Interesting ....Also I wonder about the impact on him of seeing his dad as an unemployed slacker (someone who plays or hobbies at a leisurely pace). I've heard the WFH era is giving kids unrealistic perspectives on the workworld since many traditional 'jobs' aren't so flexible.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Retirement

- Thread starter aGDevil2k

- Start date

- Replies: 188

- Views: 6K

I agree with you on the Roth conversions. The process of setting up a Roth Conversion gameplan requires making a bunch of assumptions on tax rates, tax bracket thresholds, IRMAA thresholds/rates; your spending needs etc. It also assumes that there won't be substantial alterations to the tax treatment of that Roth account. So you're doing a lot of manipulation in the hope that the rules stay the same for the next 20-30 years and your assumptions are somewhat accurate.The whole roth thing is an interesting thing. I have a 'super backdoor roth' but am really torn about whether to do the roth conversions the first few years of retirement when my tax bracket will be low. The premise is that it will reduce your mandatory withdrawals and thus your taxes. But I really don't worry about taxes so much when I'm projected to have more money that I could ever spend unless I really lose my mind with fossil collecting or crazy sports cars/real estate which I don't anticipate. I'm really struggling more with how much to leave the kids versus charitable options.

Travel will be a huge deal for as long as my wife and I are physically able but at the end of the day I will likely never touch the roth money. It all just seems like a lot of mental masturbation to try and be 'perfect' when I am already better off than 99.something% of all humans on the planet currently and likely 99.99999% of all humans who have ever lived. I'm aware that probably sounds like a brag but I'm just being honest on this thread and giving my perspective.

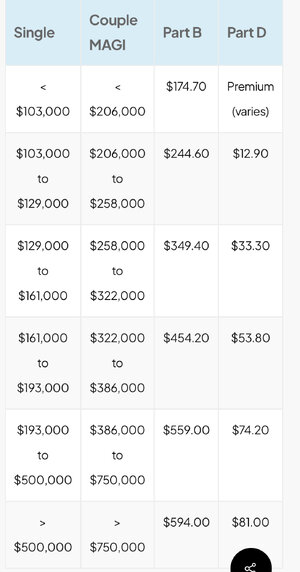

Depending on what I assume for rate of return assumptions, I can get a reasonable reduction of RMDs by using tax deferred accounts as the sole source to fund retirement. But that successful reduction breaks a bit with higher rates of return or if you sprinkle in 2-3 years of great returns. I think the real benefit of the Roth account is giving some flexibility for an unexpected expense that would push you past a different IRMAA threshold. That flexibility can be achieved with smaller conversions (IMO).

One disadvantage of having a single tax filing status is that there is not nearly as much room to make effective Roth conversions. I will probably do some smaller to moderate size conversions, but I don't think I'm going to try to min/max things.

- Messages

- 597

Hmmmm, IRMAA is new to me. I had not heard of this before. Something else to think on.IRMAA goes away a few years after you retire (as I recall they average the last three years?) It's a temporary thing, but it bit me in the ass the first few years of my retirement.

- Messages

- 3,950

You’ll have to look up the thresholds. Mine went away even though I still had a decent consulting income for 4 years after retirement. But I had a lot of income my last year working as I had equity in my employer and it was sold the year before my retirement.Does it though if you have a lot of pension income?

ETA:

- Messages

- 597

If I retire at 60, some of that may take care of itself. My income should go way down before I'm eligible for Medicare at 65.

I also need to figure out what age to start collecting SS. Right now my planner has me starting at 67.

I also need to figure out what age to start collecting SS. Right now my planner has me starting at 67.

sleehrat1955

Well-Known Member

- Messages

- 70

I just turned 69. My wife retired from banking career in 2018 with a decent pension and a great 401K that matched up to 6%. We scrimped and cut corners for years to maximize that 401k contribution. I closed my business also in 2018, although I still dabble part time to supplement my SS benefits. Damn I love socialism! SS and Medicare are wonderful, even though I recognize that I paid in at a rate of 14+% annually as a self employed wage earner. Advice to the younger generations: plan for retirement early; get advice (from parents, family members, coworkers or better yet a financial planner); find some enjoyment every day even during the drudgery and retire as early as you feel comfortable doing so. Time, especially quality time while you are healthy and can travel and do things, cannot be bought or replaced with more savings.

- Messages

- 3,913

I retired at 55yo and took SS at 62 yo.If I retire at 60, some of that may take care of itself. My income should go way down before I'm eligible for Medicare at 65.

I also need to figure out what age to start collecting SS. Right now my planner has me starting at 67.

I didn't need the SS benefit so I reinvested the SS income hoping that my ROI could match the yearly 8% increase in benefits by waiting...so far so good

Even without my ROI, my break even age was 82yo so for me it was a no brainer...

2ManyBlueCups

Esteemed Member

- Messages

- 625

Got in the state pension system early and should be able to retire before I hit 53. My wife is private sector and will have to work well into her 60s. She told me I better find something to do, because I won’t just be sitting at home all day. We are in our forever home and it should be paid off well before I retire, so hopefully expenses will be at a minimum. When the day comes, I’m going to try to work in something completely unrelated to my current career field just to stay busy and engaged.

- Messages

- 8,182

Same.Hmmmm, IRMAA is new to me. I had not heard of this before. Something else to think on.

Have to make it as complicated as possible, I guess.

- Messages

- 8,182

Agree.I retired at 55yo and took SS at 62 yo.

I didn't need the SS benefit so I reinvested the SS income hoping that my ROI could match the yearly 8% increase in benefits by waiting...so far so good

Even without my ROI, my break even age was 82yo so for me it was a no brainer...

There's probably a chance of me not reaching the breakeven point, so why wait?

- Messages

- 597

"Dying early" in my family tends to mean mid-80s, so I probably should hold out a bit on collecting. My last grandparent lived to 100... and was still hiking in the mountains in his mid-90s.

Centerpiece

Inconceivable Member

- Messages

- 3,285

Take the money as early as possible. You could get hit by a bread truck tomorrow

Centerpiece

Inconceivable Member

- Messages

- 3,285

And this, my friends, is the way to go.Got in the state pension system early and should be able to retire before I hit 53. My wife is private sector and will have to work well into her 60s. She told me I better find something to do, because I won’t just be sitting at home all day. We are in our forever home and it should be paid off well before I retire, so hopefully expenses will be at a minimum. When the day comes, I’m going to try to work in something completely unrelated to my current career field just to stay busy and engaged.

- Messages

- 3,950

In my case it is because my wife is 15 years younger than me. She is a teacher and has moved from state to state following my jobs, never staying in a single state long enough to get vested in their pension plan. She will get small payments from Ohio and California’s plans, but she teaches at a charter school in NC so she has a late start on a 401k. She will getting surviving spouse benefits from my social security and I wanted to make sure those payments are a large as possible when I’m gone. So it’s less about will I reach my breakeven point than what benefit will she receive.Agree.

There's probably a chance of me not reaching the breakeven point, so why wait?

I’ve only started taking withdrawals from my retirement account in the last two years. Fortunately, my earnings have exceeded my withdrawals and the balances in those accounts continue to increase. So I expect I will be leaving her in good shape, but I was trying to maximize her SS benefits so she can support her next husband!

Share: