Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News Thread | 3Q Annual GDP 2.8%

- Thread starter nycfan

- Start date

- Replies: 607

- Views: 12K

- Politics

aGDevil2k

Iconic Member

- Messages

- 2,474

You know tone and implication of tone?A prediction is rooting against?

aGDevil2k

Iconic Member

- Messages

- 2,474

Indeed. Like you do with Harris, hypocrite.Lol, come on, anything to keep beating him down

Trump can rot in Hell.

A few thoughts here:

- The American middle class is bifurcated in way that it perhaps has never been: those who had assets prior to COVID and those who did not. Those who owned a home with a fixed-rate mortgage, had excess cash, and some investments are likely doing fine - perhaps great - right now. Those who were either too young to own assets, or did not own assets for other reasons, are likely struggling more so than usual right now. Ultimately, we all contribute to the same economy, and I believe the market is starting to realize that the latter group no longer has excess cash to spend on non-necessary consumables or large purchases such as cars, which will drag down the economy.

- Rate hikes take a while to impact the economy, as will rate cuts. A September rate cut will not magically turn things around by November.

- Mortgage rates are only indirectly impacted by the Fed and are already trending lower. Don't expect a 25 or 50 bps rate cut to directly lower mortgage rates 25 or 50 bps. It may not impact them at all.

- Messages

- 1,381

I make more each year now than I ever did..when I was working...I am retired . I have almost no expenses ,I could almost live exclusively on Soc Sec if I wanted . Of course I have a boring life lol . One of my three children has a growing family-stay at home mom--I don't see them ever buying a house-until someone leaves them some moneyA few thoughts here:

- The American middle class is bifurcated in way that it perhaps has never been: those who had assets prior to COVID and those who did not. Those who owned a home with a fixed-rate mortgage, had excess cash, and some investments are likely doing fine - perhaps great - right now. Those who were either too young to own assets, or did not own assets for other reasons, are likely struggling more so than usual right now. Ultimately, we all contribute to the same economy, and I believe the market is starting to realize that the latter group no longer has excess cash to spend on non-necessary consumables or large purchases such as cars, which will drag down the economy.

- Rate hikes take a while to impact the economy, as will rate cuts. A September rate cut will not magically turn things around by November.

- Mortgage rates are only indirectly impacted by the Fed and are already trending lower. Don't expect a 25 or 50 bps rate cut to directly lower mortgage rates 25 or 50 bps. It may not impact them at all.

WaynetheDrain

Esteemed Member

- Messages

- 552

So, if KamalaCrash is a thing, then Trump is admitting that the dip in stocks is due to the anticipation of her winning the election. In other words, by Trump's logic this kind of thing couldn't happen unless she is now the clubhouse leader for the next POTUS.

A rare moment of honesty from Donnie.

A rare moment of honesty from Donnie.

Last edited:

- Messages

- 1,239

He deserves no benefit of the doubt. If there were any justice he would be in jail.Lol, come on, anything to keep beating him down

- Messages

- 8,634

Gift link: https://www.wsj.com/finance/stocks/...s1dr9kpcdrs3&reflink=mobilewebshare_permalink

Is This 1987 All Over Again? What’s Driving the Market Meltdown?

Just like today, going into ‘Black Monday’ investors were on edge and ready to sell to lock in big profits

- Messages

- 8,634

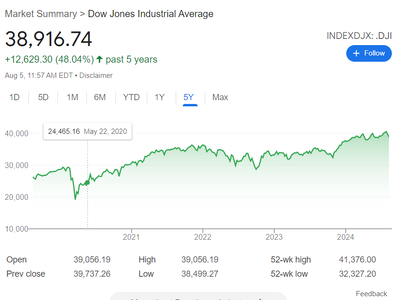

Unraveling Trades Fuel Global Market Rout

U.S. stock indexes trade sharply lower, tracing declines in international markets; Dow industrials fall more than 1000 points

“

The unwinding of some of Wall Street’s most popular trades intensified Monday, sending Japanese stocks to their worst day since the 1987 market crash and walloping U.S. technology shares.

U.S. stock indexes opened sharply lower, tracing declines in international markets, before recovering somewhat after a survey of purchasing managers showed the services sector expanded last month at a slightly higher rate than expected.

…

The rout began in Asia, where Japan’s Nikkei 225 tumbled 12% amid a surging yen. It was the worst single-day percentage drop for the Nikkei since Oct. 20, 1987. That was the Tuesday after Black Monday in the U.S., when the Dow industrials fell nearly 23%.

The selloff in Tokyo extended last week’s rout that followed the Bank of Japan’s decision to raise interest rates. That move pushed the yen higher relative to other currencies. Disappointing economic data in the U.S. stoked the selloff, unwinding a popular Wall Street bet known as the carry trade. …”

lawtig02

Iconic Member

- Messages

- 1,521

Yeah, while today’s storylines have focused on the slight rise in US unemployment, seems to me the real story is BOJ’s rate hike. And if that’s the case, this is highly likely to be a 3-5 day blip, and certainly nothing resembling a “Kamala Recession.”

Unraveling Trades Fuel Global Market Rout

U.S. stock indexes trade sharply lower, tracing declines in international markets; Dow industrials fall more than 1000 points

“

The unwinding of some of Wall Street’s most popular trades intensified Monday, sending Japanese stocks to their worst day since the 1987 market crash and walloping U.S. technology shares.

U.S. stock indexes opened sharply lower, tracing declines in international markets, before recovering somewhat after a survey of purchasing managers showed the services sector expanded last month at a slightly higher rate than expected.

…

The rout began in Asia, where Japan’s Nikkei 225 tumbled 12% amid a surging yen. It was the worst single-day percentage drop for the Nikkei since Oct. 20, 1987. That was the Tuesday after Black Monday in the U.S., when the Dow industrials fell nearly 23%.

The selloff in Tokyo extended last week’s rout that followed the Bank of Japan’s decision to raise interest rates. That move pushed the yen higher relative to other currencies. Disappointing economic data in the U.S. stoked the selloff, unwinding a popular Wall Street bet known as the carry trade. …”

CFordUNC

Inconceivable Member

- Messages

- 3,278

Republicans are going to be so frustrated when this correction doesn't turn into Great Depression 2.0.Yeah, while today’s storylines have focused on the slight rise in US unemployment, seems to me the real story is BOJ’s rate hike. And if that’s the case, this is highly likely to be a 3-5 day blip, and certainly nothing resembling a “Kamala Recession.”

- Messages

- 8,634

It is hard to get Americans to acknowledge how complex the world economy is and how our markets impact each other. Inflation has been an obvious lesson that people have chosen to ignore — our economy is massive and resilient but doesn’t and cannot operate in isolation.Yeah, while today’s storylines have focused on the slight rise in US unemployment, seems to me the real story is BOJ’s rate hike. And if that’s the case, this is highly likely to be a 3-5 day blip, and certainly nothing resembling a “Kamala Recession.”

lawtig02

Iconic Member

- Messages

- 1,521

Agree, which is why I think the timeframe matters. If the market drops further and stays down for a while, this could be a problem. If this is a 1-2 week blip, it’s irrelevant. I suspect it’s the latter, but we’ll see.It is hard to get Americans to acknowledge how complex the world economy is and how our markets impact each other. Inflation has been an obvious lesson that people have chosen to ignore — our economy is massive and resilient but doesn’t and cannot operate in isolation.