ChapelHillSooner

Iconic Member

- Messages

- 1,370

So the S&P jumped .87% in the last 20 minutes of trading to end in green. I am guessing that that is end of month stuff?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

lol waaaaaaaahhh!!

Gas prices were $2.29 in Texas and grocery prices were lower on January 19th than the end of the month. Jobs and investment were only cut when the US Economy, the envy of the world, had to hedge on all bets because of the Trump Tariff Insanity. Just ask the CEOs, and not the Billionaire Bros, although they know the truth.1. The fact that January is in this report only means it's not as bad as it would otherwise have been. Biden dragging it down, LOL.

2. You could even say the next quarter is some of Biden. Cool. We know what's coming and so does Trump.

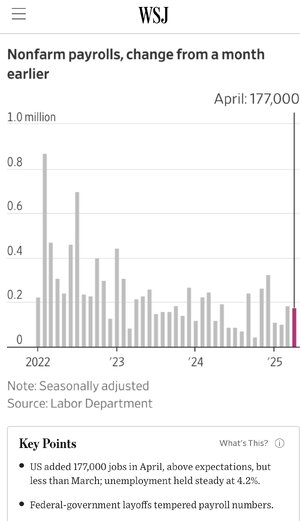

Strong report, well ahead of estimates.

Strong report, well ahead of estimates.

It is another case of the data not reflecting a lot of the more cautious business chatter and doomsaying so far. Overall, April data indicates that businesses definitely have taken defensive measures (building inventory to avoid tariffs, accelerating investments in equipment and co structuring ahead of tariffs, etc) that are warping some of the data but people have not yet slammed on the breaks. The general behavior reflected in the data to date suggests to a deep-seated expectation that the Trump Administration eventually will (mostly) back down and offset the negative impact of trade policy with steep tax cuts and regulatory relief.somewhat comforting that the Biden economy is holding on in the face of Trump's threats and posturing...

So Trump has not sunk the Biden economy in his 1st 100 days, but what will the economy look like 100 days from now ?

time will tell...

Average gasoline prices in North Carolina have risen 5.9 cents per gallon in the last week, averaging $2.88 per gallon Monday, April 29, 2025, according to GasBuddy’s survey of 6,092 stations in North Carolina.

“… In my case I had the biggest stock market increase, 88% in the last term, in my last term … I don’t take credit or discredit for the stock market … what the stock market tells you, at least in this case, it says how bad a situation we inherited …”

The Dow increased 33% over 4 years88% market growth in 4 years???????