Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 4K

- Views: 201K

- Politics

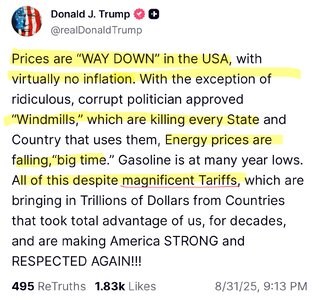

The problem is he believes this shit; and, his ass-kissing staff are afraid to tell him he’s wrong.

- Messages

- 3,829

He doesn't believe it. He is merely engaging in "truthful hyperbole", but the MAGAs sure do believe it.The problem is he believes this shit; and, his ass-kissing staff are afraid to tell him he’s wrong.

“The Art of the Deal,” 1987: The final key to the way I promote is bravado. I play to people’s fantasies. People may not always think big themselves, but they can still get very excited by those who do. That’s why a little hyperbole never hurts. People want to believe that something is the biggest and the greatest and the most spectacular. I call it truthful hyperbole. It’s an innocent form of exaggeration — and a very effective form of promotion.

In an interview with the New Yorker in 2016, Schwartz said that “truthful hyperbole” was a euphemism for deceit.

“‘Truthful hyperbole’ is a contradiction in terms. It’s a way of saying, ‘It’s a lie, but who cares?’” Schwartz said.

8992Tiger

Distinguished Member

- Messages

- 316

Worse still, his cult believes it and they are a substantial part of the electorate.The problem is he believes this shit; and, his ass-kissing staff are afraid to tell him he’s wrong.

- Messages

- 39,137

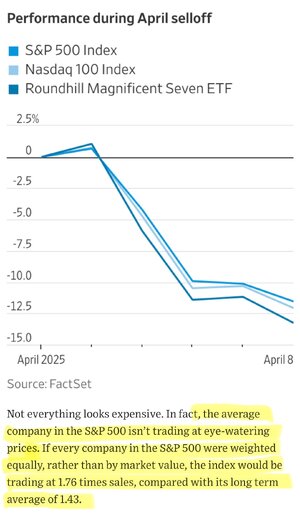

U.S. Stocks Are Now Pricier Than They Were in the Dot-Com Era

The S&P 500 has never been this expensive, or more concentrated in fewer companies

- Messages

- 39,137

“… Investors are now paying more than ever for each dollar of revenue the index’s members produce. The benchmark traded at 3.23 times sales on Thursday, a record high. …”U.S. Stocks Are Now Pricier Than They Were in the Dot-Com Era

The S&P 500 has never been this expensive, or more concentrated in fewer companies

—> https://www.wsj.com/finance/stocks/...2?st=x9GXNY&reflink=desktopwebshare_permalink

- Messages

- 39,137

Forget YIMBY. The housing shortage could disappear on its own.

Demographic shifts and construction surges are likely to resolve the housing crisis without federal intervention.“… Right now, too many people are chasing too few homes occupied by the once-largest generation in American history. The “silver tsunami” — the gradual exit of baby boomers from the housing market via downsizing, relocation or death — could significantly narrow the national supply gap. According to a 2024 report from the Mortgage Bankers Association, more than 4 million owner-occupied homes will be vacated by 2030 because of aging. Freddie Mac estimates an even larger waveof 14 million units coming on the market over the next decade.

New construction will add to that. About 1.6 million homes were built last year in the U.S. — a 15.8 percent increase over the previous year. Even if that pace slows to 1.3 million homes annually, around 6.5 million new units could be completed by the end of 2030. Add in the 4 million or more homes freed up by demographic change and the housing market might see more than 10 million additional units come online.

At the same time, the demand side of the equation is less robust than often assumed. Immigration brings in about 1 million permanent residents eachyear, which (using a rate of roughly 2½ people per household, the 2023 average) translates to 400,000 new households annually, or around 2.4 million by 2030.

When combined with declining birth rates and slower family formation, demand appears be growing steadily but not soaring. In other words, housing supply might not only catch up to demand — it is poised to overshoot.…”

——

The argument here boils down to we need to take a more actuarial view of the nationwide housing shortage and not make national policies based on more persistent long term housing shortages in a few large cities that won’t be solved by the looming life expectancy cliff of home-owning Boomers.

Centerpiece

Inconceivable Member

- Messages

- 3,246

1) “Nice new coat you have on Emperor!”

2) Boomers aging out and moving out of homes to down-size or move into assisted living spaces + fewer babies born + fewer immigrants + new house construction = Supply out paces demand and house prices go down, home values go down, property taxes go up so municipalities can at least break even on services (or they must cut services) and new house construction dips due to lack of demand.

Perhaps I’m not reading the room correctly on #2 above, but I know I’m spot on with #1

2) Boomers aging out and moving out of homes to down-size or move into assisted living spaces + fewer babies born + fewer immigrants + new house construction = Supply out paces demand and house prices go down, home values go down, property taxes go up so municipalities can at least break even on services (or they must cut services) and new house construction dips due to lack of demand.

Perhaps I’m not reading the room correctly on #2 above, but I know I’m spot on with #1

lawtig02

Legend of ZZL

- Messages

- 5,731

I think this is right but it will still be a while. From what I have read elsewhere, another part of the problem is that an unusually large percentage of new home construction is in the “luxury” space, which doesn’t help many first-time buyers.Forget YIMBY. The housing shortage could disappear on its own.

Demographic shifts and construction surges are likely to resolve the housing crisis without federal intervention.

“… Right now, too many people are chasing too few homes occupied by the once-largest generation in American history. The “silver tsunami” — the gradual exit of baby boomers from the housing market via downsizing, relocation or death — could significantly narrow the national supply gap. According to a 2024 report from the Mortgage Bankers Association, more than 4 million owner-occupied homes will be vacated by 2030 because of aging. Freddie Mac estimates an even larger waveof 14 million units coming on the market over the next decade.

New construction will add to that. About 1.6 million homes were built last year in the U.S. — a 15.8 percent increase over the previous year. Even if that pace slows to 1.3 million homes annually, around 6.5 million new units could be completed by the end of 2030. Add in the 4 million or more homes freed up by demographic change and the housing market might see more than 10 million additional units come online.

At the same time, the demand side of the equation is less robust than often assumed. Immigration brings in about 1 million permanent residents eachyear, which (using a rate of roughly 2½ people per household, the 2023 average) translates to 400,000 new households annually, or around 2.4 million by 2030.

When combined with declining birth rates and slower family formation, demand appears be growing steadily but not soaring. In other words, housing supply might not only catch up to demand — it is poised to overshoot.…”

——

The argument here boils down to we need to take a more actuarial view of the nationwide housing shortage and not make national policies based on more persistent long term housing shortages in a few large cities that won’t be solved by the looming life expectancy cliff of home-owning Boomers.

I suspect there are some tax policies that could be enacted to incentivize older Americans to speed up the downsizing/relocation trend, but zero chance anything like that could get approved in this dysfunctional political environment. I just hope young people will be sufficiently upset in 2026 and 2028 to vote to punish the people currently in power.

- Messages

- 4,037

YeaI have a few single family rentals that I have been slow to raise rents due to this. I'm from small town America, not a metro area. But I am definitely seeing signs that rental homes are staying on market longer and rents even moderating.

If you have renters that are good folk-its worth something

- Messages

- 3,829

I remember the dot-com era. My best friend (who was a savvy investor) and I had conversations about those times. We agreed that the dot-com mania was not unlike the tulip mania back in the 1600s. Little did we know at the time that the housing bubble six years later would lead to even more carnage.U.S. Stocks Are Now Pricier Than They Were in the Dot-Com Era

The S&P 500 has never been this expensive, or more concentrated in fewer companies

—> https://www.wsj.com/finance/stocks/...2?st=x9GXNY&reflink=desktopwebshare_permalink

I posted a few days ago on a different thread that the stock market is ignoring the signs of what is to come just like it did in 2001 and 2008.

Hopefully, we are not in for the same

Last edited:

I find that unlikely … like, who is going on vacation to Yemen or Burkina Faso? Please.

All they need is one more person than last year.

- Messages

- 8,127

It's good that thus is happening, I wonder how it will impact property values. Will they level out?Forget YIMBY. The housing shortage could disappear on its own.

Demographic shifts and construction surges are likely to resolve the housing crisis without federal intervention.

“… Right now, too many people are chasing too few homes occupied by the once-largest generation in American history. The “silver tsunami” — the gradual exit of baby boomers from the housing market via downsizing, relocation or death — could significantly narrow the national supply gap. According to a 2024 report from the Mortgage Bankers Association, more than 4 million owner-occupied homes will be vacated by 2030 because of aging. Freddie Mac estimates an even larger waveof 14 million units coming on the market over the next decade.

New construction will add to that. About 1.6 million homes were built last year in the U.S. — a 15.8 percent increase over the previous year. Even if that pace slows to 1.3 million homes annually, around 6.5 million new units could be completed by the end of 2030. Add in the 4 million or more homes freed up by demographic change and the housing market might see more than 10 million additional units come online.

At the same time, the demand side of the equation is less robust than often assumed. Immigration brings in about 1 million permanent residents eachyear, which (using a rate of roughly 2½ people per household, the 2023 average) translates to 400,000 new households annually, or around 2.4 million by 2030.

When combined with declining birth rates and slower family formation, demand appears be growing steadily but not soaring. In other words, housing supply might not only catch up to demand — it is poised to overshoot.…”

——

The argument here boils down to we need to take a more actuarial view of the nationwide housing shortage and not make national policies based on more persistent long term housing shortages in a few large cities that won’t be solved by the looming life expectancy cliff of home-owning Boomers.

- Messages

- 8,127

I've read similar.I think this is right but it will still be a while. From what I have read elsewhere, another part of the problem is that an unusually large percentage of new home construction is in the “luxury” space, which doesn’t help many first-time buyers.

I suspect there are some tax policies that could be enacted to incentivize older Americans to speed up the downsizing/relocation trend, but zero chance anything like that could get approved in this dysfunctional political environment. I just hope young people will be sufficiently upset in 2026 and 2028 to vote to punish the people currently in power.

And ancedotally around me everything fits this narrative. The only housing being built that is close to starter, in size, is still a half million. 4 neighborhoods within a mile of mine are all a million and up.

And they are selling as fast as they can build them.

If I were to win the lottery, I would want to figure out a way to help first time homeowners.

- Messages

- 4,037

I am truly amazed at how many people buy houses at .6 -1 million. All I mean is how many folks have that kind of moneyI've read similar.

And ancedotally around me everything fits this narrative. The only housing being built that is close to starter, in size, is still a half million. 4 neighborhoods within a mile of mine are all a million and up.

And they are selling as fast as they can build them.

If I were to win the lottery, I would want to figure out a way to help first time homeowners.

lawtig02

Legend of ZZL

- Messages

- 5,731

I hear you, but would you mind giving me a sense where you live? Only asking because I'm not far from downtown Charlotte, and I'm truly amazed at how many people buy houses from 2.5-4 million. There are apparently a TON of people with that kind of money.I am truly amazed at how many people buy houses at .6 -1 million. All I mean is how many folks have that kind of money

Share: