ZenMode

Legend of ZZL

- Messages

- 6,397

EU pauses counter-tariffs against US after Trump backs down on tariff hike

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

The EU has been talking tough but taking a risk-averse approach — their countermeasures were scheduled to go into effect in parts in May and December to create runway to avoid implementing them altogether.EU pauses counter-tariffs against US after Trump backs down on tariff hike

I guarantee you Trump band of merry idiots never even considered this possibility.

- What Are Treasury Bonds?

- They’re IOUs the U.S. government issues to borrow money.

- Countries, banks, and investors buy them, lending cash to the U.S.

- The U.S. promises to pay back the loan with interest over time (e.g., 10 years).

- Who Owns Them?

- Foreign countries hold $8.5 trillion of U.S. debt (as of 2025).

- Big players: Japan ($1 trillion+), Canada ($350 billion), EU nations ($1.5 trillion combined).

- They buy bonds to park money safely and earn steady interest.

- How Do They Affect the U.S.?

- The U.S. uses this borrowed cash to fund everything—military, Social Security, tax cuts.

- Cheap borrowing keeps the economy humming; the government spends more than it collects in taxes.

- What Happens in a Coordinated Sell-Off?

- If countries like Canada, Japan, and the EU start selling bonds together (even slowly):

- Flood of Bonds: Too many bonds hit the market at once.

- Prices Drop: More supply than demand pushes bond prices down.

- Interest Rates Spike: When bond prices fall, yields (interest rates) rise to attract buyers.

- Why Does This Hurt the U.S.?

- Borrowing Gets Expensive: Higher interest rates mean the U.S. pays more to borrow.

- Debt Snowballs: The U.S. owes $34 trillion already; pricier loans make it harder to manage.

- Dollar Weakens: Selling bonds means dumping dollars, so the currency’s value drops.

Japan has been recalibrating their U.S. Treasuries holdings for months and several prior similar claims of Japan wholesale dumping Treasuries has been debunked already earlier this year — I say that wondering about the accuracy of this report this time since very similar claims have been wrong recently.Yep, was some of his interview I saw where he explained it was Japan pulling out of treasuries. If I remember correctly, it was while the WH was trying to “make a deal” with Japan.

I feel a little bad for people in hollowed out towns that genuinely believed Trump was bringing their factories back, only to have him cater to the elites once again.

Trump’s Trade Math Ignores a Major Export: American Services

Trade wars heighten overseas risk for U.S. companies. ‘When you generate bad will, it’s harder to sell stuff.’

—> https://www.wsj.com/economy/trade/u...2b?st=LSD5hk&reflink=mobilewebshare_permalink

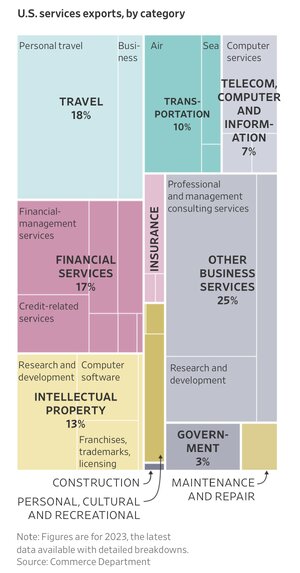

“While the U.S. buys more goods from abroad than it sells, the opposite is true for services, which include everything from streaming subscriptions to financial advice. Trump left these service exports out of his tariff math, but they are being pulled into his trade wars.

… Countries can’t easily impose tariffs on services, but they can tax, fine or even ban U.S. companies. The European Union has floated going after big U.S. tech companies in response to Trump’s sweeping tariff threats. Trump also put U.S. service exports at risk by irking foreign consumers, many of whom might choose to avoid U.S. banks, asset managers and other firms. An economic slowdown that curbs demand as markets grapple with the president’s extreme trade makeover won’t help either.

… For decades, the U.S. and the rest of the world had a deal: Other countries sent cars, phones, clothes and food to the U.S., and in return they got bonds, software and management consultants.

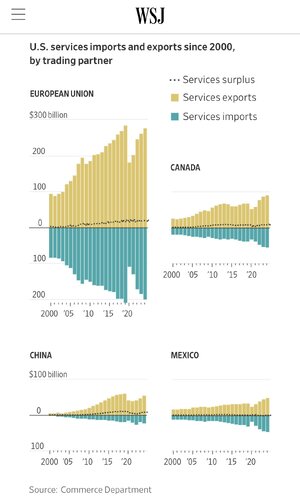

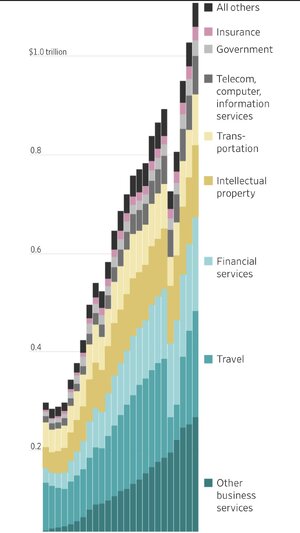

As the U.S. imported more goods from abroad and domestic factories closed, its goods trade deficitswelled to a record $1.21 trillion by 2024. At the same time, the U.S. services trade surplus grew to $295 billion last year, up from $77 billion in 2000. This is a stark reversal from the mid-20th century, when the U.S. was a manufacturing giant and had a goods export surplus, but had a services trade deficit.

Services gradually came to dominate the U.S. economy as the country grew wealthier. It was no longer Ford Motor and General Motors that mattered most, but companies such as Microsoft, Alphabet and JPMorgan Chase. Software and financial products became major U.S. exports. For some of the biggest services firms, foreign markets now matter more than the U.S. …”

This really worries me.Trump’s Trade Math Ignores a Major Export: American Services

Trade wars heighten overseas risk for U.S. companies. ‘When you generate bad will, it’s harder to sell stuff.’

—> https://www.wsj.com/economy/trade/u...2b?st=LSD5hk&reflink=mobilewebshare_permalink

“While the U.S. buys more goods from abroad than it sells, the opposite is true for services, which include everything from streaming subscriptions to financial advice. Trump left these service exports out of his tariff math, but they are being pulled into his trade wars.

… Countries can’t easily impose tariffs on services, but they can tax, fine or even ban U.S. companies. The European Union has floated going after big U.S. tech companies in response to Trump’s sweeping tariff threats. Trump also put U.S. service exports at risk by irking foreign consumers, many of whom might choose to avoid U.S. banks, asset managers and other firms. An economic slowdown that curbs demand as markets grapple with the president’s extreme trade makeover won’t help either.

… For decades, the U.S. and the rest of the world had a deal: Other countries sent cars, phones, clothes and food to the U.S., and in return they got bonds, software and management consultants.

As the U.S. imported more goods from abroad and domestic factories closed, its goods trade deficitswelled to a record $1.21 trillion by 2024. At the same time, the U.S. services trade surplus grew to $295 billion last year, up from $77 billion in 2000. This is a stark reversal from the mid-20th century, when the U.S. was a manufacturing giant and had a goods export surplus, but had a services trade deficit.

Services gradually came to dominate the U.S. economy as the country grew wealthier. It was no longer Ford Motor and General Motors that mattered most, but companies such as Microsoft, Alphabet and JPMorgan Chase. Software and financial products became major U.S. exports. For some of the biggest services firms, foreign markets now matter more than the U.S. …”

Who SHOULD trust us with our own King George III in charge?This really worries me.

Until he's gone, who will trust us?

The tariffs did NOT get cancelled. They were lowered to 10% for most, still unnamed countries. So they were dropped to 10% rather than the ridiculously high made up bogus "reciprocal" Tariffs on Trump's idiot chart.Glad the tariffs got cancelled. Now the question is how he's going to pay for extending his tax cuts without tariff revenue. My guess is those die too.

Buffett is all about fundamentals. He's not always right, but he's pretty much always the most dispassionate. Kind of like the Moneyball of financiers. What he's saying there is that bad times show who is playing the game with a strategy and who is playing it recklessly. Unfortunately, the man in charge of our entire economy is one of the most reckless, undisciplined people in the history of the modern financial world. But that doesn't change Buffett's point. And it explains a lot of why he has so much cash right now.I have a question: considering it seems Wall Street was unprepared for Trump's volatility, it makes me wonder about something Warren Buffett has said that I have never fully understood. He likes to say that when the tide goes out, you get to see who's been "skinny dipping".

I know Buffett claims he doesn't like to gamble. Accepting investment risk is another thing. So when the tide goes out, you get to see who was gambling and who was investing?

Thanks.

My expectation is for a flurry of trade deals to be announced over the coming weeks. They will be claimed as big victories, but won’t actually be much of a change from the existing arrangements.NAFTA took 2 years. The fact that the administration is trying to sell the idea they can redo global trade in 90 days is insulting to anyone with a brain.

Trump has been talking tough but taking a high risk approach.The EU has been talking tough but taking a risk-averse approach — their countermeasures were scheduled to go into effect in parts in May and December to create runway to avoid implementing them altogether.