Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tariffs Catch-All

- Thread starter BubbaOtis

- Start date

- Replies: 5K

- Views: 178K

- Politics

I call it "primary day". The date next year when Republican lawmakers know if they will have serious primary opposition. Once past that day, they are more likely to take the keys away from Trump to save their own skin.Is any of this something that can be fixed by a great Dem performance in the midterms next fall or is this something that we are going to have to endure until 2029?

Is any of this something that can be fixed by a great Dem performance in the midterms next fall or is this something that we are going to have to endure until 2029?

Some things can't be fixed. The retreat from NATO will have a meaningful impact on our $65B of aircraft exports - 6% of our total exports. Europe is now having to invest in rearmament industries because the Trump administration has made it clear that it's no longer a reliable supplier and partner. We'll still be able to sell F-16 parts, but it's clear that new weapons programs for our partners are going to be built outside of the US.

uncgriff

Honored Member

- Messages

- 899

and the world will never again trust the USA electorate to make any kind of rational decision going forward.Some things can't be fixed. The retreat from NATO will have a meaningful impact on our $65B of aircraft exports - 6% of our total exports. Europe is now having to invest in rearmament industries because the Trump administration has made it clear that it's no longer a reliable supplier and partner. We'll still be able to sell F-16 parts, but it's clear that new weapons programs for our partners are going to be built outside of the US.

UNCBAdookJD

Esteemed Member

- Messages

- 592

‘29 unless the Dem majority in ‘27 is veto-proof. And as others have said, much is irreparable, at least in the intermediate future. Maybe a decade+ once we even try to fix it for some things.Is any of this something that can be fixed by a great Dem performance in the midterms next fall or is this something that we are going to have to endure until 2029?

Last edited:

- Messages

- 41,633

Centerpiece

Inconceivable Member

- Messages

- 3,388

You mean there is still a Maga poster?Looking forward to our one remaining MAGA poster to explain why this is actually good news.

lawtig02

Legend of ZZL

- Messages

- 5,918

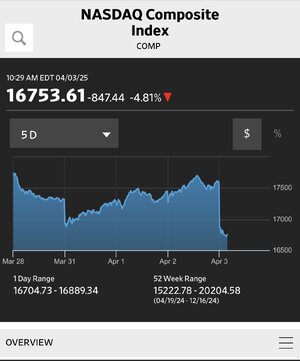

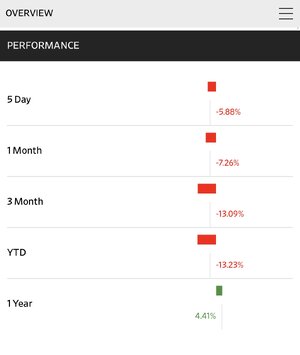

I appreciate the silver lining gazing, but considering what Biden handed Trump in January and what he's already done with it since then FOR NO REASON WHATSOEVER, I'm having a hard time feeling remotely good about that dwindling 4.4%.

- Messages

- 41,633

Trump’s Tariffs Were Supposed to Boost the Dollar. Why the Opposite Happened.

Worries that long-term U.S. growth will fade could matter more for the currency than the mechanical impact of tariffs

GIFT LINK

“While President Trump has always claimed to want a weaker dollar, the consensus among investors was that his policies would strengthen it.

Turns out he was right, but perhaps in the worst way.

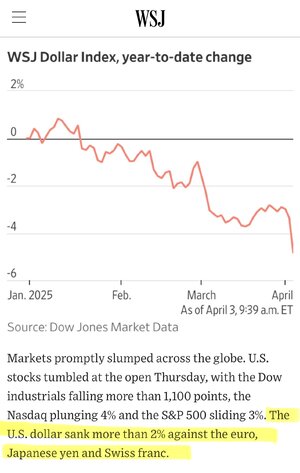

… What was more unexpected is that the U.S. dollar tumbled against most major currencies. The WSJ Dollar Index, an indicator based on a basket of currencies, has now lost more than 5% this year and is below where it was on Nov. 5, before its postelection rally.

This is making Wall Street analysts look pretty bad: Most were telling investors, even up to the very moment in which tariffs were announced Wednesday, that protectionist policies would push up the currency.

The idea was that fewer purchases of overseas goods would narrow the trade deficit and mechanically reduce U.S. demand for foreign exchange. Also, U.S. growth is outpacing the eurozone’s, which has historically been dollar-positive.

Instead, speculators have swung to betting heavily against the greenback, Commodity Futures Trading Commission derivatives data shows.

… The sudden unwind can’t truly be about tariffs increasing the risk of recession. The dollar usually strengthens during busts as well as booms because investors seek refuge in it—creating the famous “dollar smile.”

Why did the market get it wrong? Perhaps the greenback is at such expensive inflation-adjusted levels that it was primed to fall. Or, as some investors argue, U.S. economic aggression against allies is eroding the dollar’s “global reserve” status. …”

- Messages

- 41,633

Law of Unintended Consequences?Trump’s Tariffs Were Supposed to Boost the Dollar. Why the Opposite Happened.

Worries that long-term U.S. growth will fade could matter more for the currency than the mechanical impact of tariffs

GIFT LINK—> https://www.wsj.com/finance/currenc...c9?st=WHng9m&reflink=mobilewebshare_permalink

“While President Trump has always claimed to want a weaker dollar, the consensus among investors was that his policies would strengthen it.

Turns out he was right, but perhaps in the worst way.

… What was more unexpected is that the U.S. dollar tumbled against most major currencies. The WSJ Dollar Index, an indicator based on a basket of currencies, has now lost more than 5% this year and is below where it was on Nov. 5, before its postelection rally.

This is making Wall Street analysts look pretty bad: Most were telling investors, even up to the very moment in which tariffs were announced Wednesday, that protectionist policies would push up the currency.

The idea was that fewer purchases of overseas goods would narrow the trade deficit and mechanically reduce U.S. demand for foreign exchange. Also, U.S. growth is outpacing the eurozone’s, which has historically been dollar-positive.

Instead, speculators have swung to betting heavily against the greenback, Commodity Futures Trading Commission derivatives data shows.

… The sudden unwind can’t truly be about tariffs increasing the risk of recession. The dollar usually strengthens during busts as well as booms because investors seek refuge in it—creating the famous “dollar smile.”

Why did the market get it wrong? Perhaps the greenback is at such expensive inflation-adjusted levels that it was primed to fall. Or, as some investors argue, U.S. economic aggression against allies is eroding the dollar’s “global reserve” status. …”

“… In 2024, Trump’s chief economic adviser, Stephen Miran, stressed the need to tackle the trade deficit by penalizing foreign central banks and treasurers for parking assets in the U.S. This is in line with the view that haven demand overvalues the dollar and places an “exorbitant burden” upon the American economy.

It lacks empirical support, though, since higher official foreign purchases tend to coincide with a weaker dollar. Global dollar reserves have flatlined since 2018 as the dollar rose 16%, per International Monetary Fund figures.

A better answer, which is less flattering for Trump, is that faith in the U.S.’s long-term economic potential is fading.

… Markets might now be anticipating another structural shift. A rearmament push is fueling hopes of an economic revival in Europe, just as the U.S. growth story becomes tainted by protectionism and Chinese artificial-intelligence challengers.

…

The problem is that Trump’s tariffs have been sudden and erratic. Wednesday’s list of reciprocal tariffs on each trading partner are a case in point, since they aren’t based on any calculation that makes economic sense. Such policies are probably denting corporate investment rather than inducing companies to relocate production through a targeted and phased-in approach. More than Asia’s development miracles, these policies resemble Latin America’s flawed experiments with “import substitution.”

Yes, there could be benefits to General Motors and Ford reshoring assembly jobs from Mexico. But doing the same with all auto parts—including low-value components such as textiles and wiring harnesses—would just make the U.S. car industry very inefficient. This comes atop likely retaliation by other countries and the 100% tariffs on Chinese electric vehicles inherited from the Biden era. …”

lawtig02

Legend of ZZL

- Messages

- 5,918

Not to excuse the economists but it's been 100 years since the last time an American president was batshit stupid enough to try this type of economic self-immolation, and the global economy is vastly different than it was then. So it's not like the repercussions of this economic seppuku are easy to predict with precision.

lawtig02

Legend of ZZL

- Messages

- 5,918

Right. It's an indication of trust in the future of America. And foreign investors, understandably, are jumping ship right now. I'm so freaking frustrated that both Russia and China were there for the taking. Pax Americana could have extended for another 100+ years. But we gave it all up OVERNIGHT because Silence is worried about dicks in the ladies room.What's concerning is that the economists got it wrong because investors apparently are pricing the dollar based on their view of US long-term ROE rates. It's not a response to tariff mechanics, but something much more fundamental.

- Messages

- 41,633

Dude, yesterday’s tariffs have not even gone into effect yet. All you’ve done is schedule the surgery.

I swear, he is just living in the 70s and 80s — here repackaging the $6 Million Man intro:

“We can rebuild him. We have the technology. We can make him better than he was. Better, stronger, faster”

- Messages

- 3,157

Man, this second Trump term has me longing for the first Trump term.

- Messages

- 774

Did you get any Vietnamese Dong while in Nam? Sorry, worst currency name ever.I've still got some Indian Rupees from my time there... I'm rooting for a comeback for that particular currency!

Duke Mu

Iconic Member

- Messages

- 2,052

Trump was on THIRD BASE, just like 2017. All he had to do was nothing and claim victory.I appreciate the silver lining gazing, but considering what Biden handed Trump in January and what he's already done with it since then FOR NO REASON WHATSOEVER, I'm having a hard time feeling remotely good about that dwindling 4.4%.

Share: