Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

U.S. Budget - OBBB | Medicare Part D premiums set to rise

- Thread starter nycfan

- Start date

- Replies: 1K

- Views: 47K

- Politics

- Messages

- 23,707

Bill Would Give Newborns $1,000 in ‘Trump Accounts’

Bill Would Give Newborns $1,000 in ‘Trump Accounts’

The money would be invested on children’s behalf in the financial markets for them to use once they had grown up.

“…

The original draft called for the funds to be put into new a “money account for growth and advancement,” or, as the bill suggested they be called, a “MAGA account.”

Apparently, though, endowing the accounts with the name of President Trump’s political movement was not clear enough. As part of a series of last-minute changes House Republicans made to their broad fiscal package Wednesday night, they decided to just cut to the chase. The money would now be deposited in a “Trump account.”

Under the bill, children born between Jan., 1, 2025, and Jan. 1, 2029, would receive the money, which would be invested on their behalf in financial markets. Once they had grown up, they could withdraw the proceeds to pay for certain expenses, including going to college or buying a house. The child’s parents, or other third parties, could also contribute [after-tax] to the account.…”

- Messages

- 23,707

“… In the end, three Republicans who had objections to the bill chose to step aside. Andy Harris voted “present,” while two other Republican holdouts, Andrew Garbarino and David Schweikert, did not vote. If they had voted in opposition, they would have sunk the bill. …”

Bill Would Give Newborns $1,000 in ‘Trump Accounts’

Bill Would Give Newborns $1,000 in ‘Trump Accounts’

The money would be invested on children’s behalf in the financial markets for them to use once they had grown up.www.nytimes.com

“…

The original draft called for the funds to be put into new a “money account for growth and advancement,” or, as the bill suggested they be called, a “MAGA account.”

Apparently, though, endowing the accounts with the name of President Trump’s political movement was not clear enough. As part of a series of last-minute changes House Republicans made to their broad fiscal package Wednesday night, they decided to just cut to the chase. The money would now be deposited in a “Trump account.”

Under the bill, children born between Jan., 1, 2025, and Jan. 1, 2029, would receive the money, which would be invested on their behalf in financial markets. Once they had grown up, they could withdraw the proceeds to pay for certain expenses, including going to college or buying a house. The child’s parents, or other third parties, could also contribute [after-tax] to the account.…”

Good grief. Pure vanity to Trump. This will cost around 4 billion extra a year just to get his name on it.

And just what we need, another account or tax issue to keep up with. I assume the investment earnings will be tax free? Parents can't tap into it?

- Messages

- 23,707

No and maybe/mostly no. The earnings will be taxed on withdrawal, so this is not a tax advantaged account, but hey it is juiced with a $1,000 deposit. Parents can tap into it but I’ve seen conflicting details on the conditions for parents to use the funds for the minor child.Good grief. Pure vanity to Trump. This will cost around 4 billion extra a year just to get his name on it.

And just what we need, another account or tax issue to keep up with. I assume the investment earnings will be tax free? Parents can't tap into it?

- Messages

- 23,707

“…No and maybe/mostly no. The earnings will be taxed on withdrawal, so this is not a tax advantaged account, but hey it is juiced with a $1,000 deposit. Parents can tap into it but I’ve seen conflicting details on the conditions for parents to use the funds for the minor child.

- Beneficiaries would pay long-term capital gains tax rates, which are far lower than the tax rates on regular income, if the money goes to qualifying expenses like education or a mortgage.

- It's less beneficial than a 529 plan, in which withdrawals are tax-free for a variety of educational expenses, and whose contributions might be eligible for state income tax deductions. …”

Mulberry Heel

Inconceivable Member

- Messages

- 2,644

I don't know why anyone thought they wouldn't eventually get this done. When have Congressional Republicans stepped up and done the right thing almost anytime in the Age of Trump? As long as Dear Leader wanted this to pass it was going to. Although losing those three elderly Democrats who passed away this session didn't help. And although there will be some revisions in the Senate it will almost certainly pass there too once Dear Leader starts leaning on them to get it done. I can already see and hear Susan Collins expressing her "deep concerns" and furling her brow while she votes to pass whatever budget deal they put before her.

Wow, that was a short stay. Four posts and bah-bye. Super Ignore this troll or Russian bot. Take your pick.Winning seems to be what the GOP is doing while the left sits around crying about every damn -ism they can think of.

But at least you beat Trump in 2020!!!

- Messages

- 23,707

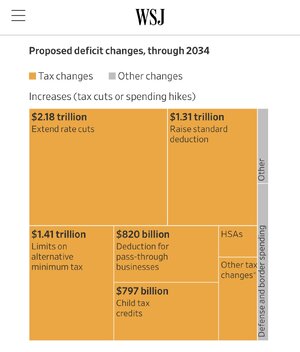

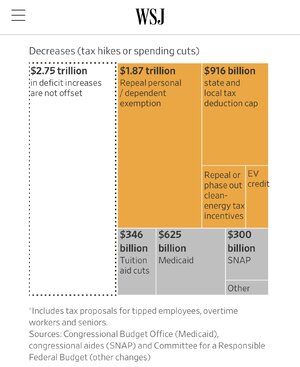

Breaking Down What’s in the GOP Tax Bill

Proposed tax cuts and new spending outweigh planned reductions to Medicaid and SNAP

- Messages

- 23,707

Breaking Down What’s in the GOP Tax Bill

Proposed tax cuts and new spending outweigh planned reductions to Medicaid and SNAP

—> https://www.wsj.com/politics/policy...82?st=ry3BXA&reflink=mobilewebshare_permalink

heelinhell

Iconic Member

- Messages

- 2,235

I have posted before that I believe the most pressing problem our country faces today is that the poor have too much and the rich have too little. The Big Beautiful Bill is insufficient to solve this ongoing problem, but it is a step in the right direction.

Thank you, Mr. President !!!

Thank you, Mr. President !!!

lawtig02

Inconceivable Member

- Messages

- 4,183

Agree, but the challenges are not over. The Senate version will almost certainly blow up the deficit even more, and it's not clear what will be too much for the hardliners in the House. I do agree with you they'll eventually get something done because they're all so afraid of being primaried from the right, but it's going to take a while still.I don't know why anyone thought they wouldn't eventually get this done. When have Congressional Republicans stepped up and done the right thing almost anytime in the Age of Trump? As long as Dear Leader wanted this to pass it was going to. Although losing those three elderly Democrats who passed away this session didn't help. And although there will be some revisions in the Senate it will almost certainly pass there too once Dear Leader starts leaning on them to get it done. I can already see and hear Susan Collins expressing her "deep concerns" and furling her brow while she votes to pass whatever budget deal they put before her.

chrissteel

Exceptional Member

- Messages

- 179

- The Tax Cuts and Jobs Act (TCJA) of 2017 included many provisions that are set to expire after 2025, especially for individual income taxes (like lower rates, the larger standard deduction, child tax credit changes, etc.).

- The CBO assumes these individual tax provisions will expire on schedule, meaning that in its baseline, taxes for individuals will rise starting in 2026.

- Therefore, any proposal to extend or make those provisions permanent is treated by the CBO as a new tax cut (because it's cutting taxes relative to the current law baseline).

StrangePackage

Iconic Member

- Messages

- 1,657

Does the Big Stupid Bill actually attempt to strip courts of their contempt powers?

robertreich.substack.com

robertreich.substack.com

The hidden provision in the Big Ugly Bill that makes Trump king

Don’t let this happen

ChileG

Iconic Member

- Messages

- 2,021

What pisses me off is regular people are told to tighten their belts for the good of the country - which turns out to nobody’s surprise means “for the good of Trump and Elon.”One thing that pisses me off -- I know I'm not the only one -- is why the billionaires are seeking tax cuts in the first place.

The point of being rich is that you no longer have to trouble yourself with such details. You don't have to make enemies just to save $20M on taxes when your net worth is 200x that. Do they also haggle over whether they got full credit for their discount rewards points at Subway?

It's hard to believe that even This Corrupt Supreme Court would consider that provision constitutional.Does the Big Stupid Bill actually attempt to strip courts of their contempt powers?

The hidden provision in the Big Ugly Bill that makes Trump king

Don’t let this happenrobertreich.substack.com

Share: