As I understand it, IRMAA does not go away. It gets evaluated every year and is based on the most recently available tax return so it looks at the year prior to the year that is ending. 2025 would use 2023's tax return; 2026 would use 2024 and so on.

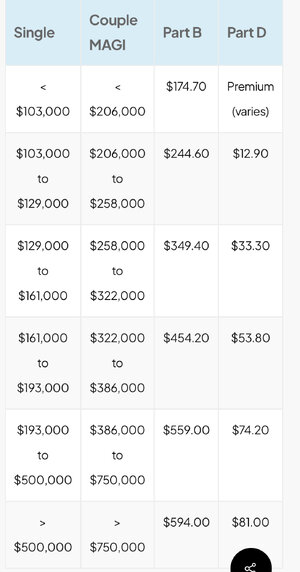

While it doesn't go away, if your taxable income goes below the threshold, you won't get a supplemental charge. The chart you had in that post is the total Medicare cost (ain't nothin free) but even if you are making below the IRMAA thresholds, you are still paying $175 a month. A bit clearer way to look at it is to look at the additional cost per level. The first threshold is $70/month or $840, the next three thresholds are each an extra $105/month or $1260 and that last threshold is $135/month or $1620. Going over the threshold is ok if it makes sense financially but you just don't want to go over by a small amount because it is a tax cliff and being over by $1 is the same cost as being over by $50k.

The year you turn 65, you won't go on Medicare until your birthday and thus won't have to pay IRMAA until then. So if you have a late birthday like I do (Oct), you would only have a few months of extra cost and it is less impactful if you have a lot of extra income when you were 63.

Notice that the IRMAA thresholds are close to income tax rate breaks but not the same. Also if you are doing Roth Conversions based on tax brackets, you will only have a guestimate where the IRMAA threshold will be 2 years later. However, it does seem like they move somewhat consistently and if you only fill up the 22/25% bracket, you are probably going to be below IRMAA, if you fill up the 24/28% bracket, you are going to trigger multiple IRMAA brackets, but you probably will be slightly below the 4th level. For example, the first 2024 IRMAA charge comes at $103k ($206k married) while the 2022 22% tax bracket goes up to $89k so there was plenty of room between the top of 22% and the first IRMAA charge. On the other hand, if you filled up your 24% bracket in 2022, you would be in the 3rd level IRMAA for 2024 and close to but safely under the 4th level ($182k income v $193k threshold).