UNCBAdookJD

Esteemed Member

- Messages

- 592

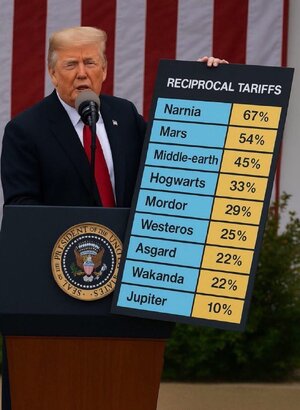

He be didn’t even base these tariffs on the tariffs anyone is charging us. The tariffs were determined by our relative trade deficit with the country. It was a completely nonsensical calculation and in no way actually reciprocal.So whats the solution? Other countries continue ripping the US off?

We don't need other countries to flourish, they would have to lower their prices.