Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tariffs Catch-All

- Thread starter BubbaOtis

- Start date

- Replies: 5K

- Views: 178K

- Politics

HandsonFire

Esteemed Member

- Messages

- 667

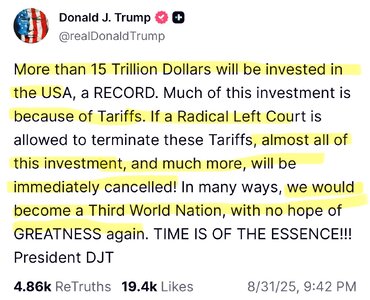

Yeah a MAGA buddy of mine just posted this. He believes it 100%. Believes manufacturing is coming back to the US, Donal is the only politician that cares about them.

I got a bill for a business part yesterday. For the first time ever, a tariff charge was tacked on. Part cost = $1,175.44. TARIFFS = $324.56.

Wonder when I can expect China to pay that tariff for me? How about the billionaires who got the tax cut? Are any of them going to step up?

Just a real-world example of the practice of bad economics (with a heapin' helpin' of disinformation thrown in for good measure).

Wonder when I can expect China to pay that tariff for me? How about the billionaires who got the tax cut? Are any of them going to step up?

Just a real-world example of the practice of bad economics (with a heapin' helpin' of disinformation thrown in for good measure).

heelslegup

Esteemed Member

- Messages

- 646

They better have a Plan B ready. The Constitution is pretty clear on tariffs

ChileG

Inconceivable Member

- Messages

- 3,165

This is what happens when you elect the galactically stupid.

heelslegup

Esteemed Member

- Messages

- 646

Smoot-Hawley: When one Great Depression is not enough!

Given the optics of that name, should probably go back to 19t Century and dig out another old tariff bill. Or just raise the max tax rate for large corps to 27% and add back in the extra 2& for people earming over $500,000

Given the optics of that name, should probably go back to 19t Century and dig out another old tariff bill. Or just raise the max tax rate for large corps to 27% and add back in the extra 2& for people earming over $500,000

- Messages

- 41,523

“… Call it The Chicken Little Defense: If the courts do not sign off on the administration’s tariffs, it “would be a total disaster for the Country” and “would literally destroy the United States of America,” Trump said on Friday after the U.S. Court of Appeals for the Federal Circuit ruled that the bulk of the president’s tariffs are illegal. He doubled down on those claims on Tuesday while tacking on the transparently ridiculous assertion that the U.S. is “taking in $17 trillion … because of tariffs.”

…In the petition to the Supreme Court filed on Wednesday night, the administration continued in this vein, saying that “the tariffs are promoting peace and unprecedented economic prosperity” and “pulling America back from the precipice of disaster, restoring its respect and standing in the world.”

This should all be seen for what it is — a tacit admission that the administration is on very weak footing as a legal matter. … A less generous read of the situation is that this is an effort to politically blackmail the court into giving Trump what he wants even if it is clearly unlawful or unconstitutional….”

- Messages

- 41,523

“… the Constitution gives Congress the authority to tax and impose tariffs. Over the years, Congress has delegated that authority to the executive branch in a handful of trade laws with a variety of procedural and substantive constraints designed to limit that authority.“… Call it The Chicken Little Defense: If the courts do not sign off on the administration’s tariffs, it “would be a total disaster for the Country” and “would literally destroy the United States of America,” Trump said on Friday after the U.S. Court of Appeals for the Federal Circuit ruled that the bulk of the president’s tariffs are illegal. He doubled down on those claims on Tuesday while tacking on the transparently ridiculous assertion that the U.S. is “taking in $17 trillion … because of tariffs.”

…In the petition to the Supreme Court filed on Wednesday night, the administration continued in this vein, saying that “the tariffs are promoting peace and unprecedented economic prosperity” and “pulling America back from the precipice of disaster, restoring its respect and standing in the world.”

This should all be seen for what it is — a tacit admission that the administration is on very weak footing as a legal matter. … A less generous read of the situation is that this is an effort to politically blackmail the court into giving Trump what he wants even if it is clearly unlawful or unconstitutional….”

By contrast, IEEPA — a statute that is generally used to impose economic sanctions — does not even contain the word “tariffs,” and before Trump, no president had attempted to use IEEPAto impose tariffs in the nearly 50 years since the statute has been on the books.

In fact, Congress passed IEEPA to limit the president’s emergency economic powers — not to give him the ability to impose a massive tax increase on Americans without congressional approval, or to disrupt the global financial system whenever he wants and for whatever reason he wants.

For liberal jurists, this alone should suffice to reject the president’s position, but the Trump administration’s proposed interpretation of IEEPA also runs afoul of the “major questions doctrine” developed in recent years by the Republican appointees on the Supreme Court. Under that doctrine, when an executive action crosses some undefined threshold of “economic and political significance,” there must be a clear delegation of authority from Congress. If that does not exist, then the action is unlawful.

Conservatives cheered this theory on when the conservative majority on the Supreme Court used it to toss out the bulk of Joe Biden’s student-loan forgiveness plan, but the proposed economic impact of that initiative pales in comparison to Trump’s tariff policy. …”

- Messages

- 41,523

“… The fact that the administration persisted with its erratic tariff regime even after the ruling in May from the Court of International Trade should also have attracted far more attention and criticism. There was a stay on the ruling, but even so, Republicans would have been outraged if a Democratic president insisted on pushing aggressively forward with a policy that a credible court had said was unlawful.“… the Constitution gives Congress the authority to tax and impose tariffs. Over the years, Congress has delegated that authority to the executive branch in a handful of trade laws with a variety of procedural and substantive constraints designed to limit that authority.

By contrast, IEEPA — a statute that is generally used to impose economic sanctions — does not even contain the word “tariffs,” and before Trump, no president had attempted to use IEEPAto impose tariffs in the nearly 50 years since the statute has been on the books.

In fact, Congress passed IEEPA to limit the president’s emergency economic powers — not to give him the ability to impose a massive tax increase on Americans without congressional approval, or to disrupt the global financial system whenever he wants and for whatever reason he wants.

For liberal jurists, this alone should suffice to reject the president’s position, but the Trump administration’s proposed interpretation of IEEPA also runs afoul of the “major questions doctrine” developed in recent years by the Republican appointees on the Supreme Court. Under that doctrine, when an executive action crosses some undefined threshold of “economic and political significance,” there must be a clear delegation of authority from Congress. If that does not exist, then the action is unlawful.

Conservatives cheered this theory on when the conservative majority on the Supreme Court used it to toss out the bulk of Joe Biden’s student-loan forgiveness plan, but the proposed economic impact of that initiative pales in comparison to Trump’s tariff policy. …”

For that reason, the Trump administration’s arguments about the impact of a loss on foreign relations are, in a way, almost precisely backwards.

It may be true that a Supreme Court ruling against the administration would hurt its diplomatic standing, but that is because foreign governments may have been the victims of a global policy initiative that was illegal all along. If Trump officials end up being embarrassed, they will have earned it for themselves.

The second important fact to bear in mind is that if Trump is right — if his tariffs are necessary and wonderful and will stave off a Great Depression while also bringing an end to the Russia-Ukraine war — then he should go to Congress and get it to pass a law codifying them.

… Republicans on Capitol Hill have let Trump have his way pretty much all year. The fact that they will not bail him out here is telling.

Will the Republican appointees on the Supreme Court do it instead? We are about to find out.”

- Messages

- 4,119

so who would you expect the galactically stupid to vote for ?This is what happens when you elect the galactically stupid.

lawtig02

Legend of ZZL

- Messages

- 5,895

It's going to be super interesting to see what Roberts, Kav and Barrett do with the major questions doctrine in this case. I have absolutely no doubt Thomas and Alito will find some stupid way to distinguish it. Gorsuch will probably go along with them. But this may be one where the other three realize there's no possible way to square the legality of Trump's tariffs with their recent decisions. Or maybe it won't.

- Messages

- 5,217

In Tariff Standoff With Trump, China Boycotts American Soybeans

U.S. farmers need to sell their incoming crop, and China needs to buy it in case its main alternative, Brazil, has a flood or drought. But their trade war prevents a deal.

China has been boycotting purchases of U.S. soybeans since late May to show displeasure with President Trump’s imposition of tariffs on imports from China. The pain is being felt in Midwest states, especially Illinois, Iowa, Minnesota and Indiana. For the first time in many years, American farmers are preparing to harvest their crop this fall with no purchase orders from China.

“The further into the autumn we get without reaching an agreement with China on soybeans, the worse the impacts will be on U.S. soybean farmers,” the American Soybean Association warned in a letter to Mr. Trump on Aug. 19.

ChileG

Inconceivable Member

- Messages

- 3,165

President of the soybean association voted for Trump. After Trump fucked them in his first term.

In Tariff Standoff With Trump, China Boycotts American Soybeans

U.S. farmers need to sell their incoming crop, and China needs to buy it in case its main alternative, Brazil, has a flood or drought. But their trade war prevents a deal.www.nytimes.com

China has been boycotting purchases of U.S. soybeans since late May to show displeasure with President Trump’s imposition of tariffs on imports from China. The pain is being felt in Midwest states, especially Illinois, Iowa, Minnesota and Indiana. For the first time in many years, American farmers are preparing to harvest their crop this fall with no purchase orders from China.

“The further into the autumn we get without reaching an agreement with China on soybeans, the worse the impacts will be on U.S. soybean farmers,” the American Soybean Association warned in a letter to Mr. Trump on Aug. 19.

Welcome to the party, pal.

Share: