Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

War on Universities, Lawyers & Expertise

- Thread starter nycfan

- Start date

- Replies: 1K

- Views: 36K

- Politics

- Messages

- 4,244

bringing us folks like CFord!

- Messages

- 41,540

- Messages

- 41,540

“… Have there been any threats to classroom freedom at the University of Virginia? Not really. A couple of years ago, the administration wanted to know how our teaching and writing contributed to diversity, equity and inclusion. I protested this as soon as I saw it: The freedom to ignore DEI or teach in ways that came into conflict with it seemed precious to me.

I sounded my mild protest to the president, Jim Ryan, the provost Ian Baucom (now president of Middlebury College), the chair of my department and anyone else I could find in power. The whole thing was a bit tricky, because I believe in many of the tenets of DEI. I just didn’t want the university to try to persuade professors to bend their teachings toward what I see as a political position. All the officials were willing to talk, debate, reconsider. When I and others spoke up, the people in charge wanted to hear.

Now the tables have turned. Last month, President Trump’s Justice Department forced Jim Ryan to resign by threatening to cut off crucial funding to the university, claiming that Ryan hadn’t done enough to dismantle DEI programs. When the Trump administration attacked Harvard, the members of the Harvard Corporation fought back. At the University of Virginia, unlike Harvard, the Board of Visitors is state-appointed, and the current members, all chosen by Republican governors, caved in to the demands. So did the attorney general of the state, who might have defended us.

The members of the Jefferson Council, a conservative alumni group, have spoken much about the brainwashing and indoctrination they feel goes on in our classrooms. There may be some of that, I’ll concede, but not nearly as much as they imagine. I think that conservative students who bottle themselves up in class are more afraid of their peers’ reactions than their professors. How long before the Board of Visitors, guided by the Jefferson Council, decides it must take an active hand and begin vetting our syllabi?

Hannah Arendt, the political philosopher, suggests that a politically unanimous condition is always something to fear. When you have a sphere without tensions, without civil conflict, tyranny is in the wings.

I fear that we at UVA may be on the verge of such a condition. The road that runs from the White House, to the Justice Department, to Gov. Glenn Youngkin’s office, to our Board of Visitors looks to be all too smooth. Who is going to stop the call for political conformity as it gathers force?…”

donbosco

Legend of ZZL

- Messages

- 6,954

Very, very much on the mind...

- Messages

- 41,540

How Trump’s crackdown on universities is affecting the world

How Trump’s crackdown on universities is affecting the world

Mr. Trump’s ideological war on universities is putting students, professors and scientists under pressure. That could undermine the global dominance that American science has enjoyed for decades.

“… In the mid-20th century, America was seen by many as a benign power, committed to scientific freedom and democracy. It attracted the best brains fleeing fascism and authoritarianism in Europe.

Today, the biggest beneficiary could be China and Chinese universities, which have been trying to recruit world-class scientific talent for years. Now Mr. Trump is doing their work for them. One indication of the success of China’s campaign to attract the best and brightest is Africa, the world’s youngest continent. Africans are learning Mandarin in growing numbers. Nearly twice as many study in China as in America.

Could America gamble away its scientific supremacy in the service of ideology? It has happened before.

Under the Nazis, Germany lost its scientific edge to America in the space of a few years. As a German, my brain may wander too readily to the lessons of the 1930s, but in this case the analogy feels instructive. Several of my colleagues covering the fallout from the crackdown on international students and researchers pointed to Hitler’s silencing of scientists and intellectuals.

No one region can currently replicate the magic sauce of resources, freedom, a culture of risk-taking and welcoming immigrants that made America the engine of scientific innovation. But if it tumbles as a scientific superpower, and potential breakthroughs are disrupted, it would be a setback for the whole world. …”

- Messages

- 4,123

We have already ceded our influential soft power to China when it comes to geopolitics.How Trump’s crackdown on universities is affecting the world

How Trump’s crackdown on universities is affecting the world

Mr. Trump’s ideological war on universities is putting students, professors and scientists under pressure. That could undermine the global dominance that American science has enjoyed for decades.www.nytimes.com

“… In the mid-20th century, America was seen by many as a benign power, committed to scientific freedom and democracy. It attracted the best brains fleeing fascism and authoritarianism in Europe.

Today, the biggest beneficiary could be China and Chinese universities, which have been trying to recruit world-class scientific talent for years. Now Mr. Trump is doing their work for them. One indication of the success of China’s campaign to attract the best and brightest is Africa, the world’s youngest continent. Africans are learning Mandarin in growing numbers. Nearly twice as many study in China as in America.

Could America gamble away its scientific supremacy in the service of ideology? It has happened before.

Under the Nazis, Germany lost its scientific edge to America in the space of a few years. As a German, my brain may wander too readily to the lessons of the 1930s, but in this case the analogy feels instructive. Several of my colleagues covering the fallout from the crackdown on international students and researchers pointed to Hitler’s silencing of scientists and intellectuals.

No one region can currently replicate the magic sauce of resources, freedom, a culture of risk-taking and welcoming immigrants that made America the engine of scientific innovation. But if it tumbles as a scientific superpower, and potential breakthroughs are disrupted, it would be a setback for the whole world. …”

We have already alienated our allies with stupid tariff threats.

We are in the process of creating a soon to be "brain drain" and ceding our scientific superpower status to China

We are on a path to aid China as it seeks to replace America as the dominant global superpower.

- Messages

- 41,540

Background:

How a Free-Speech University Sidles Up to Orbán’s Strongman Rule

Bari Weiss's University of Austin, touted as a haven for free academic inquiry, has a dozen scholars and officials with ties to Hungary's speech-suppressing regime

“The University of Austin, the school founded by intellectual dark web champion and professional wokeness foe Bari Weiss, proclaims its “fearless” dedication to open inquiry, maintaining that its scholars and students “pursue their academic interests and deliberate freely, without fear of censorship or retribution.”

It’s a rather awkward look, then, for the university to retain a dozen scholars and administrators with ties to Viktor Orbán’s regime in Hungary, which has consolidated state control over the country’s universities and media outlets in the service of an authoritarian agenda that goes by the euphemistic name “illiberal democracy.” (This week, Orbán’s government showcased the incoherence of this idea with a new anti-LGBTQ+ bill that outlaws Budapest’s gay pride march.)…

Weiss announced the launch of the University of Austin in 2021, calling it an institution “dedicated to the pursuit of truth.” She also said that the school’s curriculum would be designed in partnership with “dissidents who have stood up to authoritarianism.”

UATX began holding classes in September 2024, taught by 29 faculty members, and with 39 listed staffers, according to the university’s website. Weiss launched UATX with Big Tech backers like venture capitalist Peter Thiel and Palantir executive Joe Lonsdale, along with major academic figures like Larry Summers as advisers. Billionaire hedge fund manager Bill Ackman has donated, along with major GOP donors like Harlan Crow and Jeffrey Yass, according to The Wall Street Journal.

The school’s funders have touted UATX’s commitment to ideological diversity, and its dedication to free speech. Ackman called UATX “a startup university where truth is the aspiration, free speech is allowed and encouraged, and politics are left at the door,” in a post on X last year. Notably, Ackman has also called for American universities to distance themselves from foreign donors—another position that stands athwart the enthusiastic shilling that UATX scholars do on behalf of Hungarian policy objectives on the Orbán administration’s dime.

The university is not accredited but received approval from Texas to grant degrees in 2023.…”

- Messages

- 41,540

Background:

How a Free-Speech University Sidles Up to Orbán’s Strongman Rule

Bari Weiss's University of Austin, touted as a haven for free academic inquiry, has a dozen scholars and officials with ties to Hungary's speech-suppressing regime

“The University of Austin, the school founded by intellectual dark web champion and professional wokeness foe Bari Weiss, proclaims its “fearless” dedication to open inquiry, maintaining that its scholars and students “pursue their academic interests and deliberate freely, without fear of censorship or retribution.”

It’s a rather awkward look, then, for the university to retain a dozen scholars and administrators with ties to Viktor Orbán’s regime in Hungary, which has consolidated state control over the country’s universities and media outlets in the service of an authoritarian agenda that goes by the euphemistic name “illiberal democracy.” (This week, Orbán’s government showcased the incoherence of this idea with a new anti-LGBTQ+ bill that outlaws Budapest’s gay pride march.)…

Weiss announced the launch of the University of Austin in 2021, calling it an institution “dedicated to the pursuit of truth.” She also said that the school’s curriculum would be designed in partnership with “dissidents who have stood up to authoritarianism.”

UATX began holding classes in September 2024, taught by 29 faculty members, and with 39 listed staffers, according to the university’s website. Weiss launched UATX with Big Tech backers like venture capitalist Peter Thiel and Palantir executive Joe Lonsdale, along with major academic figures like Larry Summers as advisers. Billionaire hedge fund manager Bill Ackman has donated, along with major GOP donors like Harlan Crow and Jeffrey Yass, according to The Wall Street Journal.

The school’s funders have touted UATX’s commitment to ideological diversity, and its dedication to free speech. Ackman called UATX “a startup university where truth is the aspiration, free speech is allowed and encouraged, and politics are left at the door,” in a post on X last year. Notably, Ackman has also called for American universities to distance themselves from foreign donors—another position that stands athwart the enthusiastic shilling that UATX scholars do on behalf of Hungarian policy objectives on the Orbán administration’s dime.

The university is not accredited but received approval from Texas to grant degrees in 2023.…”

“… David Rhodes, the onetime CBS News head and current executive at Sky in the U.K., is in talks to take over CBS News if/when the Skydance acquisition of Paramount closes, per three sources familiar with the negotiations. As with all of these things, talks could still fall apart. But if David Ellison and his Skydance team sign Rhodes and close a pending deal to acquire The Free Press, the center-right media brand founded by Bari Weiss, the plan would call for Rhodes to manage and operate CBS News day-to-day alongside Weiss as an ideological guide of sorts. (Skydance declined to comment. Rhodes didn’t respond when I DM’d him.)

… Rhodes, who is currently executive chair of Sky News, ran CBS News from 2011 through 2019. Before that, he worked at Fox News for 12 years, albeit running the news shows, not the opinion programming. (That was back in the ’90s and 2000s under Roger Ailes, when there was a much clearer distinction.) Before joining Sky, Rhodes also worked for the Murdochs on media initiatives in the U.K. His name came up in the speculation around who would take over CNN after Chris Licht was ousted in 2023. (His brother is Ben Rhodes, the former top Obama aide.)

… Ellison, who I’m told has met personally with Rhodes, believes he possesses the even-keeled temperament to steer the plane through the current turbulence and balance Weiss, who can be… less even-keeled …”

- Messages

- 41,540

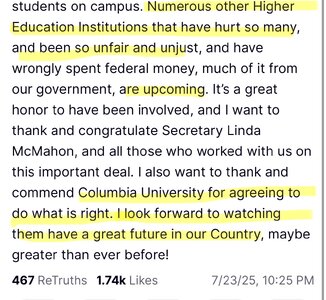

“… U.S. District Judge Allison Burroughs pushed back Monday on the government’s assertion that the case is a straightforward contract dispute and that antisemitism on Harvard’s campus justified cutting the grants. She also questioned whether the government went through the proper process to terminate the grants.

“You can’t violate the constitution to terminate a contract,” Burroughs said. “There are limits to what you can terminate and why and how.”

Harvard is seeking a ruling from Burroughs that it has proven its case and should have its funding restored. Harvard asked Burroughs to make a decision by early September, before a deadline given to Harvard by the federal government to fully close out the canceled research projects. …”

- Messages

- 41,540

—> https://www.wsj.com/us-news/educati...4?st=LgzuQ2&reflink=desktopwebshare_permalink

“… U.S. District Judge Allison Burroughs pushed back Monday on the government’s assertion that the case is a straightforward contract dispute and that antisemitism on Harvard’s campus justified cutting the grants. She also questioned whether the government went through the proper process to terminate the grants.

“You can’t violate the constitution to terminate a contract,” Burroughs said. “There are limits to what you can terminate and why and how.”

Harvard is seeking a ruling from Burroughs that it has proven its case and should have its funding restored. Harvard asked Burroughs to make a decision by early September, before a deadline given to Harvard by the federal government to fully close out the canceled research projects. …”

lawtig02

Legend of ZZL

- Messages

- 5,899

Just wait until he sees what Gayles does with his WSJ lawsuit.

- Messages

- 3,700

Petulant bastard.

uncjhodges

Honored Member

- Messages

- 892

he’s just the worst fucking person and it blows my mind every day that people like him. It’s just such small dick energyPetulant bastard.

Mulberry Heel

Inconceivable Member

- Messages

- 3,996

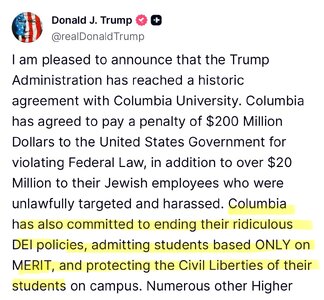

LOL at Columbia if they think this "deal" will end the Trump Administration's interference with their operations and curriculum and pretty much everything else. Now that Trump and his minions know that Columbia can be bullied and extorted they'll just keep harassing them with complaints and demands for ever greater micromanagement of their curriculum and anything else they don't like.

- Messages

- 4,244

The Department of Justice Wednesday said a new probe was focused on determining whether the schools were granting scholarships for recipients of the Deferred Action for Childhood Arrivals (DACA) program in violation of Title VI of the Civil Rights Act, which prohibits discrimination based on national origin.

The targets of the probe include the University of Michigan, University of Louisville, the University of Nebraska Omaha, University of Miami, and Western Michigan University.

The targets of the probe include the University of Michigan, University of Louisville, the University of Nebraska Omaha, University of Miami, and Western Michigan University.

Share: