- Messages

- 39,158

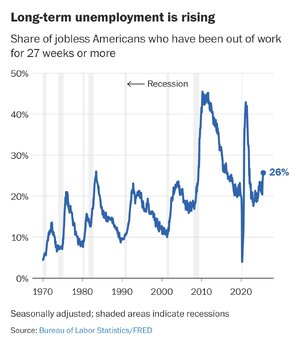

Among other things, this chart indicates that we never recovered from the massive increase of long term unemployed people during the Great Recession. It improved but the trough of long term unemployed since then (ignoring the COVId gyration) is closer to the peak of long term unemployment of prior recessions.

Are people more willing to/ able to hold out for a similar position now or is there a larger cohort of poorly skilled workers who struggle to find permanent gainful employment?

“… Six months of unemployment often signals a turning point in a person’s job search, according to economists. They’ve likely run out of unemployment insurance benefits and severance payments by then, leaving them on shakier financial ground. People who have been unemployed for more than six months are also more likely to become discouraged and stop looking for work altogether.

… Studies have found that workers who are unemployed long-term are less likely to find jobs than others. They’re also more likely to drop out of the workforce entirely. A 2014 study by economists at Princeton University found that nearly half of those unemployed for seven months or longer, in the aftermath of the Great Recession, ended up leaving the labor force.

“The longer people linger in unemployment, the more likely they are to lose their contacts and connections, and after an extended period of time, their skills can depreciate,” said Francine Blau, a labor economist and professor emeritus at Cornell University. “And there is the possibility that employers see [long-term unemployment] as a sign of a less desirable worker.”…”