- Messages

- 39,152

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic News

- Thread starter nycfan

- Start date

- Replies: 4K

- Views: 201K

- Politics

- Messages

- 3,831

- Messages

- 39,152

- Messages

- 39,152

superrific

Master of the ZZLverse

- Messages

- 11,933

Lumber is used for more than just housing, and it is considered a leading indicator.

This looks to me like a pullback based on what we all know is coming -- a significant economic downturn.

- Messages

- 8,132

Just trying to determine when to move to cash.The days leading to and immediately after the rate cut will juice the market. Additional rate cuts likely occur through next year, leading up to the midterms. Trump will absolutely tout the market highs as a singularly unique talent of his. The vibes in the disinformation ecosystem will continue to offer spasms of all time highs for the next year, IMO, as Trump is indeed unique in people believing his bullshit (and subsequent algo responses).

Unfortunately, at some point, the square has to be circled. Corporations can only hide extortion schemes in their earnings reports for so long. Fake BLS and consumer behavior data can only cover for unemployment, foreclosures, dusty cars on dealer lots, and failing tourism businesses for so long. Trump et al. will try to extort ADP for “the right” labor data, but that’s a corporation that has its market share because it sells accuracy. Additionally, foreign investments aren’t happening like Trump claims, and eventually that absence becomes real. Additionally, foreign investments are likely to retract bc the US is stochastic, fundamentally unsound, and outright dangerous.

I think we’ll see the Dow hit 50k in the next twelve months, and I think it’ll be about as reflective of real value as a Bored Ape nft.

- Messages

- 39,152

- Messages

- 39,152

Just gonna put a pin in this response from the White House:

“… A White House official said the report won’t be a tool to force BLS officials to leave the agency.

“There is nothing newsworthy about monitoring and documenting the quality of government economic statistics, and baseless conjecture that the administration is conspiring to oust BLS leadership should be treated as another unserious conspiracy theory,” said White House spokeswoman Taylor Rogers.

She said “fake news” reporters are printing what she called “illogical nonsense.”…

… Commerce Secretary Howard Lutnick said in an interview with CNBC before the numbers were released on Friday that he believes the data will improve once more changes are made at the agency.

“I think they’ll get better because you’ll take out the people who are just trying to create noise against the president,” Lutnick said.“

- Messages

- 39,152

Dude, 8 long boxes full of Shadowhawk #1 are going to pay off.Don't get me wrong, I have benefited hugely from this period of growth (although if I invested more in stocks and less in comics, I'd be in a significantly better place financially). But, the implications behind why stocks are behaving the way they are... Yes, I know, part of it is smarter algorithms used by stockbrokers. And part of is that the rise of the crypto currency era is having some really odd reverberations on the stock market, but I can't help but feel like I am living through a giant ponzi scheme.

- Messages

- 8,132

I'm moving it slowly, but yes it will not be cash.

I have a stable index fund and several bond funds as options.

I just cannot afford a 50% or greater fall like we had with the housing bubble.

- Messages

- 2,468

It’s like musical chairs for adults. Adults that want suicide to not be the best option for leaving something to their children.I'm moving it slowly, but yes it will not be cash.

I have a stable index fund and several bond funds as options.

I just cannot afford a 50% or greater fall like we had with the housing bubble.

sringwal

Iconic Member

- Messages

- 2,174

There was a hot minute, during COVID, where that joke had spread far enough that newbies really believed it, and the book spiked to $50. It didn’t last longer than two weeks, but those were 14 glorious days.Dude, 8 long boxes full of Shadowhawk #1 are going to pay off.

There was a hot minute, during COVID, where that joke had spread far enough that newbies really believed it, and the book spiked to $50. It didn’t last longer than two weeks, but those were 14 glorious days.

Hah--I had no idea that was a bygone joke. I just tried to think of the worst 90s comic with the most speculation.

- Messages

- 3,831

Get ready for Trump to blame Sleepy Joe and too late Powell for the current jobs situation...

- Messages

- 5,077

Trump’s Treasury Secretary Threatens to Punch Housing Official in the Face

The dust-up, at a members-only club in Georgetown, was not the first time Scott Bessent has shown a hot temper.

Scott Bessent was fed up.

For weeks, the Treasury secretary believed that William J. Pulte, the director of the Federal Housing Finance Agency, was bad-mouthing him to President Trump.

And then, last Wednesday, the two men found each other face to face at the kickoff dinner for the Executive Branch, a members-only club in Georgetown started by the president’s eldest son and a few of his allies.

A back-and-forth by the bar ensued. Mr. Bessent demanded to know why Mr. Pulte was trash-talking him to the president, and then threatened to punch him in the face.

- Messages

- 3,831

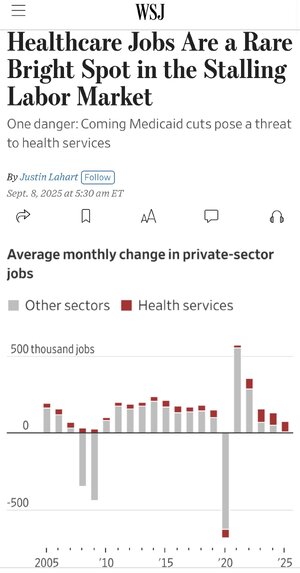

From March 2024- March 2025 BLS revision reports 911,000 fewer jobs were created. This revision should bolster the call for a rate cut this month. I was certain there would be 25bps reduction in rates but seeing this interesting revision, I'm guessing it could be a 50bps reduction.

Share: