Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tariffs Catch-All

- Thread starter BubbaOtis

- Start date

- Replies: 5K

- Views: 178K

- Politics

heelslegup

Esteemed Member

- Messages

- 645

Tariff overnight news per Blomberg

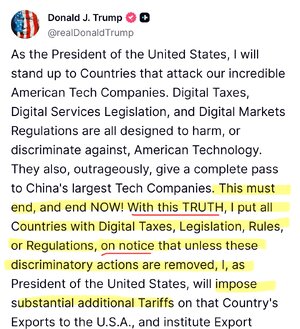

1) Trump threatens EU with new tariffs and export restrictions of adv tech over digital services tax

2) Trump threatens China with 200$ tariffs over issue of rare earth e;ements supply to US. Pickimg a rare earth fight with China before US was prepared waS not smart.

1) Trump threatens EU with new tariffs and export restrictions of adv tech over digital services tax

2) Trump threatens China with 200$ tariffs over issue of rare earth e;ements supply to US. Pickimg a rare earth fight with China before US was prepared waS not smart.

- Messages

- 8,292

Trump claims South Korea had to accept his terms and now says the EU agreed to pay us $950 Billion …

The man is incapable of telling the truth.

All policy aside, the right should be embarrassed they elected this turd.

- Messages

- 8,292

Mob boss speak. Show respect or swim with the fishes.

Duke Mu

Iconic Member

- Messages

- 2,030

Yeah, this is Trump's grandfather's Archie Bunker/Queens type economic "thinking."Speaking of stupid.

"Buddy, we could use a man like Herbert Hoover again..."

Duke Mu

Iconic Member

- Messages

- 2,030

Mob boss speak. Show respect or swim with the fishes.

Tariffs - that word does not mean what you think it means.

ZenMode

Legend of ZZL

- Messages

- 6,358

"We project that increases in tariffs implemented during the period from January 6, 2025, to August 19, 2025 will decrease primary deficits (which exclude net outlays for interest) by $3.3 trillion if the higher tariffs persist for the 2025‒2035 period," Phillip Swagel, CBO’s director wrote. "By reducing the need for federal borrowing, those tariff collections will also reduce federal outlays for interest by an additional $0.7 trillion. As a result, the changes in tariffs will reduce total deficits by $4.0 trillion altogether."

An Update About CBO's Projections of the Budgetary Effects of Tariffs

An Update About CBO's Projections of the Budgetary Effects of Tariffs

superrific

Master of the ZZLverse

- Messages

- 12,420

They expressly state that they are not allowed to take account of the effects of tariffs on the economy. So the estimate is nonsense. It's not the CBO's fault. It's House rules."We project that increases in tariffs implemented during the period from January 6, 2025, to August 19, 2025 will decrease primary deficits (which exclude net outlays for interest) by $3.3 trillion if the higher tariffs persist for the 2025‒2035 period," Phillip Swagel, CBO’s director wrote. "By reducing the need for federal borrowing, those tariff collections will also reduce federal outlays for interest by an additional $0.7 trillion. As a result, the changes in tariffs will reduce total deficits by $4.0 trillion altogether."

An Update About CBO's Projections of the Budgetary Effects of Tariffs

- Messages

- 41,518

Yeah, I posted that a few days ago when the update came out. A major shift of the tax burden to corporate and consumer taxes but not enough to offset the reduction income taxes to result in a balanced budget, much less paying down the debt. And as already noted, this estimate (a) assumes tariffs won’t change over the next decade (will be interesting to see what happens in the long term but in the near term Trump has proven wildly erratic) and (b) doesn’t include any offsetting impact tariffs might have on the economy."We project that increases in tariffs implemented during the period from January 6, 2025, to August 19, 2025 will decrease primary deficits (which exclude net outlays for interest) by $3.3 trillion if the higher tariffs persist for the 2025‒2035 period," Phillip Swagel, CBO’s director wrote. "By reducing the need for federal borrowing, those tariff collections will also reduce federal outlays for interest by an additional $0.7 trillion. As a result, the changes in tariffs will reduce total deficits by $4.0 trillion altogether."

An Update About CBO's Projections of the Budgetary Effects of Tariffs

I just read a story about a new study yesterday suggesting that the top 400 richest people are much more impacted by corporate taxation than income taxes due to how they make their money, so to the extent companies eat some or all of the tariffs, I guess there is an argument it is the equivalent of raising taxes on the wealthiest 400 people, but count me dubious on that. And the rest is a regressive tax on small businesses and consumers.

ZenMode

Legend of ZZL

- Messages

- 6,358

Right, but that is true of most any CBO forecast, is it not?They expressly state that they are not allowed to take account of the effects of tariffs on the economy. So the estimate is nonsense. It's not the CBO's fault. It's House rules.

- Messages

- 4,118

thought experiment...Yeah, I posted that a few days ago when the update came out. A major shift of the tax burden to corporate and consumer taxes but not enough to offset the reduction income taxes to result in a balanced budget, much less paying down the debt. And as already noted, this estimate (a) assumes tariffs won’t change over the next decade (will be interesting to see what happens in the long term but in the near term Trump has proven wildly erratic) and (b) doesn’t include any offsetting impact tariffs might have on the economy.

I just read a story about a new study yesterday suggesting that the top 400 richest people are much more impacted by corporate taxation than income taxes due to how they make their money, so to the extent companies eat some or all of the tariffs, I guess there is an argument it is the equivalent of raising taxes on the wealthiest 400 people, but count me dubious on that. And the rest is a regressive tax on small businesses and consumers.

If someone held a gun to your head and said your life depends upon giving the correct answer to this question :

Who will suffer more from Trump's economic policies ? The 400 richest people in America or small businesses and consumers ?

If that gun is held to my head, I would ask the person holding the gun, "Is this a trick question " ?

- Messages

- 1,842

The world economy will go to shit with stagflation, etc., for a decade but at least we'll reduce the federal deficit by $4 trillion."We project that increases in tariffs implemented during the period from January 6, 2025, to August 19, 2025 will decrease primary deficits (which exclude net outlays for interest) by $3.3 trillion if the higher tariffs persist for the 2025‒2035 period," Phillip Swagel, CBO’s director wrote. "By reducing the need for federal borrowing, those tariff collections will also reduce federal outlays for interest by an additional $0.7 trillion. As a result, the changes in tariffs will reduce total deficits by $4.0 trillion altogether."

An Update About CBO's Projections of the Budgetary Effects of Tariffs

superrific

Master of the ZZLverse

- Messages

- 12,420

Typically, but:Right, but that is true of most any CBO forecast, is it not?

1. Sometimes the House will specifically ask for dynamic scoring. Interesting that they didn't here.

2. The effect of dynamic scoring varies. For instance, the impact of the Trump tax cuts is generally estimated at 0.7% over a ten year period. That's 0.07%. That doesn't make much difference at all in projections. That's a rounding error, literally. And it's common sense, because it didn't try to remake anything. It just tweaked a few knobs.

By contrast, the difference between dynamic and static scoring for tariffs is enormous. Yale Budget Lab, in a static analysis like the CBO, reaches a result of about 0.5% over 10 years -- basically the same prediction as Trump tax cut in fact. But the dynamic scoring models, like the ones at Wharton, are predicting a loss of GDP of 6% over a longer period, which is like 0.5%-0.9% depending on your interpretation of the time frame. Other studies are estimating GDP decreases of a full 1.5% in 2026 and about 0.8% per year after.

So the difference between static and dynamic scoring is at least 10x bigger than with the tax cuts.

ZenMode

Legend of ZZL

- Messages

- 6,358

What's going to happen when taxes are raised on all of us to address the debt? Will it be that much different?The world economy will go to shit with stagflation, etc., for a decade but at least we'll reduce the federal deficit by $4 trillion.

- Messages

- 1,842

It's the 'raised on all of us' part that's the issue. The deficit could be eliminated by increasing taxes, not just on income, but capital gains, inherited wealth, etc. on the wealthiest Americans. But the Pubs won't do it. The filthy rich are their base.What's going to happen when taxes are raised on all of us to address the debt?

And tariffs are a tax on us ordinary folks, and the poor. The rich won't feel any pain, which is why they like tariffs.

ZenMode

Legend of ZZL

- Messages

- 6,358

I don't believe we can pay off the debt on the backs of only the wealthy. Bill Clinton raised capital gains taxes to address the deficit and even he admitted that he raised them too much.It's the 'raised on all of us' part that's the issue. The deficit could be eliminated by increasing taxes, not just on income, but capital gains, inherited wealth, etc. on the wealthiest Americans. But the Pubs won't do it. The filthy rich are their base.

- Messages

- 1,842

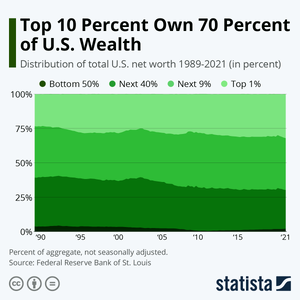

You see this chart? ....I don't believe we can pay off the debt on the backs of only the wealthy. Bill Clinton raised capital gains taxes to address the deficit and even he admitted that he raised them too much.

1% of Americans own 27% of the net worth in this country. 50% of Americans own about 2-3% of the net worth. Tax the rich, eliminate the deficit.

Share: