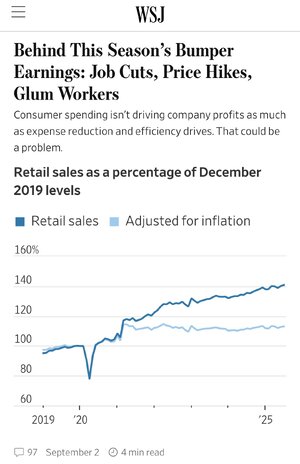

I think this is right but it will still be a while. From what I have read elsewhere, another part of the problem is that an unusually large percentage of new home construction is in the “luxury” space, which doesn’t help many first-time buyers.

I suspect there are some tax policies that could be enacted to incentivize older Americans to speed up the downsizing/relocation trend, but zero chance anything like that could get approved in this dysfunctional political environment. I just hope young people will be sufficiently upset in 2026 and 2028 to vote to punish the people currently in power.