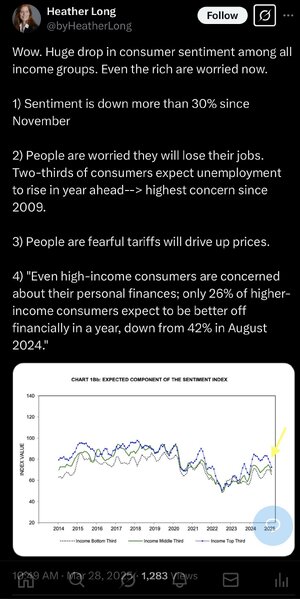

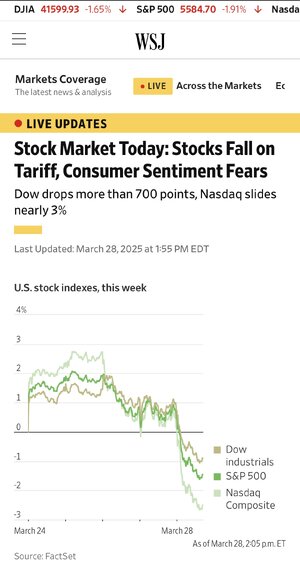

That post by Heather Long on last page is fairly prescient, about how people are watching prices more closely now than in 2017/2018 the last time Trump toyed with tariffs.

But hell, 2017/2018? Try 1805 and 1900. Newt Gingrich was praising the effectiveness of tariffs under Jefferson and McKinley. He even stated that we didn't even need internal taxes under Jefferson because he used tariffs. This is where Trump is getting his tariff ideas.

I'd say our economy and government are completely different now. Hell, they didn't even have electricity back then. A majority of the population was self sustaining, living off the land, farming, and building their own houses. The government was just beginning and there was not much of an economy yet.

These people live in lala land.