Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News Thread | Consumer Confidence declines

- Thread starter nycfan

- Start date

- Replies: 1K

- Views: 30K

- Politics

- Messages

- 15,065

Is there a regional inventory and home price shift on the horizon, with home prices in the Sunbelt on the verge of a downward adjustment?

www.wsj.com

www.wsj.com

"... Beneath the headline numbers, different states are recovering at sharply different paces. Inventory has shot above 2019 levels in a handful of areas. In Texas, the number of properties for sale is 20% higher than it was before the pandemic, data from Realtor.com shows. Florida and Colorado are also above 2019 levels.

...At the other end of the spectrum, supply is crunched in parts of the Northeast and Midwest. In 15 states including New Jersey and Pennsylvania, the number of homes currently on the market is still less than half what was normal before the pandemic.

Several things are causing a two-speed housing market. One is a glut of newly built homes. Last December, builders had 118,000 ready-to-occupy single-family homes sitting unsold, according to the National Association of Home Builders—the highest level since August 2009.

Based on permitting applications, most new construction has happened in the South, particularly in Florida and Texas. Florida expanded its housing stock by 15% since 2020, according to estimates by Brad O’Connor, chief economist at Florida Realtors. These newly built homes are hitting the market at a time when demand from buyers is exceptionally weak because mortgage rates remain high. As properties sit unsold, inventories are creeping up.

Meanwhile, in states like Illinois, strict zoning laws and expensive building costs have hampered new construction. And the inventory of existing homes for sale is gummed up. Jeff Baker, chief executive officer of Illinois Realtors, says that although many homeowners in the state want to move, there is so little supply and prices are so inflated that people have little choice but to stay put.

The lock-in effect of cheap mortgages is also slightly weaker in some regions than in others, which is influencing how fast homes are hitting the market. In the South, 21% of outstanding mortgages on average had a rate of 6% or higher at the third quarter of last year compared with 18% in the Northeast, based on an analysis by Chris Porter, a senior vice president at John Burns Research and Consulting. This is largely because more homes have sold in the South since interest rates rose, because of continued migration to the region. ..."

Are Home Values About to Fall? It Depends on the Location

The supply of houses for sale is recovering much faster in some parts of the country than in others.

- Home values are likely to fall in some parts of the country such as Florida and Texas, where there is an oversupply of newly built homes and prices look overvalued.

- In other parts of the country, such as the Northeast and Midwest, there is a continued lack of supply.

- The national supply of homes for sale is still below prepandemic levels, but it is increasing as more homeowners decide to sell.

"... Beneath the headline numbers, different states are recovering at sharply different paces. Inventory has shot above 2019 levels in a handful of areas. In Texas, the number of properties for sale is 20% higher than it was before the pandemic, data from Realtor.com shows. Florida and Colorado are also above 2019 levels.

...At the other end of the spectrum, supply is crunched in parts of the Northeast and Midwest. In 15 states including New Jersey and Pennsylvania, the number of homes currently on the market is still less than half what was normal before the pandemic.

Several things are causing a two-speed housing market. One is a glut of newly built homes. Last December, builders had 118,000 ready-to-occupy single-family homes sitting unsold, according to the National Association of Home Builders—the highest level since August 2009.

Based on permitting applications, most new construction has happened in the South, particularly in Florida and Texas. Florida expanded its housing stock by 15% since 2020, according to estimates by Brad O’Connor, chief economist at Florida Realtors. These newly built homes are hitting the market at a time when demand from buyers is exceptionally weak because mortgage rates remain high. As properties sit unsold, inventories are creeping up.

Meanwhile, in states like Illinois, strict zoning laws and expensive building costs have hampered new construction. And the inventory of existing homes for sale is gummed up. Jeff Baker, chief executive officer of Illinois Realtors, says that although many homeowners in the state want to move, there is so little supply and prices are so inflated that people have little choice but to stay put.

The lock-in effect of cheap mortgages is also slightly weaker in some regions than in others, which is influencing how fast homes are hitting the market. In the South, 21% of outstanding mortgages on average had a rate of 6% or higher at the third quarter of last year compared with 18% in the Northeast, based on an analysis by Chris Porter, a senior vice president at John Burns Research and Consulting. This is largely because more homes have sold in the South since interest rates rose, because of continued migration to the region. ..."

- Messages

- 1,674

‘Trumpcession’ predicted to crash economy after new Trump tariffs hit markets: Live

President’s trade aggression causes unease after he suspends American aid for Ukraine

U.S. forecast to enter recession after Trump crashes markets with tariffs on Canada, China and Mexico: Live

ChapelHillSooner

Esteemed Member

- Messages

- 664

I really think that this entire thing is going to be a massive wealth transfer from the right to left. That is aside from the creation of American oligarchs.

People in the left and center get what is going on. They have an understanding of the significant risks. People on the right are in a cult and are not going to make solid financial decisions.

On various subreddits I have noticed those who still hold out hope that their stocks will be fine are MAGA types. (You can tell by looking at their comments on other subreddits.)

Once those people start to realize the shit storm we are in it will be too late. Stocks will crash hard at that point.

People in the left and center get what is going on. They have an understanding of the significant risks. People on the right are in a cult and are not going to make solid financial decisions.

On various subreddits I have noticed those who still hold out hope that their stocks will be fine are MAGA types. (You can tell by looking at their comments on other subreddits.)

Once those people start to realize the shit storm we are in it will be too late. Stocks will crash hard at that point.

uncmba

Well-Known Member

- Messages

- 93

A Poor North Carolina County Is Counting on Trump for a Comeback

Scotland County ushered in Republicans locally, too. But now one farmer says, “We better see some relief.”

MOUNTAINH33L

Distinguished Member

- Messages

- 428

A Poor North Carolina County Is Counting on Trump for a Comeback

Scotland County ushered in Republicans locally, too. But now one farmer says, “We better see some relief.”www.wsj.com

- Messages

- 1,674

- Private companies added just 77,000 new workers for the month, well off the upwardly revised 186,000 in January and below the 148,000 estimate, ADP reported.

- The report reflected tariff concerns, as a sector that lumps together trade, transportation and utility jobs saw a loss of 33,000 positions.

- Messages

- 3,693

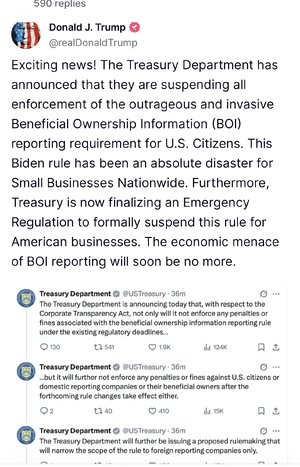

So, Trump’s enterprises are safe now.This doesn’t seem like a good idea.

superrific

Legend of ZZL

- Messages

- 5,517

This is astounding, but also entirely predictable. It really shows the lie behind Elon's implications when he wants to take out government spending out of GDP. He thinks he's hitting the government; he apparently doesn't realize that he's hitting the private sector even harder.

- Private companies added just 77,000 new workers for the month, well off the upwardly revised 186,000 in January and below the 148,000 estimate, ADP reported.

- The report reflected tariff concerns, as a sector that lumps together trade, transportation and utility jobs saw a loss of 33,000 positions.

It's not just tariff concerns, of course. That's a big part of it, but economic uncertainty in general is paralyzing. What is going to happen to consumer demand with 500K laid off federal workers? What is going to happen to my receivables from organizations that have their funding cut off and are probably going to go under? These are not conditions in which companies will hire. The tariffs are probably the biggest component, but not the only one.

Again, the month-over-month is jarring. The economy was strong in January. Trump has decimated it in one month.

- Messages

- 1,674

They cant (or won't see) that every dollar spent by government has ripple effects through the private sector, which in turn flows into the populace. Of course people like trump and Elon want it to flow into their own accounts.This is astounding, but also entirely predictable. It really shows the lie behind Elon's implications when he wants to take out government spending out of GDP. He thinks he's hitting the government; he apparently doesn't realize that he's hitting the private sector even harder.

It's not just tariff concerns, of course. That's a big part of it, but economic uncertainty in general is paralyzing. What is going to happen to consumer demand with 500K laid off federal workers? What is going to happen to my receivables from organizations that have their funding cut off and are probably going to go under? These are not conditions in which companies will hire. The tariffs are probably the biggest component, but not the only one.

Again, the month-over-month is jarring. The economy was strong in January. Trump has decimated it in one month.

ChileG

Iconic Member

- Messages

- 1,223

Evidence of Trumps amazing negotiation strategy, I suppose.

- Private companies added just 77,000 new workers for the month, well off the upwardly revised 186,000 in January and below the 148,000 estimate, ADP reported.

- The report reflected tariff concerns, as a sector that lumps together trade, transportation and utility jobs saw a loss of 33,000 positions.

superrific

Legend of ZZL

- Messages

- 5,517

Well, not every dollar. But certainly the dollars of salaried employees who lose their jobs.They cant (or won't see) that every dollar spent by government has ripple effects through the private sector, which in turn flows into the populace. Of course people like trump and Elon want it to flow into their own accounts.

Economists often talk about multiplier effects, which is basically a measure of the stimulative or contractionary effect of different policies. The favored stimulus measure for Pubs, tax cuts, has a very low but positive multiplier. Tapering defense spending over a couple of years would have a negative multiplier, but it would be low in absolute value.

Mass firing of employees is one of the most negative multiplier policies that an administration could pursue. Wouldn't surprise me if these policies have a multiplier as significant as minus two.

- Messages

- 15,065

“Eight of the 12 Federal Reserve districts reported flat or slightly negative growth in February, according to the central bank’s Beige Book survey, released Wednesday. Six districts reported no change in activity while two saw slight contractions.

Overall, activity across the country rose “slightly,” the report said, while employment only “nudged slightly higher.” …”

Mulberry Heel

Iconic Member

- Messages

- 1,666

You may well be right, although I do think that cutting federal funding is going to hurt a lot of liberal researchers, doctors, scientists, and the like, and I think MAGA Nation isn't going to stop using the government to go after liberals in various professions. I do think you're absolutely right that Trump's base - especially the non-college educated, rural ones - are going to likely suffer the most. Trump doesn't care about them beyond their votes, he's often expressed contempt for them in private conversations that were later leaked, and if they struggle he's just going to shrug as long as they stick with him.I really think that this entire thing is going to be a massive wealth transfer from the right to left. That is aside from the creation of American oligarchs.

People in the left and center get what is going on. They have an understanding of the significant risks. People on the right are in a cult and are not going to make solid financial decisions.

On various subreddits I have noticed those who still hold out hope that their stocks will be fine are MAGA types. (You can tell by looking at their comments on other subreddits.)

Once those people start to realize the shit storm we are in it will be too late. Stocks will crash hard at that point.

- Messages

- 3,693

Great leader, the greatest leader. Just ask him.Evidence of Trumps amazing negotiation strategy, I suppose.

JCTarheel82

Iconic Member

- Messages

- 1,157

Saw that Bessent is still trying to blame Biden for the negative impact of Trump's terrible economic policies. This entire administration has severe BDS.

- Messages

- 559

European markets (especially Germany) and China are on a tear. U.S. markets now flat over Trump regime. Investors have fooled themselves into believing that Trump's tariffs are all bluffs and bluster, so far.

MAGAts are generally dumb and manipulated.

MAGAts are generally dumb and manipulated.

ChapelHillSooner

Esteemed Member

- Messages

- 664

That is a good point. I don’t want to minimize the direct impact on people. I very well could lose my own job in the coming months.You may well be right, although I do think that cutting federal funding is going to hurt a lot of liberal researchers, doctors, scientists, and the like, and I think MAGA Nation isn't going to stop using the government to go after liberals in various professions. I do think you're absolutely right that Trump's base - especially the non-college educated, rural ones - are going to likely suffer the most. Trump doesn't care about them beyond their votes, he's often expressed contempt for them in private conversations that were later leaked, and if they struggle he's just going to shrug as long as they stick with him.

I was thinking about the investment side only.

Share: