- Messages

- 41,500

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 5K

- Views: 213K

- Politics

Bigs23

Inconceivable Member

- Messages

- 3,099

Not even surprising.

BillOfRights

Iconic Member

- Messages

- 1,593

Uh oh

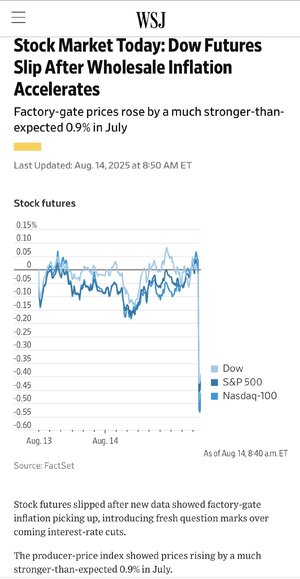

Wholesale prices rose 0.9% in July, much more than expected

Wholesale prices rose 0.9% in July, much more than expected

MOUNTAINH33L

Iconic Member

- Messages

- 1,083

p5mmr9

Distinguished Member

- Messages

- 432

This is so hilarious.

- Messages

- 41,500

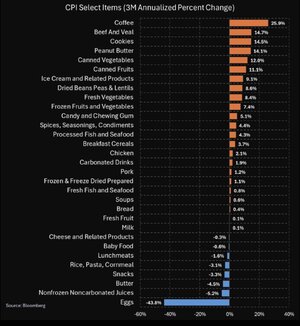

We saw the wholesale CPI data play out pretty clearly in the reverse direction for egg prices earlier this year. While egg prices stayed elevated, Trump started claiming repeatedly the prices were dropping. It eventually became clear he was citing drops in wholesale egg prices, which started dropping significantly 6-8 weeks ahead of the eventual drop in retail egg prices (which may have been delayed by Easter demand / seasonal price hikes).

- Messages

- 41,500

p5mmr9

Distinguished Member

- Messages

- 432

President Donald Trump’s pick to run the Bureau of Labor Statistics was among the crowd outside the Capitol on Jan. 6, 2021, with the White House saying he was a “bystander” who wandered over after seeing coverage on the news.

hahahahahah

lawtig02

Legend of ZZL

- Messages

- 5,894

Lolololol. If there's every been more dispositive proof of how stupid the "It's the Price of Eggs!!!" talking point has always been, I've never seen it.

- Messages

- 41,500

Compared to 2022, the inflation rate is only a third of that spiked rate, but it does look like we are seeing wholesale impact of the tariffs settling and being factored into pricing (the portion attributable to tariffs is not true inflation from an economic perspective — increases attributable to tariffs are an artificial increase from tax/government policy, not truly inflationary supply/demand pressure, though beef certainly has separate supply/demand inflation issues).Loading…

www.cnn.com

Yep inflation is back, big time. But this time, it brings a Stag along with it. Thanks idiot voters.

BillOfRights

Iconic Member

- Messages

- 1,593

The impact of the tariffs is just starting to build. We should probably expect more increases.Compared to 2022, the inflation rate is only a third of that spiked rate, but it does look like we are seeing wholesale impact of the tariffs settling and being factored into pricing (the portion attributable to tariffs is not true inflation from an economic perspective — increases attributable to tariffs are an artificial increase from tax/government policy, not truly inflationary supply/demand pressure, though beef certainly has separate supply/demand inflation issues).

So many own goals and self-inflicted wounds with this administration, and we have 3 1/2 more years of this.

- Messages

- 4,112

I'm not an economist, but isn't the PPI considered a predictor of the inflation to come as opposed to CPI which is considered a lagging indicator of inflation ?

I will be interested to see where things are in October as we head into the holiday season.

I will be interested to see where things are in October as we head into the holiday season.

- Messages

- 41,500

Yeah, PPI (sometimes aka wholesale CPI) is broader than CPI and measures price increases at the production level. It also includes more stuff than products headed for retail (like services), while CPI measures changes in what consumers were paying for retail items last measurement period in sampled areas (urban).I'm not an economist, but isn't the PPI considered a predictor of the inflation to come as opposed to CPI which is considered a lagging indicator of inflation ?

I will be interested to see where things are in October as we head into the holiday season.

Share: