Mulberry Heel

Iconic Member

- Messages

- 1,169

"Only Dem economists, legacy media and this board are freaking out about Trump’s tariffs."WSJ:

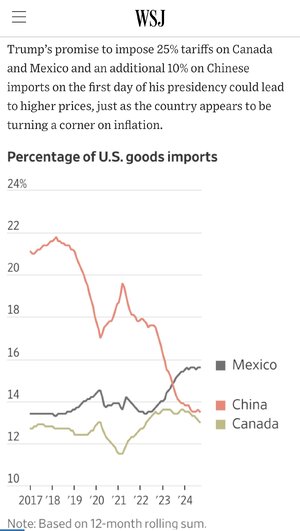

What Trump’s New Tariff Threats Mean for the U.S. Economy

If president-elect follows through, consumers and businesses are likely to see prices rise on everything from fresh fruit to electronics

“… The tariff threat upends the forecasts of many economists who have been assuming that the duties Trump will impose wouldn’t be nearly as high as what he pledged on the campaign trail.

… On Tuesday, economists at the Budget Lab at Yale reworked their estimates of how tariffs under Trump might affect the economy.

Tariffs of 25% on Canada and Mexico, and 10 percentage points added to existing tariffs on China, with those countries imposing retaliatory tariffs, would raise U.S. consumer prices by 0.75% next year, according to the Budget Lab. That estimate drops to 0.65% if households substitute purchases toward domestically produced or lower-tariff imported options. That would amount to more than $1000 in lost purchasing power per household, in 2023 dollars.

If the tariffs against Chinese goods were layered on top of the 60% Trump has already threatened, versus existing tariffs, the estimated inflationary effect would be higher. Beyond raising the prices that Americans pay for goods, higher inflation could lead the Federal Reserve to cut interest rates less than expected in the year ahead. That would keep rates on credit card balances and other loans higher than they otherwise might have been. …”

Yes, that well-known left-wing Murdoch rag, The Wall Street Journal, is also deeply concerned about the impact of possible sharp hikes in tariff rates.