Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 5K

- Views: 213K

- Politics

- Messages

- 4,109

and look at the price of eggs and other groceries

Such an easy layup for Democrats. Flood the zone with the talking point that the threat of Trump tariffs caused inflation to come back because business stocked up and drove prices up. The media will then start asking Trump about it. Pin the tail on that orange elephant.

aGDevil2k

Inconceivable Member

- Messages

- 4,726

You gotta stop posting/viewing X!

BillOfRights

Iconic Member

- Messages

- 1,588

- Messages

- 41,427

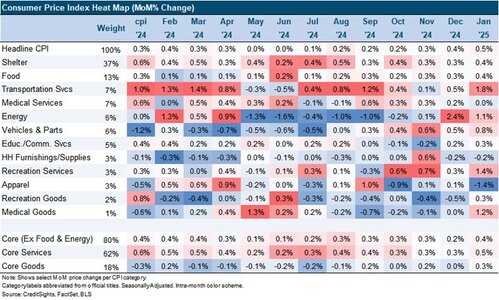

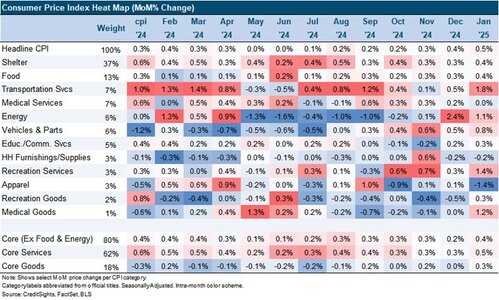

From CreditSights / LevFin Insights newsletter:

"...

"...

- Headline CPI beat consensus expectations by two-tenths with a 0.5% MoM increase. That pushed the 3m annualized rate to 4.7%, the fastest pace since November 2022 when the YoY rate of headline CPI was 7.1%. Both Food and Energy prices accelerated contributing to the upside surprise.

- Core CPI rose 0.4% MoM, besting consensus expectations by one-tenth. Core services rose 0.5% MoM, the fastest pace since March 2024, while core goods rose 0.3% MoM, the fastest pace since 2023. A sustained reversal in the core goods deflation we saw throughout 2024 will present a renewed challenge for the Fed, while key services components continue to prove sticky.

- We expect monetary policy expectations to start to reflect two-sided risk (either a hike or cut next) and this, among other factors, will begin to push credit spreads wider. The upside surprise to January 2024 CPI reported last February led to 6 bp of IG and 1 bp of HY spread tightening over the next week. Last year's moves at this time are counter intuitive, but are indicative of less overall policy uncertainty, a strong US economy and greater conviction that the next monetary policy move will be a cut, not a hike. While the US economy remains solid, fiscal policy uncertainty has reached a fever pitch, and we expect the market to begin pricing in a meaningful probability that the Fed will hike...."

- Messages

- 7,975

Wow. The Trump inflation

Ugh. I know, I know. It’s a terrible addiction and hard to break!You gotta stop posting/viewing X!

StoneColdHeel

Legend of ZZL

- Messages

- 5,844

Inflation is worse now with Trump. Who would have guessed that?

- Messages

- 41,427

Inflation is worse now with Trump. Who would have guessed that?

StoneColdHeel

Legend of ZZL

- Messages

- 5,844

- Messages

- 7,975

Oh dang, that's a great idea. I honestly didn't realize BlueSky had that many folks on it. Just downloaded the BlueSky app as we speak! Time to start the migration.It’s really not. Spend 20 minutes on a flight or layover deleting your account and following a similar core of 40-50 accounts on Bluesky. You’ll gradually build up the same information diet and followings without the christonationalism and Nazi adjacent posts musk forces into your feed.

Within a handful of days, I suspect you won’t think a thing of Twitter, outside of breaking the reflexive habit of clicking the app or shortcut.

- Messages

- 41,427

I use both and there are still considerably more news outlets and related traffic at Twitter than BSKY, and far more users with realtime updates in a disaster scenario still at Twitter, which is why I still use both as news aggregation. I never post etc on Twitter, just scroll & scrape it. Of course, I don’t post very often on BSKY and didn’t post often on Twitter before Musk bought it. I don’t see the far right pop up on my following feed on Twitter (until you get to responses to posts) but find it useful when I want to find MAGA and extremists responses.It’s really not. Spend 20 minutes on a flight or layover deleting your account and following a similar core of 40-50 accounts on Bluesky. You’ll gradually build up the same information diet and followings without the christonationalism and Nazi adjacent posts musk forces into your feed.

Within a handful of days, I suspect you won’t think a thing of Twitter, outside of breaking the reflexive habit of clicking the app or shortcut.

- Messages

- 5,217

Canada and Mexico tariffs risk inflating US housing crisis, Trump is warned

Exclusive: Dozens of congressional Democrats urge president to reconsider threatened import duties on US’s two largest trading partners

Blue Sky starter packs are the answer.Wow. The Trump inflation

Ugh. I know, I know. It’s a terrible addiction and hard to break!

superrific

Master of the ZZLverse

- Messages

- 12,410

I hate the way the media reports inflation. This inflation report was WAY worse than what was implied.

It was a 0.5% month-over-month increase. That's 6% a year. That's what inflation actually is right now. Over the past three months, it's 5.4%. Again, that's where inflation is right now.

It's not eggs. It's not gas. It's the inevitable result of the destabilizing rhetoric of tariffs and endless bullshit. Producers are raising prices now in advance to avoid sticker shock effects when the 25% or 50% or 100% or whatever tariffs are actually implemented. Investment is dropping like a stone in vinegar, because of uncertainty. Consumer confidence is in free fall and inflation expectations are way up.

Right now, it appears the Fed is choosing between three options: cut rates; hold rates; increase rates. It has never happened in our lifetimes that "cut" and "increase" are both on the table -- normally, it's always a choice between do something or do nothing. And when the Fed isn't sure whether to cut or raise, you know something has gone very wrong with the economy.

To be clear for some of our less economically literate posters: the market (and per reporting, the Fed) sees high inflation and recession as risks. That's really bad.

Biden and the Fed engineered the "soft landing." But 1000 feet before landing, Trump cut the parachute.

It was a 0.5% month-over-month increase. That's 6% a year. That's what inflation actually is right now. Over the past three months, it's 5.4%. Again, that's where inflation is right now.

It's not eggs. It's not gas. It's the inevitable result of the destabilizing rhetoric of tariffs and endless bullshit. Producers are raising prices now in advance to avoid sticker shock effects when the 25% or 50% or 100% or whatever tariffs are actually implemented. Investment is dropping like a stone in vinegar, because of uncertainty. Consumer confidence is in free fall and inflation expectations are way up.

Right now, it appears the Fed is choosing between three options: cut rates; hold rates; increase rates. It has never happened in our lifetimes that "cut" and "increase" are both on the table -- normally, it's always a choice between do something or do nothing. And when the Fed isn't sure whether to cut or raise, you know something has gone very wrong with the economy.

To be clear for some of our less economically literate posters: the market (and per reporting, the Fed) sees high inflation and recession as risks. That's really bad.

Biden and the Fed engineered the "soft landing." But 1000 feet before landing, Trump cut the parachute.

- Messages

- 5,217

Chevron will slash up to 20% of its workforce as the oil major implements a plan to cut costs by up to $3 billion, the company said Wednesday.

The workforce reductions will begin this year with most of the cuts complete before the end of 2026, according to Chevron.

″We do not take these actions lightly and will support our employees through the transition,” Chevron Vice Chairman Mark Nelson said in a statement. “But responsible leadership requires taking these steps to improve the long-term competitiveness of our company for our people, our shareholders and our communities.”

ChileG

Inconceivable Member

- Messages

- 3,159

Just before the CPI data was released:

It should be lower but isn’t BECAUSE OF TRUMP.

This isn’t an opinion. It is fact.

superrific

Master of the ZZLverse

- Messages

- 12,410

Its workforce where? It employs a lot of people in a lot of places.

Chevron will slash up to 20% of its workforce as the oil major implements a plan to cut costs by up to $3 billion, the company said Wednesday.

The workforce reductions will begin this year with most of the cuts complete before the end of 2026, according to Chevron.

″We do not take these actions lightly and will support our employees through the transition,” Chevron Vice Chairman Mark Nelson said in a statement. “But responsible leadership requires taking these steps to improve the long-term competitiveness of our company for our people, our shareholders and our communities.”

- Messages

- 5,217

They are not being specific yet, but thought it was a pretty drastic number for a fossil fuel company when you consider the de-regulation halcyon days that are ahead.Its workforce where? It employs a lot of people in a lot of places.

- Messages

- 41,427

This Chevron news may be first shoe to drop in a cascade of “right-sizing” by many corporations that have been holding onto employees due to labor market dynamics that have made it hard to replace workers.

Now that those conditions have relaxed and the Federal government is dumping workers, more companies may see a clear runway to downsize their employee base to take advantage of increased efficiencies from tech solutions without worrying about being caught flat-footed in a tight labor market if they need to rapidly upsize a particular project or sector.

It’s like we’ve been playing a giant game of rummy with nobody laying down any cards other than forced discards, but once the guy holding 20 cards lays down several sets and only holds a few cards, others will feel compelled to do the same to not be caught holding too many cards …

Now that those conditions have relaxed and the Federal government is dumping workers, more companies may see a clear runway to downsize their employee base to take advantage of increased efficiencies from tech solutions without worrying about being caught flat-footed in a tight labor market if they need to rapidly upsize a particular project or sector.

It’s like we’ve been playing a giant game of rummy with nobody laying down any cards other than forced discards, but once the guy holding 20 cards lays down several sets and only holds a few cards, others will feel compelled to do the same to not be caught holding too many cards …

Share: