BubbaOtis

Exceptional Member

- Messages

- 241

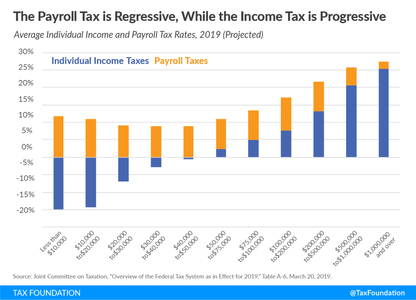

Social Security doesn't function the way you describe and never has, to my knowledge. The biggest monthly benefits go to those with the highest earnings records, though the lowest earners do get a higher percentage of the base wages on which they did pay social security. No one makes too much money to qualify for SS. Generally, anybody with income over the mid $30k range includes 85% of their SS in their taxable income.SS was created to assist those most vulnerable by providing some security for the elderly, disabled and those unable to care for themselves due to a deceased family member. People that already have a healthy income, even in retirement, were never the intended recipients for SS benefits.

Thus, if you make over a certain threshold, naturally those benefits would incur some tax.

I'm trying to understand where this starts to become unfair, but I haven't come up with any reasons.

The detailed computation is a bit more complex, of course.. The biggest beneficiaries of not taxing SS would be affluent retired people who have other sources of income (dividends, IRA's, pensions, rentals, pass through entities, etc.) and are thus in higher tax brackets.