- Messages

- 23,341

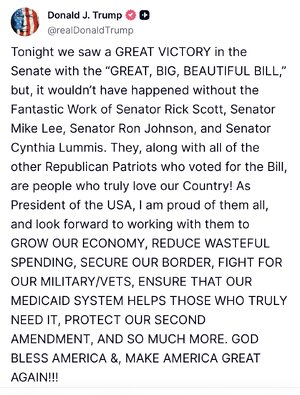

“… The bill would also force states to take on a greater share of the cost of providing food assistance. The amount a state owes would be based on a formula set by the percentage of erroneous payments reported each year. Those changes would go into effect in 2028. [I read elsewhere there is a waiver of this for states not in the co rigorous United States — the Murkowski vote concession as Alaska apparently has one of the highest error rates in the country]

… The Senate plan would temporarily lift the [SALT] cap to $40,000 for married couples with incomes up to $500,000. But that provision would expire after 2028 — an effort to buoy the blue-state Republicans through the 2026 midterm and 2028 election cycles, while limiting the long-term impact of the cuts on federal tax revenue.

… The Senate plan would require able bodied adults to work 80 hours per month until age 65 to qualify for benefits. There are carveouts for parents of children under 14 and those with disabilities.

The plan would also cap and gradually reduce the tax states can impose on Medicaid providers. The phase out would begin in 2028, ultimately ending in a 3.5 percent cap on that tax. Several GOP senators have raised concerns that the tax is a critical funding stream for rural hospitals in particular — which could close if that income stream dries up.

In an effort to alleviate some of those concerns, Senate GOP leaders included a new $25 billion fund to support rural hospitals. That program would also begin in 2028 and funds would be spread out over five years…”

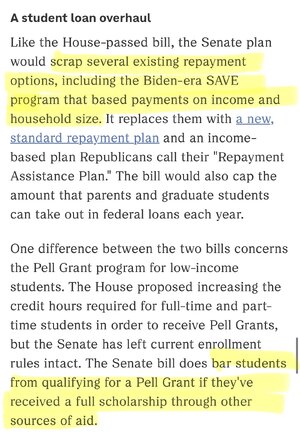

Background on Senate repayment plan: https://www.npr.org/2025/04/30/nx-s1-5381149/trump-republicans-student-loan-repayment

“… In their place will be two options: 1) a "Standard Repayment Plan" with fixed monthly payments across a range of 10 to 25 years and 2) a "Repayment Assistance Plan" that bases monthly payments on a borrower's total adjusted gross income. The plan also waives unpaid interest that isn't covered by the monthly payment, according to a Republican fact sheet. …”