Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market/Investing/Fin Planning Catch-All

- Thread starter heelslegup

- Start date

- Replies: 860

- Views: 35K

- Off-Topic

KishiKaisei

Distinguished Member

- Messages

- 349

Trump Media & Technology Group Corp. (DJT) Stock Price Today, Quote, Latest Discussions, Interactive Chart and News

Track Trump Media & Technology Group Corp. (DJT) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get valuable insights from the community of like minded traders and investors

Centerpiece

Inconceivable Member

- Messages

- 3,373

Apparently the Feds should have cut interest rates in July. Waiting too long and the market is selling off in hard response.Serious question because I am clueless

What does "the stock market" want the Fed to do?

Centerpiece

Inconceivable Member

- Messages

- 3,373

But I don’t know anything, I just googled itApparently the Feds should have cut interest rates in July. Waiting too long and the market is selling off in hard response.

- Messages

- 2,032

Part 2:

Grandma works her entire life to give her grandson enough wealth to never have to worry about retirement. Grandson the second he gets his inheritance: yeah, go ahead and put it all on red.

I hate to laugh at the kid because I'm sure he's curled up in the fetal position wanting to vomit but...

Grandma works her entire life to give her grandson enough wealth to never have to worry about retirement. Grandson the second he gets his inheritance: yeah, go ahead and put it all on red.

I hate to laugh at the kid because I'm sure he's curled up in the fetal position wanting to vomit but...

p5mmr9

Distinguished Member

- Messages

- 429

I'm not sure what you are asking. Are you asking why is the market in free fall the last few days? Or are you asking generally what does the "market" want the Fed to do as a long term strategy?Serious question because I am clueless

What does "the stock market" want the Fed to do?

Regarding the former - we've had a run of bad readings on important economic indicators in addition to a number of very large company revenue misses (and shitty future guidances). This combined with the market being overbought (at least by historical p/e ratio standards) has nudged the market off the edge a bit. Quite frankly the NASDAQ was due - we've been riding this NVIDIA AI wave for far longer than it deserves.

As for the latter - in simplified terms - the market wants the Fed to cut its benchmark rates to make lending cheaper so businesses can better utilize credit to expand and grow. This is the gasoline that fuels a significant part of our economy. I expect the Fed WILL cut rates very soon.

Last edited:

heelslegup

Esteemed Member

- Messages

- 635

S&P500 Calendar Year Returns

1moretimeagain

Inconceivable Member

- Messages

- 4,109

Serious question because I am clueless

What does "the stock market" want the Fed to do?

Stock market wants lower rates, but wants the rates lower as a result of inflation subsiding. If rates are being lowered due to a slowing economy then the situation becomes more complicated for stock prices.

Bigs23

Inconceivable Member

- Messages

- 3,076

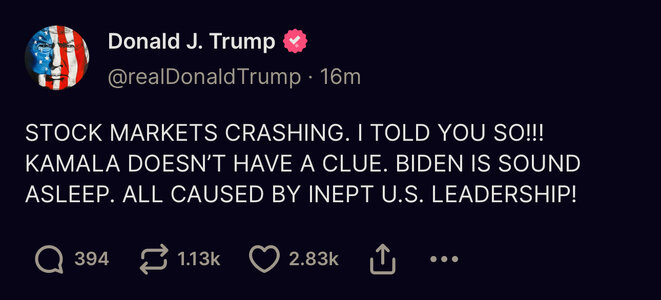

He thinks Kamala is controlling the market?

He never disappoints.

WayneThaDrain

Member

- Messages

- 3

I’m taking a bath this morning

HeelYeah2012

Honored Member

- Messages

- 853

Seems like today is going to be a bad day

- Messages

- 4,066

What is the current Democratic definition of a recession ?Wonder if the Democrats are going to have the definition of a recession changed again?

CallMeTyler

Esteemed Member

- Messages

- 614

I suspect you know very little about the market and what drives a dip like we're seeing. Maybe you'll surprise me.But we have been told countless times how great the economy is based on the stock market correct?

I mean... how many lower-middle class people wake up each day, grab their WSJ and head over to the stock reports?

At least you have a POTUS that is out in front of this and a nominee that has been taking daily questions from the media that are scripted and read from a teleprompter.....

Sorry.... I'm getting told that those statements are false....

Buckle up America... we are watching a crash and potential war in the Middle East.... let's see how this gets blamed on President Trump.

Should I have shown similar concern when the market dipped in April? What followed that?

There's a massive unwind of Yen carrying trade positions contributing to the sharp declines in US stocks. Primarily, traders were borrowing JPY at low rates, converting to USD, and using this to purchase stocks.

The BOJ is raising rates, thus strengthening the JPY against the USD.

Traders now paying higher rates of interest, and the assets won't cover, thus the unwind and margin calls. Sell of US stocks to raise USD, convert to JPY, and pay back the loans = selloff and dip.

Now, point to Biden's economic policy, and be specific, so you can counter the drivers in the market. BE SPECIFIC (can't emphasize this point enough).

camvilpack

Member

- Messages

- 4

Very happy to see this thread over here. I miss the stock market / investing thread over on the now VIP-only Brickyard!Reason to invest if at all possible in your situation. Data from Ritholtz Asset Mgmt. Bottom line re average stock market returns. Positive 3 out of 4 years. The average gain in positive years is much greater than the average loss in down years.

Study of rolling one-year returns 1926-today (late 2023)[TR]

Market up 75% of those years

UP YEARS

40% or more 6.7% of time

30% or more 18,4%

20% or more 34%

10% or more 57%

DOWN

40% or more 1%

30% or more 3%

20% or more 6%

10% or more 12.9%

[td width="44px"][/td]

[td width="520.008px"]ReplyForward

Add reaction[/td]

[/TR]

I’ve been watching some of the Ramsey show on YouTube (for pure entertainment purposes) recently while walking or just bored, and every now and then he throws out a good nugget of information. Now, what I am about to quote him on, I have not researched to see how true it is.

But, it relates to some of the “I have a lump some of money…should I invest it in the market…put it in my 4% savings account…etc?” The question he always asks is “How soon do you need the money?”

He has said a few times, “If you look at every 5-year period in the history of market, the market has a gain 97% of the time. And every 3-year period has a gain 67% of the time (or something like that).” He recommends (keeping in mind the population to which he is speaking) if you expect to need the money in 2-3 years, put it in savings. If you don’t need the money for 4 or 5 years or more, dump it in the market, into whatever mutual fund you like (similar funds that people here are referencing).

I’ve recently (last couple of years) reshuffled my 401(k) and IRAs to have a 90/10 risk with the 90 being made up of a few different large cap type funds (large cap growth, large cap value, and something closer to QQQ) and the 10 being made up of 5% bonds and 5% Target Date funds (I’m 15-20 years from retirement). Before that, I was more in a 75/25 mix.

It does look like today is going to be an uppercut, but I never look fewer than 3-5 years out when “worrying” about the market. As others have said here, if we get a huge decline it may give me the chance to do some Roth conversions. We haven’t been able to contribute to a Roth for a really long time due to our MFJ income, but would like to get some more Roth as part of our retirement to avoid some RMDs in retirement.

Edited to add: I keep some play money in a Fidelity brokerage account, really just money to buy my next new (errr…slightly used) car with cash. It’s sitting at about 48% FXAIX, 29% FSPGX, 19% QQQ, and 4% NVDA. I dump a little into it every month, with the occasional extra contribution every now and then.

Last edited:

Share: