Senate to Begin Voting on Policy Bill, as G.O.P. Grasps for Support

—>

https://www.nytimes.com/live/2025/0...e_code=1.S08.6w6S.vk0MI4ulU_Yg&smid=url-share

“…

Senate Republicans moved on Sunday to upend how the costs of tax cuts are counted, a change they are seeking as part of a broader attempt to expand what lawmakers can pass without a filibuster-proof majority.

The gambit concerns how long Republicans’ tax cuts can last. Typically, lawmakers cannot pass costly long-term policies through the Senate without bipartisan support. But Republicans want to lock in lower taxes permanently, and they are preparing to smash precedent to do so.

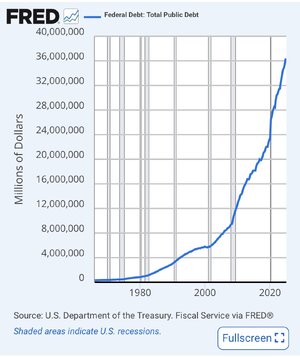

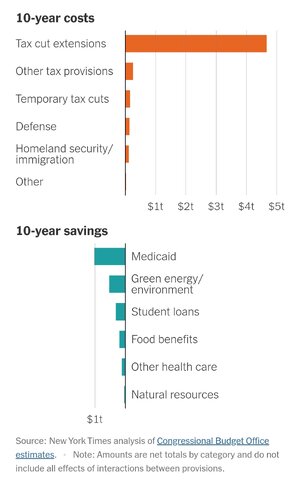

To pass their sprawling tax and health care bill, Republicans are using a legislative process called reconciliation that allows them to ignore Democratic opposition in the Senate and approve the bill with a simple majority of 51 votes, rather than the 60 typically needed to overcome a filibuster. But using reconciliation has long imposed additional rules on lawmakers, including that the legislation can only add to the deficit for 10 years. After a decade, a bill cannot create new costs.

…

Republicans argue that the tax cuts they originally passed in 2017, which expire at the end of the year, should be baked into the country’s fiscal forecasts even though Congress has not yet actually renewed them. By that logic, the $3.8 trillion cost of extending the 2017 cuts is zero, and those cuts can be extended for decades even though reconciliation’s rules prohibit long-term deficit increases.

The entire Senate Republican bill relies on this view of the tax cuts’ costs. Without this accounting assumption, the legislation would run afoul of Senate rules…

…

The two parties disagree on whether altering accounting standards is allowed. The Senate majority leader, John Thune, a South Dakota Republican, took to the floor on Sunday to begin the process of pushing through the G.O.P. interpretation of the budget.

“This is an issue that I think we need to deal with right off the bat,” Mr. Thune said, arguing that Senate rules allow the chairman of the Budget Committee, Senator Lindsey Graham, Republican of South Carolina, to decide how costs are accounted for.

… Republicans have avoided putting the issue directly to the chamber’s parliamentarian, who helps enforce Senate rules. Unlike the many other measures that are litigated with the parliamentarian ahead of the bill coming to the floor, Republicans and Democrats did not formally discuss the issue with her.

Given that many Republicans say they are hesitant to directly contradict the parliamentarian, such a discussion would have had very high stakes for the G.O.P., potentially requiring an overhaul of the bill. But Republicans say the parliamentarian’s view is not necessary, pointing to an

obscure clause in budget law that they say blesses their tactic.

“I’m setting the numbers,” Mr. Graham said.

… The nonpartisan Congressional Budget Office provided two estimates for the legislation, one according to the Senate Republican method and one according to their typical rules.

The bill would reduce the debt by roughly $500 billion if the cost of extending the 2017 tax cuts is ignored, the budget office said, but increase the debt by at least $3.3 trillion if that cost is accounted for.…”