP participation rates and higher grocery market concentration. Increases in sales, after controlling for price effects, are also larger in counties with higher SNAP participation rates. We estimate small and statistically insignificant effects on other store types, firm dynamics such as retailer entry and exit, and market structure. We estimate a positive price effect not only for SNAP-eligible products but also for SNAP-ineligible products, although the sales effect is much stronger in high-participation counties for SNAP-eligible goods but not for SNAP-ineligible goods. We regard this as evidence consistent with multi-product pricing models such as that of Chen and Rey (2012), suggesting that retailers are able to raise markups on both eligible and ineligible products….”

- Messages

- 39,917

How SNAP Cuts Will Impact American Communities

How SNAP Cuts Will Impact American Communities | The Harvard Kenneth C. Griffin Graduate School of Arts and Sciences

The cuts to the Supplemental Nutrition Assistance Program in President Trump’s “big beautiful bill” will have a devastating impact on food-insecure families and the communities in which they live, according to University of Southern California sociologist Leah Gose, PhD ’23.

“… The USDA estimates that even in a weak economy, every dollar of SNAP spending generates about $1.50 in economic activity. That means the program boosts not only household budgets but also the broader communities in which recipients live. It reduces food insecurity, yes, but it also helps people avoid impossible choices—like whether to buy groceries or fill a prescription. For low-income families, being able to afford food often determines whether they can afford medicine.

… Research shows that about 45 percent of food pantry users are already on SNAP. So for many households, SNAP isn’t a standalone solution—it’s one link in a chain. People might use SNAP, formerly food stamps, visit pantries or soup kitchens, and rely on community networks just to stay afloat. SNAP keeps people from falling off a cliff. If you cut it, you’re not trimming fat—you’re breaking a vital link in that chain.

… [OBBB] includes a provision to cap the TFP going forward, meaning that even as food costs rise, SNAP benefits won’t increase to match them. That erodes the value of every SNAP dollar. …”

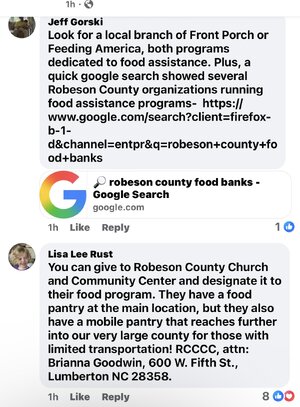

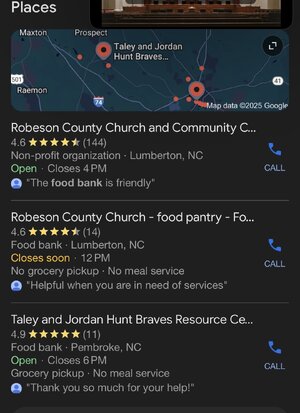

NYCfan had suggested I share info that might lead to money coming to a county where 40 percent of the people depend somewhat on SNAP. So I did something on Facebook. The google link is pretty good.

www.facebook.com

www.facebook.com

Log into Facebook

Log into Facebook to start sharing and connecting with your friends, family, and people you know.

www.facebook.com

www.facebook.com

gtyellowjacket

Inconceivable Member

- Messages

- 2,993

I remember George HW Bush was amazed at grocery store scanners when he went into a grocery store during a campaign stop. Pretty sure they had been in place for a decade at that point. Supermarket scanner moment was shorthand for a while about a politician being out of touch.

And as it turned out, I learned today almost a quarter century later, that it was a complete myth. The President was at a grocery convention and was amazed at genuinely new scanner technology that allowed produce to be weighed and damaged barcodes to be read. One reporter from the Houston chronicle mentioned that older Bush was amazed by the technology but didn't give the context. The New York Times picked it up and ran with it.

Supermarket scanner moment - Wikipedia

Last edited:

- Messages

- 39,917

NYCfan had suggested I share info that might lead to money coming to a county where 40 percent of the people depend somewhat on SNAP. So I did something on Facebook. The google link is pretty good.

Log into Facebook

Log into Facebook to start sharing and connecting with your friends, family, and people you know.www.facebook.com

- Messages

- 1,579

Why aren't they hammering Trump on the Mar-a-Lardo Gatsby party? That's a(nother) turnkey gift-wrapped campaign ad.

Share: