CallMeTyler

Esteemed Member

- Messages

- 614

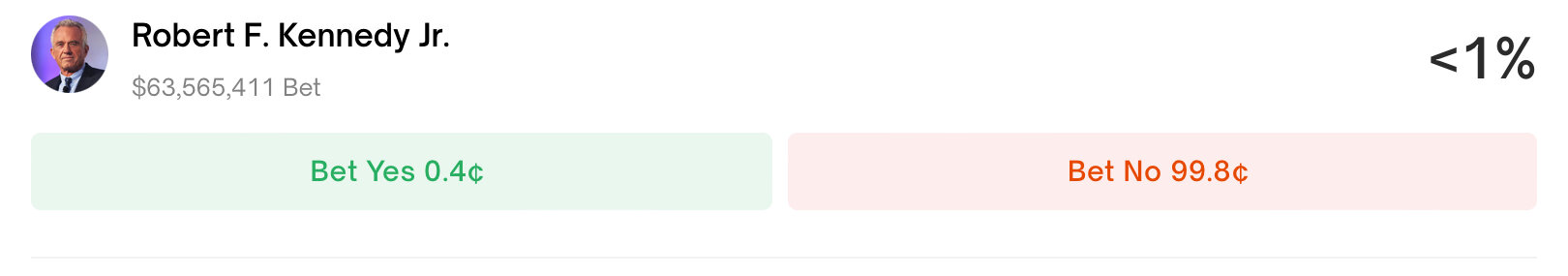

I can count on one hand the amount of times betting markets are discussed here, and that's regardless of who leads at any one time. If 5 days ago, it was Harris. Today - Trump.I’m not sure comments sections are an accurate sampling of all bettors.

Why do I have the feeling that if the betting markets were 80% for Kamala, certain posters would not be trying so hard to disavow the numbers? It reminds me of all the polling methodology criticism I read when Trump was ahead of Biden in the polls.

Again, betting markets are just one data point - and not a particularly important one. But they aren’t irrelevant either. It is a part of the information puzzle.

Again, you seem to ascertain some value from these lines moving. It doesn't appear many in this community do.

Hope that clears things up.