Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tariffs Catch-All

- Thread starter BubbaOtis

- Start date

- Replies: 5K

- Views: 178K

- Politics

JCTarheel82

Inconceivable Member

- Messages

- 2,532

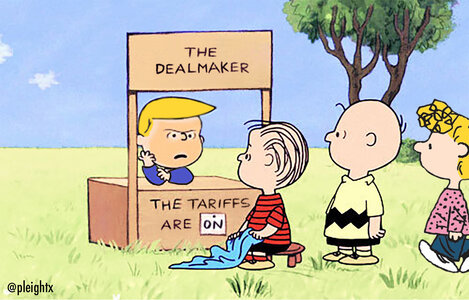

Trump is one of the great fiction writers of our time.Just a fountain of nonsense. The guy lies with every breath, unless he’s talking about himself, in which case he reveals with every breath his malignant intentions.

- Messages

- 2,395

Prolific but not terribly talented.Trump is one of the great fiction writers of our time.

Mulberry Heel

Inconceivable Member

- Messages

- 4,000

I can’t decide whether it’s just that Bessent lacks speaking/PR skills or he is struggling to make up excuses for Trump and his changing claims and policies.

Trump 1.0 was awful and still a shitshow, but at least he did have some competent (or non-insane) people (Kelly, Mnuchin, Haley, etc.) around who, at least in private, were either willing to stand up to him occasionally or just ignore his orders and run their agency or department without causing too much damage. That's not to say that these people were ethical or decent or not hard-right or didn't hurt people in their jobs, but they at least had some knowledge of what they were doing and were competent enough to hold their jobs. Trump clearly resented most of these people (like Kelly) and in his second term was determined to appoint nothing but blind loyalists and lackeys who would do only his bidding, and whether they were competent or just sane has not been a consideration.

So now in Trump 2.0 he is surrounded by nothing but sycophants and ass-kissers and loons who only real job is to blow smoke up Trump's ass at cabinet meetings and tell him how great he is all the time and aggressively defend him in public at every opportunity, as they know that Trump carefully watches them on television and social media. It's likely how Hegseth has survived this long - he's been very aggressive in trolling liberals and denying any wrongdoing. Trump knows that Hegseth will do whatever Trump wants without hesitating, no matter how odious or unconstitutional or just crazy it is. It's a mob boss mentality taken into the Oval Office, except that even mob bosses expect some competency from their lackeys, which Trump doesn't. Bessent (and even more Navarro) fit his pattern perfectly.

- Messages

- 5,217

Dutch people booking far fewer holiday trips to the United States

People based in the Netherlands booked far fewer holidays to the United States last month. Vacation reservations to the U.S. fell by 30 percent last month compared to March 2024, according to the monitoring service from travel agent association ANVR and market research firm NielsenIQ.

Dutch people booking far fewer holiday trips to the United States

People based in the Netherlands booked far fewer holidays to the United States last month. Vacation reservations to the U.S. fell by 30 percent last month compared to March 2024, according to the monitoring service from travel agent association ANVR and market research firm NielsenIQ.

Last week, the International Trade Administration reported that fewer foreign travellers flew to the U.S. in March. This is because a growing number of people are put off by policies from President Donald Trump’s administration since his return to the White House in January, the American government office said.

This effect now also seems to be apparent in the Netherlands. “This decline occurred in all regions within the US. Canada also saw a similar percentage decline in bookings, but this can be better explained by a one-time peak in bookings in March 2024,” said ANVR representative Walter Schut.

- Messages

- 5,217

Mazda has confirmed it will halt production of CX-50 vehicles bound for Canada due to the tariffs in the U.S. and the corresponding retaliatory measures enacted in Canada.

The company confirmed that production at its Huntsville, Alabama, plant will be suspended beginning on May 12.

The plant produces the CX-50 vehicles for the North American market. The duration of the suspension has yet to be determined.

The company confirmed that production at its Huntsville, Alabama, plant will be suspended beginning on May 12.

The plant produces the CX-50 vehicles for the North American market. The duration of the suspension has yet to be determined.

Most prolific…….nothing great about him.Trump is one of the great fiction writers of our time.

- Messages

- 5,217

The Publisher of Wingspan and Other Board Games to Sue over Trump's Tariffs

Stonemaier Games, the publisher of board games like Wingspan, are suing over Trump's tariffs, which threaten the tabletop industry.

Americans have gotten used to asking certain questions over the last three months. Chief among them: “What the hell is going on?” “Why are they doing this?” “How is this legal?” “Do they want everybody to die?” And, most commonly, “Who’s going to stop this?” Congress, the Supreme Court, the Democrats, Wall Street, and the entire American legal system have all shown little interest or ability in trying to stop the Trump Administration’s non-stop assault on America’s institutions, but one brave organization has stepped forward to defend America. And it’s the people who brought us games like Tokaido and Wingspan.

Stonemaier Games, the tabletop publisher behind Elizabeth Hargrave’s phenomenon Wingspan and its various spinoffs, has joined a lawsuit over Trump’s tariffs. As they explain in a post on their site, the U.S. based company faces almost $1.5 million in tariffs on products they commissioned from their Chinese printing partners before the tariffs were implemented. Trump’s 145% tariffs on products imported from China will force Stonemaier to pay $14.50 on every $10 they spend on manufacturing. In their post Stonemaier makes no bones about who they blame for the tariffs, decrying “the unchecked authority of the executive branch” and claiming companies like theirs are being “treated like pawns in a political game.”

- Messages

- 1,951

Bessent keeps going off script.

- Messages

- 1,850

Trump probably thinks 'hey, I thought Bessent was talking to China.' Kakistocracy in action.

- Messages

- 41,588

- Messages

- 2,395

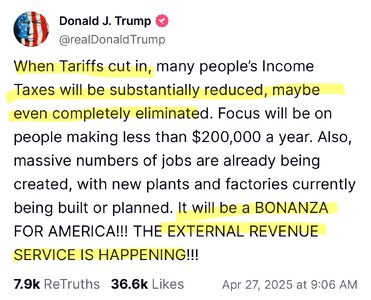

Obvious lies, but the press doesn't challenge him on that.

Bigs23

Inconceivable Member

- Messages

- 3,113

I wonder if he is lying about tariffs and taxes?Obvious lies, but the press doesn't challenge him on that.

He’s poorly educated and extremely poorly read since his lackluster college career.

He’s likely in some stage of dementia.

No one tells him the emperor has no clothes.

He might believe the BS he spewed in that clip.

- Messages

- 1,850

It's great that tariffs will reduce taxes, because we'll need that money to pay for the inflated prices of goods. Winning!

superrific

Master of the ZZLverse

- Messages

- 12,447

Especially since tariffs are taxes. Kinda miraculous.It's great that tariffs will reduce taxes

Share: