Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tariffs Catch-All

- Thread starter BubbaOtis

- Start date

- Replies: 5K

- Views: 178K

- Politics

ChileG

Inconceivable Member

- Messages

- 3,169

Thank you to everyone who voted for Trump or third party. Really appreciate your hand in crashing the economy.

ChileG

Inconceivable Member

- Messages

- 3,169

Yes there is another way to interpret that.So… Trump is basically putting a feeler out for bribes for tariff exemptions here, right? Is there another way to interpret that comment?

Biden Crime Family!!!!!111111111111

- Messages

- 8,302

Once a conman...So… Trump is basically putting a feeler out for bribes for tariff exemptions here, right? Is there another way to interpret that comment?

ChileG

Inconceivable Member

- Messages

- 3,169

Do Trump voters even know this happened in his last administration because of the tariffs? Will they be aware it is happening this time?

I’ll bet dollars to donuts the cost of bailing out the farmers will be more than any cuts DOGE makes.

ChileG

Inconceivable Member

- Messages

- 3,169

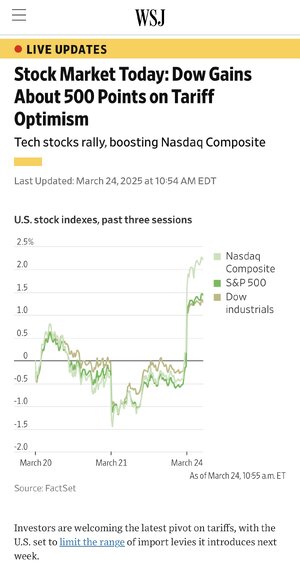

Sounds like maybe a positive thing until you read the article under the headline, unfortunately.

B.C. food bank received surge of U.S. produce as Canadians avoided buying it

- Messages

- 41,551

China Explores Limiting Its Own Exports to Mollify Trump

Chinese officials weigh Japan’s 1980s strategy—restraining exports while charging more—for products such as electric vehicles or batteries

GIFT LINK

“… Now, faced with an even greater economic assaultfrom the second Trump presidency at a time of sluggish growth at home, Beijing may take a page from Tokyo’s playbook—on one specific issue it sees as in its own interest.

Like Japan decades ago, China is considering trying to blunt greater U.S. tariffs and other trade barriers by offering to curb the quantity of certain goods exported to the U.S., according to advisers to the Chinese government.

Tokyo’s adoption of so-called voluntary export restraints, or VERs, to limit its auto shipments to the U.S. in the 1980s helped prevent Washington from imposing higher import duties. …”

superrific

Master of the ZZLverse

- Messages

- 12,447

To be clear, a Voluntary Export Restraint is just a tariff where the home country keeps all the revenue. If China VERs its EV industry, it will lead to higher prices in the US. It's just that the higher prices will remain in the producer's pocket, because they are limiting themselves to inframarginal sales; the US will get nothing.

I had forgotten about VERs, but they are close cousins to Export Duties. I have said (and it appears to have been borne out) that Trump was going to lose his fucking mind when he found about Export Duties. If he understood VERs, he would lose his mind about them too . . .. but he will probably interpret the VER as a sign of obedience (they aren't), and soon he will be insisting other countries adopt VERs. Which, again, have all the downsides of tariffs and none of the upsides.

I had forgotten about VERs, but they are close cousins to Export Duties. I have said (and it appears to have been borne out) that Trump was going to lose his fucking mind when he found about Export Duties. If he understood VERs, he would lose his mind about them too . . .. but he will probably interpret the VER as a sign of obedience (they aren't), and soon he will be insisting other countries adopt VERs. Which, again, have all the downsides of tariffs and none of the upsides.

- Messages

- 41,551

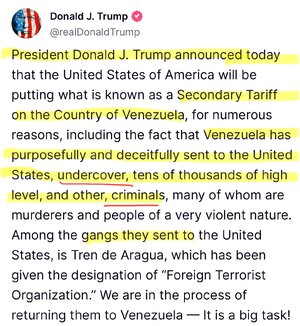

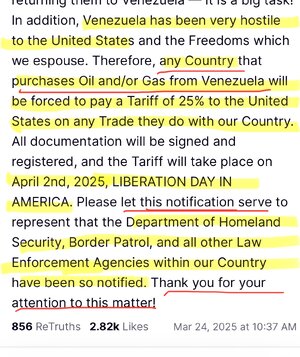

White House Narrows April 2 Tariffs

Tariffs on industrial sectors like cars and microchips are no longer expected to be announced on that date, though major trading partners will still be hit with so-called reciprocal tariffs

“… President Trump has declared his April 2 deadline to be “Liberation Day” for the U.S., when he will put in place so-called reciprocal tariffs that seek to equalize U.S. tariffs with the duties charged by trading partners, as well as tariffs on sectors like automobiles, pharmaceuticals and semiconductors he repeatedly said would be enacted on that day.

Those sector-specific tariffs, however, are now not likely to be announced on April 2, said an administration official, who said the White House is still planning to unveil the reciprocal tariff action on that day, though planning remains fluid. The shift was earlier reported by Bloomberg.

The fate of the sectoral tariffs, as well as tariffs on Canada and Mexico that Trump said were justified by fentanyl trafficking, remains uncertain. The White House didn’t respond to requests for comment on if or when any of those tariffs are still planned to go into effect.

…

The focus of the reciprocal action now looks to be more targeted than originally thought, according to people with knowledge of the planning, though it will still hit countries that account for most of the U.S.’s imports.

The administration is now focusing on applying tariffs to about 15% of nations with persistent trade imbalances with the U.S.—a so-called “dirty 15,” as Treasury Secretary Scott Bessent put it last week. Those nations, which Bessent said account for most of the U.S.’s foreign trade, will be especially hard-hit with higher tariffs, said people with knowledge of the matter, though other nations could be given more modest tariffs as well.

Targeted nations are expected to be close to those laid out by the U.S. trade representative in a Federal Register notice last month, which directed commenters to focus on nations with trade imbalances with the U.S., such as the G-20 nations and Australia, Brazil, Canada, China, the European Union, India, Japan, South Korea, Mexico, Russia, Vietnam and more, said a person with knowledge of the plans. …”

p5mmr9

Distinguished Member

- Messages

- 432

They can do this under the de minimis provision assuming they ship less than a value $800 at a time from the secondary warehouse, but considering the current state of tariffs with Mexico and Canada - you'd have to go out of your way to find an amenable situation. They should consider re-sourcing their product to other countries outside China at this point. There has been a lot of chatter about eliminating de minimis. And if Trump eventually starts issuing tariffs on developing nations (other than China) - then I don't know where some of these low cost items will be produced.I have a young friend that works for a large outfit in the Triangle that is in the LED business-very reliant on Chinese imports. She says some of her customers are talking about setting up logistics to have Chinese goods send to another country , then exported here.... etc

Crazy times

Mulberry Heel

Inconceivable Member

- Messages

- 3,998

Also, I thought Trumpers and Republicans generally hated socialism and "government handouts." Yet if the government gives billions of dollars to farmers to keep them afloat because of Trump's disastrous trade policies then what is that but government handouts and big-government socialism propping up an industry that is failing? And as you pointed out, this already happened during Trump's first term when his disastrous trade policies hammered American farmers. I remember reading an article that said that a majority of farmer's "profits" at the end of his first term were actually coming from government handouts, not real profits made from selling their food and other products. I've said this before, but Trumpers and conservatives don't really mind socialism or handouts, and will gladly accept them, they just want them directed at the "right" people and not minorities or other "unworthy" poors.Do Trump voters even know this happened in his last administration because of the tariffs? Will they be aware it is happening this time?

I’ll bet dollars to donuts the cost of bailing out the farmers will be more than any cuts DOGE makes.

- Messages

- 41,551

ChileG

Inconceivable Member

- Messages

- 3,169

It’s weird…our resident “HYPOCRITE” monitor hasn’t opined on this phenomenon.Also, I thought Trumpers and Republicans generally hated socialism and "government handouts." Yet if the government gives billions of dollars to farmers to keep them afloat because of Trump's disastrous trade policies then what is that but government handouts and big-government socialism propping up an industry that is failing? And as you pointed out, this already happened during Trump's first term when his disastrous trade policies hammered American farmers. I remember reading an article that said that a majority of farmer's "profits" at the end of his first term were actually coming from government handouts, not real profits made from selling their food and other products. I've said this before, but Trumpers and conservatives don't really mind socialism or handouts, and will gladly accept them, they just want them directed at the "right" people and not minorities or other "unworthy" poors.

ChapelHillSooner

Iconic Member

- Messages

- 1,370

The constant threats and removals of tariffs are really making Trump look weak. If a bully refuses time and time again to make good on his threats they become irrelevant.

Small governments may be forced to play along with Trump's game because he can afford to hit them back. But the EU should absolutely call his bluff and dare him to make good on the tariffs. You can't continue to appease a bully and when one is clearly not willing to make good on his threats then it is time to go on the offensive.

Trump has given them an opening to make him look incredibly weak. Force him into a lose/lose proposition. Back down after they directly challenged him or initiate tariffs and destroy his own economy.

International leaders have tried to appease Trump for far too long and it has cost them because giving even a perceived victory to Trump encourages more and more bad behavior.

Small governments may be forced to play along with Trump's game because he can afford to hit them back. But the EU should absolutely call his bluff and dare him to make good on the tariffs. You can't continue to appease a bully and when one is clearly not willing to make good on his threats then it is time to go on the offensive.

Trump has given them an opening to make him look incredibly weak. Force him into a lose/lose proposition. Back down after they directly challenged him or initiate tariffs and destroy his own economy.

International leaders have tried to appease Trump for far too long and it has cost them because giving even a perceived victory to Trump encourages more and more bad behavior.

- Messages

- 774

Next tariff annooncement, an extra 10% on countries that sent their criminals here to eat our family pets. Then a few weeks later when the market is down more, he will rescind tariffs against cat eaters, they are fine. But we must protect our dogs. Stock market up 1.75% that day.

Share: