superrific

Legend of ZZL

- Messages

- 5,517

For the record, the median of the top 10% is also known as 95th percentile.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

My sister did a mass text and stuff urging everyone she knows to do it. think it needed wider public coverage to have any effect. I had not heard of it til then.Anybody doing the economic blackout thing today? Friday Feb 28…

I’m not sure if this will have any affect or effect - even if every single non-Trumper participated. But I’m in, just not sure if it’s going to matter one iota.

Never been one for downers but dabbled a bit. Had a buddy who was stationed in Korea who would write me letters with sticky black stuff smeared on. Yes it was opium. As you say sweet dreams.I mostly stay away from opiates. They cause terrible constipation for me. They had morphine as a fallback for me after my trach. I was able to settle for Tylenol. Since they said I couldn't leave until I was able to have a bowel movement, I decided the opiates weren't worth it.

There was a time back in the very early 70s that I had a fair amount of fun smoking opium. A bit of opium, some hash and some cognac made for some sweet dreams.

Weren't my thing for the most part but a couple of my buddies had just gotten back from Vietnam and had some sort of thing going. Don't really know what but bits and pieces came my way.Never been one for downers but dabbled a bit. Had a buddy who was stationed in Korea who would write me letters with sticky black stuff smeared on. Yes it was opium. As you say sweet dreams.

There's no way this can be true. Trump has the keys to the best economy ever, he told us so. And he told us he was going to give it to us, because we are so deserving.That will get the fed to cut interest rates. Unless we enter stagflation.

Hooray !For the record, the median of the top 10% is also known as 95th percentile.

You are an elite!!!Hooray !

That makes me feel even richer

I am a proud limousine liberalYou are an elite!!!

They Crashed the Economy in 2008. Now They’re Back and Bigger Than Ever.

Wall Street expects to sell more than $335 billion in asset-backed debt this year. Remember that conference in ‘The Big Short’? It just drew a record 10,000.

“… Wall Street is once again creating and selling securities backed by everything—the more creative the better—including corporate loans and consumer credit-card debt, lease payments on cars, airplanes and golf carts, and payments to data centers. Once dominated by bonds backed by home mortgages, deals now reach into nearly every cranny of the economy.

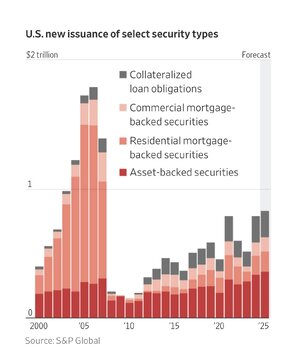

… New U.S. issuance of some of the most popular flavors of publicly traded structured credit hit record levels in 2024 and are expected to surpass those tallies this year, according to S&P Global. New asset-backed securities totaled $335 billion last year. Collateralized loan obligations, or baskets of corporate debt, rose to $201 billion, also an all-time high.

… Today, big investors want to buy these types of securities because they think they are relatively safe and yield more than government-backed bonds. Banks are mostly middlemen because regulations instituted after 2008 curtailed their lending. That has opened the way for giant fund-management companies like KKR, Apollo Global Management and Ares Management to muscle in and make loans with their own capital.

… The business came back, Goldwasser said, because a lot of securitized debt has performed well over time, and proved useful to smaller companies in search of cheaper financing. “It’s the great equalizer of finance,” she said.

… Sales of securitized debt have been surging since the Covid-19 pandemic, when the Fed lowered rates and investors were awash with cash and looking for investments, Flanagan said. “Everything is going to end up here,” he said.

That includes debt backed by money tied to artificial intelligence, solar energy and even payments from plastic-surgery patients. Bonds backed by leases on data centers and fiber-optic networks—which power companies’ AI operations—hit $4 billion in the first two months of this year, equivalent to one-third of total issuance in 2024, according to Finsight.

… Data-center bonds are backed by lease payments from companies that rent out computing capacity. It will cost about $3 trillion to build the centers needed in the next five years, according to BlackRock. That prospect had many at the conference giddy with excitement. …”

What is a tech-based ABS? You mean auto loans from Tesla? Netflix receivables?As a background note, a loan that is secured by an asset (a house or a car, for instance in consumer terms, or assets of a business) is “collateralized.” If a secured or “collateralized” loan is not repaid, a specific asset (or all the assets) owned by the debtor can be repossessed or sold by the lender to recover all or part of the debt owed.

But a Collateralized Loan Obligation (CLO) in its simplest form is a large pool (at least 200) of individual secured corporate loans (i.e. loans to companies usually for general corporate purposes) that are bundled into a group and interests in the payments on those loans is the return on investment. In theory, the way the price of an investment in a CLO (bundle of loans) is discounted should reflect the risk of some reasonable percentage of defaults in the bundle of loans still resulting in a return on the investment because all the other loans perform as expected.

Similarly, asset-backed securitization is a large pool of consumer or (mostly small or start-up) business loans secured by a particular asset (consumer auto loans, for example). In most of these cases, any individual loan in the class is too small to syndicate (sell a portion of the risk to other lender or investors), but when bundled together a large group of these small loans become a security that can be sold to investors to spread the risk on all of them in a bundle (priced based on a discount assuming some rate of default based on the quality of the loans and assets).

A potential issue right now is that a lot of new investors seem drawn to related tech-based asset classes of ABS and CLO securities — especially the component parts of crypto and especially AI development, from leases to cooling equipment to energy support to computing tech, as well as lenders making secured loans in the tech sector and energy supporting the tech sector. The problem could become that if what looks like diversified risk is really all tech sector risk by various names and there is a major downturn in that sector (say driven by a cheap new alternative to wildly expensive energy consuming AI), large financial investors across the economy are now sharing the risk. That can be good if the risk is diluted by the securitization but catastrophic if the risk is too large for the economy to absorb (see the Great Recession).

Anyway, securitization is a key to creating liquidity and is not inherently bad — well managed it actually does dilute risk to the economy of a sector downturn while maintaining healthy liquidity for consumers and business. But as we saw with the mortgage-backed securitization crisis in 2007-2008, if too much risk is concentrated in a particular segment, a severe blow to that segment can cause a cascade throughout the entire economy…

We are definitely going to get it alright.There's no way this can be true. Trump has the keys to the best economy ever, he told us so. And he told us he was going to give it to us, because we are so deserving.

As a background note, a loan that is secured by an asset (a house or a car, for instance in consumer terms, or assets of a business) is “collateralized.” If a secured or “collateralized” loan is not repaid, a specific asset (or all the assets) owned by the debtor can be repossessed or sold by the lender to recover all or part of the debt owed.

But a Collateralized Loan Obligation (CLO) in its simplest form is a large pool (at least 200) of individual secured corporate loans (i.e. loans to companies usually for general corporate purposes) that are bundled into a group and interests in the payments on those loans is the return on investment. In theory, the way the price of an investment in a CLO (bundle of loans) is discounted should reflect the risk of some reasonable percentage of defaults in the bundle of loans still resulting in a return on the investment because all the other loans perform as expected.

Similarly, asset-backed securitization is a large pool of consumer or (mostly small or start-up) business loans secured by a particular asset (consumer auto loans, for example). In most of these cases, any individual loan in the class is too small to syndicate (sell a portion of the risk to other lender or investors), but when bundled together a large group of these small loans become a security that can be sold to investors to spread the risk on all of them in a bundle (priced based on a discount assuming some rate of default based on the quality of the loans and assets).

A potential issue right now is that a lot of new investors seem drawn to related tech-based asset classes of ABS and CLO securities — especially the component parts of crypto and especially AI development, from leases to cooling equipment to energy support to computing tech, as well as lenders making secured loans in the tech sector and energy supporting the tech sector. The problem could become that if what looks like diversified risk is really all tech sector risk by various names and there is a major downturn in that sector (say driven by a cheap new alternative to wildly expensive energy consuming AI), large financial investors across the economy are now sharing the risk. That can be good if the risk is diluted by the securitization but catastrophic if the risk is too large for the economy to absorb (see the Great Recession).

Anyway, securitization is a key to creating liquidity and is not inherently bad — well managed it actually does dilute risk to the economy of a sector downturn while maintaining healthy liquidity for consumers and business. But as we saw with the mortgage-backed securitization crisis in 2007-2008, if too much risk is concentrated in a particular segment, a severe blow to that segment can cause a cascade throughout the entire economy…

Esoterics include fiber, telecom and tech equipment leases, blockchain tech and support equipment, software IP, cloud services and SaaS streams.What is a tech-based ABS? You mean auto loans from Tesla? Netflix receivables?

Oh, I missed the part where you mentioned leases (those leases are for everything that follows, right? They aren't putting cooling equipment in an ABS). But who are the tech companies, which I guess was my main question.

It’s a great idea if you’re acting as a proxy for the world’s greatest money launderer.This doesn’t seem like a good idea.