Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 5K

- Views: 211K

- Politics

- Messages

- 40,918

As the August jobs report showed a weakening economy, Fox cast doubt on the data before it was even released

Continuing the shoot the messenger approach, Fox was casting doubt on the jobs data even before it was released“…

- That afternoon [yesterday], host Larry Kudlow dismissed the monthly jobs reports as “one big crapshoot” and complained: “Plus, we've seen some very big downward revisions in recent months. It's quite possible there would be more of these on the way.”

Kudlow then lamented that Trump’s chosen nominee for the BLS isn’t in place yet, saying: “We have a new man at the BLS, E.J. Antoni, a great friend of this show and an awfully smart fella, but he's not going to be in the office and not going to make any real improvements for quite some time. It's going to take a while.”

Kudlow also said: “Don't hang your hat on tomorrow's jobs report, because the economy's doing better than you think.”…”

superrific

Master of the ZZLverse

- Messages

- 12,313

Unless, like some of our board mooks, they don't understand it.Republicans have hit 100% Dear Leader saturation. It’s one thing to offer complete fealty through deflecting and obfuscating blatant corruption, criminality, and idiocy, but it’s another thing entirely to deny arithmetic.

ChileG

Inconceivable Member

- Messages

- 3,147

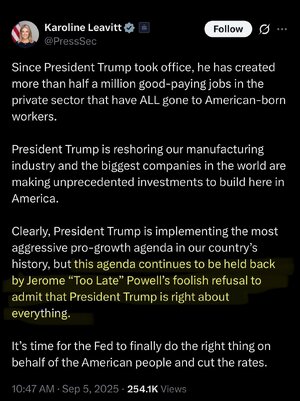

And the very next post (by nycfan) after I posted this. This administration is as predictable as the are deplorable.The decline in jobs and the rise in the employment rate show that Powell should have reduced rates already…also, those jobs and employment numbers are democrats hoaxes!

... and the REAL numbers are likely to get worse. I heard an economist say that revisions (and particularly second revisions) are typically downward because businesses are more reluctant to send in bad numbers. If numbers are good, they generally send them in quicker.

superrific

Master of the ZZLverse

- Messages

- 12,313

I don't know about that. It has been established that revisions tend to (but only tend to) cluster in the same direction. If three reports in a row were revised down, it's more likely that the fourth revision is also down. This was news to me, as I had thought the revision tended to be stochastic, but apparently that was either stale information or not accurate.... and the REAL numbers are likely to get worse. I heard an economist say that revisions (and particularly second revisions) are typically downward because businesses are more reluctant to send in bad numbers. If numbers are good, they generally send them in quicker.

- Messages

- 40,918

This Hyundai story is weird, BTW, but unfortunately the government is plotted with co piracy nuts making it hard to take anything seriously. Perhaps that is the true goal.

“… The operation Thursday, at an electric vehicle battery plant owned by Hyundai Motor and LG Energy Solutions, resulted in the arrest of 475 individuals. More than 300 were South Korean nationals, according to an official from the country.…

… Among those detained at the factory were South Korean employees of LG Energy Solution who were traveling for business. Hyundai Motor said it believed that it didn’t directly employ any of those detained. LG Energy said Friday it was cooperating with the South Korean government and relevant authorities to ensure the employees’ safety and secure their prompt release from detention.

The joint venture said it was cooperating with authorities and paused construction. …”

Is Hyundai insourcing Korean workers to build this plant or what is actually going on? It seems very odd.

superrific

Master of the ZZLverse

- Messages

- 12,313

This Hyundai story is weird, BTW, but unfortunately the government is plotted with co piracy nuts making it hard to take anything seriously. Perhaps that is the true goal.

—> https://www.wsj.com/us-news/u-s-arr...b?st=y4xyki&reflink=desktopwebshare_permalink

“… The operation Thursday, at an electric vehicle battery plant owned by Hyundai Motor and LG Energy Solutions, resulted in the arrest of 475 individuals. More than 300 were South Korean nationals, according to an official from the country.…

… Among those detained at the factory were South Korean employees of LG Energy Solution who were traveling for business. Hyundai Motor said it believed that it didn’t directly employ any of those detained. LG Energy said Friday it was cooperating with the South Korean government and relevant authorities to ensure the employees’ safety and secure their prompt release from detention.

The joint venture said it was cooperating with authorities and paused construction. …”

Is Hyundai insourcing Korean workers to build this plant or what is actually going on? It seems very odd.

It's an EV plant and LG Energy is a partner in the battery tech. The factory is in the construction stage, so it doesn't surprise me at all that there were so many S. Korean employees. I would have thought more. Usually tech companies (American companies too) do their designs in-house and send people abroad to establish the plant if they are building it elsewhere. Sort of how law firms send US lawyers abroad when they open offices in foreign lands.

So these people were almost certainly engineers/technical advisers/executives. Hyundai Motor might not have "directly employed" them because there are plenty of US subsidiaries. It suppose it's possible that they had a bunch of LG people there working on batteries, but I doubt 300. I would wager a lot of money that none of the South Koreans were "illegal" in any way.

BillOfRights

Iconic Member

- Messages

- 1,563

BillOfRights

Iconic Member

- Messages

- 1,563

Mr. Heritage Foundation McClownface hasn't been confirmed or assumed his duties yet. Deputy Commissioner William Wiatkowski is the acting commissioner.The new BLS guy may be sitting down shortly with the "Mooch " to have a beer and share war stories from their few weeks spent in Trump's good grace.

Edit : Or maybe this BLS guy met with Trump and they planned to present a very bad jobs report to lock in a 50bs rate cut this month and next month and then revise the numbers for August and September in November showing a million new jobs were created

BillOfRights

Iconic Member

- Messages

- 1,563

And America is the HOTTEST country with the best economy in history, but Powell needs to cut rates.The decline in jobs and the rise in the employment rate show that Powell should have reduced rates already…also, those jobs and employment numbers are democrats hoaxes!

BillOfRights

Iconic Member

- Messages

- 1,563

trump said it was 1700%.Republicans have hit 100% Dear Leader saturation. It’s one thing to offer complete fealty through deflecting and obfuscating blatant corruption, criminality, and idiocy, but it’s another thing entirely to deny arithmetic.

- Messages

- 40,918

“… The unemployment rate in the information-technology job market fell to 4.5% in August from 5.5% the prior month. However, there are still fewer jobs available for tech workers, especially those who don’t specialize in artificial intelligence.

The number of unemployed IT workers fell to 118,000 in August from 140,000 in July, according to consulting firm Janco Associates, which bases its findings on data from the U.S. Labor Department.

…

Though there were fewer unemployed IT professionals last month, companies aren’t hiring tech workers at the same pace they used to, said Janco Chief Executive Victor Janulaitis. And while there is still high demand for workers with AI skills, there is greater reluctance to hire people with general IT skills, Janulaitis added.

For one thing, the tech jobs market continues to shrink—a trend that has been accelerated by the effects of AI and automation on areas such as telecommunications and networking, according to Janulaitis. Outsourcing of traditional IT jobs in payroll and accounts payable is also whittling down the overall number of available tech positions.…”

heelslegup

Esteemed Member

- Messages

- 620

Im the latest jobs report, manuf jobs continue to decline. Tariffs working their magic path to recession or stagflatiop

Share: