- Messages

- 37,870

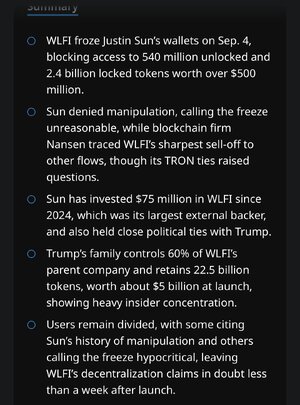

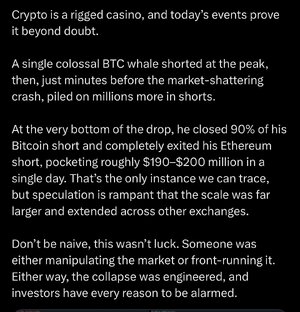

It certainly appears like possible insider trading by someone who shorted the token just ahead of Trump announcing the China tariff increase. But none of this will be subject to any government scrutiny, so it’s open season for crypto manipulation and insider trading trading.

But the insider who made a ton also profited off of others who just invested huge amount just ahead of the crash. It is not hard to view this as thinly disguised bribery by investing in this token a few days before someone with a huge position (likely an “early investor” since a bunch of their shares unlocked in September) dumped a huge amount of the meme coin.

Big losses on a political meme coin like this (especially just hours or days free a huge investment in the meme coin) look like bribery payments. Could just be catastrophically terrible investment timing (maybe “buying the dip” even as all Trump-linked crypto ventures have been taking a bath on large trades suggesting the early investors with unlocked interests are dumping), of course, but in an unregulated market of anonymous traders with the family of the POTUS as the original investors with unlocked coins to dump/convert to hard currency, it just stinks to high heaven.

But the insider who made a ton also profited off of others who just invested huge amount just ahead of the crash. It is not hard to view this as thinly disguised bribery by investing in this token a few days before someone with a huge position (likely an “early investor” since a bunch of their shares unlocked in September) dumped a huge amount of the meme coin.

Big losses on a political meme coin like this (especially just hours or days free a huge investment in the meme coin) look like bribery payments. Could just be catastrophically terrible investment timing (maybe “buying the dip” even as all Trump-linked crypto ventures have been taking a bath on large trades suggesting the early investors with unlocked interests are dumping), of course, but in an unregulated market of anonymous traders with the family of the POTUS as the original investors with unlocked coins to dump/convert to hard currency, it just stinks to high heaven.

Last edited: