- Messages

- 507

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

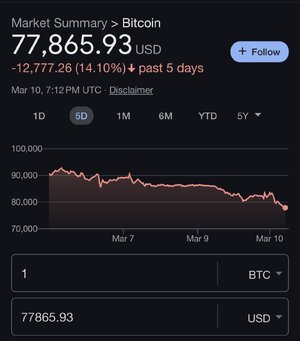

Crypto crashing - reversed by Crypto Reserve tweet

- Thread starter nycfan

- Start date

- Replies: 166

- Views: 4K

- Politics

- Messages

- 15,320

Crypto bros are hoping he will announce that today — a plan for zero capital gains on US crypto and 30% capital gains rate on foreign crypto.Did I see the headline correctly that Trump is issuing an EO to exempt crypto from capital gains taxes?

Duke Mu

Honored Member

- Messages

- 784

Tonight I'm going to party like it's 1929.

Duke Mu

Honored Member

- Messages

- 784

Yet, somehow deduct losses.Crypto bros are hoping he will announce that today — a plan for zero capital gains on US crypto and 30% capital gains rate on foreign crypto.

- Messages

- 15,320

But apparently Eric Trump’s promises about no capital gains one crypto never came up. A lot of crypto enthusiasts are irked that the event was a PR stunt that was mainly about other participants praising Trump and Trump reading some vague prepared remarks to cheerlead crypto (“but who the hell knows” he couldn’t help but add).

1moretimeagain

Iconic Member

- Messages

- 1,115

- Messages

- 15,320

Why Are Bitcoin, Ethereum Prices Falling?

Bitcoin and Ethereum extend losses as traders digest Trump’s Strategic Bitcoin Reserve order and a wave of U.S. trade tariffs.

“… “The knee-jerk reaction lower likely stems from the realization that no actual budget has been allocated for Bitcoin purchases in the near term,” Singapore-based digital asset trading firm QCP Capital wrote in a recent note.

Indeed, the order directs the Secretaries of Treasury and Commerce to develop “budget-neutral" strategies for acquiring additional Bitcoin but stops short of utilizing taxpayer funds to conduct spot purchases.

That appears to have rubbed investors the wrong way, according to David Lawant, head of research at FalconX.

… The executive order establishes a Bitcoin Strategic Reserve, separate from the Digital Asset Stockpile comprising a basket of altcoins, including Ethereum.

U.S. government wallets hold approximately 198,000 BTC (worth about $16.1 billion at current prices), according to Arkham Intelligence.

However, some of those holdings stem from exchange hacks and may not be available for the reserve if returned to prior owners.

The order also mandates a 60-day Treasury review of legal and investment considerations for the reserve, while Treasury and Commerce must explore ways to acquire more Bitcoin without impacting the federal budget or costing taxpayers.

Potential solutions include reallocating a portion of U.S. gold reserves or tapping into the Exchange Stabilization Fund. …”

——

About that pending Trump/Musk “audit” of Fort Knox …

superrific

Legend of ZZL

- Messages

- 5,679

Bitcoin is down 14% because TSLA is down 14%. BTC is just a weird proxy for tech stocks.

uncgriff

Esteemed Member

- Messages

- 583

Tesla is down 15% today.Bitcoin is down 14% because TSLA is down 14%. BTC is just a weird proxy for tech stocks.

- Messages

- 566

hope they both go to zero

It is now back to where it was before the election. The Trump bump is over for TSLA. Now it is about to get the Musk dump.Tesla is down 15% today.

CFordUNC

Inconceivable Member

- Messages

- 4,379

I don’t really do individual stock picking but just for fun several years ago I bought something like 25 shares of Tesla stock with one of my annual bonus checks. Sold them essentially the moment Elon acquired Twitter and glad I did. He’s going to single-handedly tank the whole damn company.

uncgriff

Esteemed Member

- Messages

- 583

The half of the country that would actually buy a Tesla will now never buy a Tesla. The other half would never buy a Tesla anyway. And Europe is never going to be a market after the last 6 weeks

Hertz lost their shirts when they bought a fleet of teslas. Nobody rented them and they couldn't sell them used. People who have teslas now are going to be shocked when their resale value is abysmal

All because of a ketamine induced messianic delusional complex.

Hertz lost their shirts when they bought a fleet of teslas. Nobody rented them and they couldn't sell them used. People who have teslas now are going to be shocked when their resale value is abysmal

All because of a ketamine induced messianic delusional complex.

I dunno. Teslas are still popular in California - especially with Asian and Indian buyers (who seem less bothered by Musk’s antics).The half of the country that would actually buy a Tesla will now never buy a Tesla. The other half would never buy a Tesla anyway. And Europe is never going to be a market after the last 6 weeks

uncgriff

Esteemed Member

- Messages

- 583

This was BEFORE the last 6 weeks.I dunno. Teslas are still popular in California - especially with Asian and Indian buyers (who seem less bothered by Musk’s antics).

Apparently that’s because they were all bought around where I live. Irvine is basically Tesla central.This was BEFORE the last 6 weeks.

uncgriff

Esteemed Member

- Messages

- 583

It's not like they are going to vanish off the roads overnight. But new sales will be dismalApparently that’s because they were all bought around where I live. Irvine is basically Tesla central.

- Messages

- 1,956

Think I read the other day the California State tax fund break for EVS ran out of $--this was before the MUSK IS GOD stringApparently that’s because they were all bought around where I live. Irvine is basically Tesla central.

Share: