Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 5K

- Views: 213K

- Politics

- Messages

- 1,147

no wonder why...there have been new homes being built nearby and they are asking $500-$600 a sq ft for them. thats nothing but pure fucking greed

- Messages

- 8,287

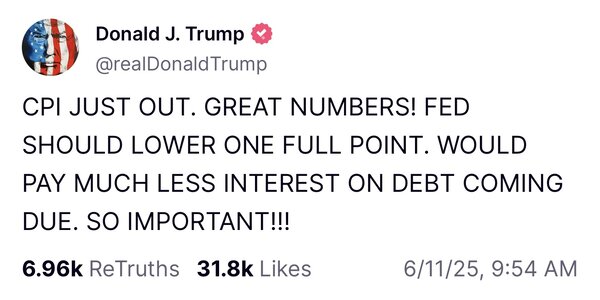

Really, now the stupid mutherfucker wants to take over the Fed. Wow.

ChileG

Inconceivable Member

- Messages

- 3,159

During what would be a great economy if the Trump administration would stop actively fucking it up.

ChileG

Inconceivable Member

- Messages

- 3,159

Penciling in = holding out hope Trump will chicken out when the economic realities of his stupid tariffs kick in.

- Messages

- 5,217

BofA sees 'cracks' in foreign demand for Treasuries

Strategists say the "unusual" decline, coming at a time when the dollar is weak, is part of a broader concerning trend of investors lightening their US asset exposure.

Central banks have been selling Treasuries since March, suggesting that they are diversifying away from dollar assets, according to Bank of America Corp.

Treasuries held by global central banks and other official entities in custody at the New York Federal Reserve fell $17 billion in the week through June 11 on average, extending their declines since late March to $48 billion. In addition, foreign holdings in the Fed’s reverse repurchase agreement facility have dropped roughly $15 billion since late March.

The decline is “unusual” because central banks typically buy Treasuries when the dollar is weak, as it has been this year, strategists led by Meghan Swiber wrote in a note Monday, with the title “Foreign UST demand shows cracks.”

International appetite for Treasuries has been under increasing scrutiny in recent months. President Donald Trump’s trade and fiscal policies have roiled financial markets and fueled speculation that overseas buyers will shun US assets — the so-called Sell America trade. The Bloomberg Spot Dollar Index is down about 8% in 2025, and is near a three-year low in part on concern that the levies will sour the US economy’s prospects.

ChileG

Inconceivable Member

- Messages

- 3,159

Trump supporters - who and what do you think is causing this?

BofA sees 'cracks' in foreign demand for Treasuries

Strategists say the "unusual" decline, coming at a time when the dollar is weak, is part of a broader concerning trend of investors lightening their US asset exposure.www.investmentnews.com

Central banks have been selling Treasuries since March, suggesting that they are diversifying away from dollar assets, according to Bank of America Corp.

Treasuries held by global central banks and other official entities in custody at the New York Federal Reserve fell $17 billion in the week through June 11 on average, extending their declines since late March to $48 billion. In addition, foreign holdings in the Fed’s reverse repurchase agreement facility have dropped roughly $15 billion since late March.

The decline is “unusual” because central banks typically buy Treasuries when the dollar is weak, as it has been this year, strategists led by Meghan Swiber wrote in a note Monday, with the title “Foreign UST demand shows cracks.”

International appetite for Treasuries has been under increasing scrutiny in recent months. President Donald Trump’s trade and fiscal policies have roiled financial markets and fueled speculation that overseas buyers will shun US assets — the so-called Sell America trade. The Bloomberg Spot Dollar Index is down about 8% in 2025, and is near a three-year low in part on concern that the levies will sour the US economy’s prospects.

BillOfRights

Iconic Member

- Messages

- 1,588

The Conference Board Leading Economic Index® (LEI) for the US Inched Down in May

/PRNewswire/ -- The Conference Board Leading Economic Index® (LEI) for the US ticked down by 0.1% in May 2025 to 99.0 (2016=100), after declining by 1.4% in...

lawtig02

Legend of ZZL

- Messages

- 5,891

I'm going out on a limb here because you know about a million times more about this than I do, but I'm also starting to hope for a big cut in July. Yes, I know it will trigger more inflation. But we need to do something to start getting the housing market unstuck, and a substantial cut would help a lot. I also think we could use a jolt of energy with all the chaos happening around us right now.

- Messages

- 4,109

GWB was known for playing video games on his computer in the White House. At the time I prayed he would leave alone the good economy that Clinton left him and stick to playing video games.During what would be a great economy if the Trump administration would stop actively fucking it up.

Likewise, in 2017 I prayed that Trump would leave alone the good economy that Obama left him on a silver platter and stick to cheating on the golf course

And now I have been praying Trump would leave alone the good economy that Sleepy Joe Biden left him and stick to conning the MAGAs out of their beer and cigarette money.

Hey God, if you actually exist, you are 0-3

- Messages

- 41,433

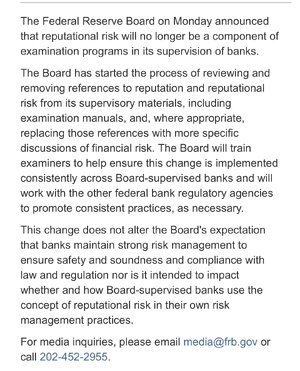

Federal Reserve Board announces that reputational risk will no longer be a component of examination programs in its supervision of banks

Federal Reserve Board announces that reputational risk will no longer be a component of examination programs in its supervision of banks

The Federal Reserve Board on Monday announced that reputational risk will no longer be a component of examination programs in its supervision of banks. The Bo

www.federalreserve.gov

The Fed - SR 95-51 (SUP): Rating the Adequacy of Risk Management Processes and Internal Controls at State Member Banks and Bank Holding Companies

The Federal Reserve Board of Governors in Washington DC.

www.federalreserve.gov

lawtig02

Legend of ZZL

- Messages

- 5,891

Not a bad thing, IMO. Judge banks based on what they're doing now, not what has happened in the past.Federal Reserve Board announces that reputational risk will no longer be a component of examination programs in its supervision of banks

Federal Reserve Board announces that reputational risk will no longer be a component of examination programs in its supervision of banks

The Federal Reserve Board on Monday announced that reputational risk will no longer be a component of examination programs in its supervision of banks. The Bowww.federalreserve.gov

The Fed - SR 95-51 (SUP): Rating the Adequacy of Risk Management Processes and Internal Controls at State Member Banks and Bank Holding Companies

The Federal Reserve Board of Governors in Washington DC.www.federalreserve.gov

Of course, that requires a rigorous and credible examination regime, which Elon and Trump intentionally gutted.

superrific

Master of the ZZLverse

- Messages

- 12,413

Bank runs are basically all about confidence and reputation. A bank with a bad reputation will soon be an ex-bank.Not a bad thing, IMO. Judge banks based on what they're doing now, not what has happened in the past.

I'm no banking regulator, and the whole topic of risk management for banks is super-complex and beyond my expertise by quite a lot. Still, as someone with adjacent expertise, my initial reaction to this is quite negative. I'd need to see the arguments both ways to form any judgment. Here I'm conveying my instinct.

- Messages

- 41,433

This move is consistent with Treasury/OCC policy announced in March to discontinue assessing reputational risk as one of the 8 prongs of a bank audit. The Trump Administration was adamant that the reputational risk assessment put too much pressure on crypto and other developing industries and contributed to debanking of such industries to avoid pressure on the reputational risk component of the audit.Federal Reserve Board announces that reputational risk will no longer be a component of examination programs in its supervision of banks

Federal Reserve Board announces that reputational risk will no longer be a component of examination programs in its supervision of banks

The Federal Reserve Board on Monday announced that reputational risk will no longer be a component of examination programs in its supervision of banks. The Bowww.federalreserve.gov

The Fed - SR 95-51 (SUP): Rating the Adequacy of Risk Management Processes and Internal Controls at State Member Banks and Bank Holding Companies

The Federal Reserve Board of Governors in Washington DC.www.federalreserve.gov

For their part, lenders have complained that the reputational risk component is too subjective and can ding an institution for matters out of their control that do not impact the financial risks to the lender or depository.

- Messages

- 41,433

The lack of regulatory concern about reputational risk has given fintechs a leg up on traditional banks and has made it hard for some industries (crypto, gun dealers, payday lenders, marijuana growers, gambling establishments, racist organizations, etc.) to obtain customary banking services, but my view is that the reputational risk component could be modified instead of eliminated as a key to the survival of a bank or other financial institution.

I suspect the biggest impact will be for the benefit of crypto companies in the immediate term as I think banks are not otherwise eager to platform some of the other socially questionable organizations they avoid under the reputational risk regulation. This change could also complicate efforts to of banks that want to terminate a customer that creates reputational risk by association for the bank (which I am sure is part of the intent from the “debanking” conspiracists who complain that law-abiding members of right wing militias and other right wing or libertarian groups can’t get or keep banking services because of the tyranny of reputational risk concerns).

I suspect the biggest impact will be for the benefit of crypto companies in the immediate term as I think banks are not otherwise eager to platform some of the other socially questionable organizations they avoid under the reputational risk regulation. This change could also complicate efforts to of banks that want to terminate a customer that creates reputational risk by association for the bank (which I am sure is part of the intent from the “debanking” conspiracists who complain that law-abiding members of right wing militias and other right wing or libertarian groups can’t get or keep banking services because of the tyranny of reputational risk concerns).

Last edited:

superrific

Master of the ZZLverse

- Messages

- 12,413

Exactly. The purpose isn't to regulate banking. It's again bending the rules to accommodate an industry that doesn't live in the real world.The Trump Administration was adamant that the reputational risk assessment put too much pressure on crypto and other developing industries and contributed to debanking of such industries to avoid pressure on the reputational risk component of the audit.

It is utterly crazy how crypto has gotten so much loving attention in DC despite its track record. Almost every major player in the business has faced felony charges and several have been convicted. Theft and fraud is everywhere. So what does Congress do? Hey, let's trust the people who brought us Binance and FTX to create "stablecoins."

Share: