mynameisbond

Esteemed Member

- Messages

- 698

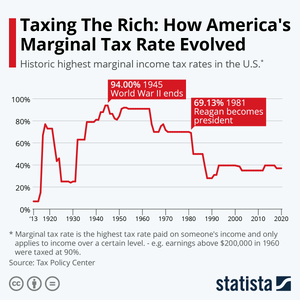

I've been working and having income withheld to pay into SS since age 16. Don't tell me it's an "entitlement". Having those funds taken in order to extend Trump's 2017 tax cuts for the wealthy is nothing less than stealing from working Americans to benefit the rich.