Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tariffs Catch-All

- Thread starter BubbaOtis

- Start date

- Replies: 5K

- Views: 178K

- Politics

circlesky88

Esteemed Member

- Messages

- 619

evrheel

Esteemed Member

- Messages

- 587

Changing from an income tax to a national sales tax

- Messages

- 41,587

Trump to Soften Blow of Automotive Tariffs

Companies paying Trump’s car tariffs won’t also be charged for other levies

“President Trump is expected to soften the impact of his automotive tariffs, preventing duties on foreign-made cars from stacking on top of other tariffs he has imposed and easing some levies on foreign parts used to manufacture cars in the U.S., according to people familiar with the matter.

The decision will mean that automakers paying Trump’s automotive tariffs won’t also be charged for other duties, such as those on steel and aluminum, according to people familiar with the policy. The move would be retroactive, the people said, meaning that automakers could be reimbursed for such tariffs already paid. The 25% tariff on finished foreign-made cars went into effect early this month.

The administration will also modify its tariffs on foreign auto parts—slated to be 25% and effective May 3—allowing automakers to be reimbursed for those tariffs up to an amount equal to 3.75% of the value of a U.S.-made car for one year. The reimbursement would fall to 2.75% of the car’s value in a second year, and then be phased out altogether.

Trump is expected to take the actions ahead of a trip to Michigan for a rally outside Detroit on Tuesday evening, marking 100 days since he took office. …”

——

- Messages

- 41,587

“… The steps are meant to provide automakers time to move supply chains for parts back to the U.S., and would likely be a significant boost to automakers in the short term, said one person familiar with the plan.Trump to Soften Blow of Automotive Tariffs

Companies paying Trump’s car tariffs won’t also be charged for other levies

“President Trump is expected to soften the impact of his automotive tariffs, preventing duties on foreign-made cars from stacking on top of other tariffs he has imposed and easing some levies on foreign parts used to manufacture cars in the U.S., according to people familiar with the matter.

The decision will mean that automakers paying Trump’s automotive tariffs won’t also be charged for other duties, such as those on steel and aluminum, according to people familiar with the policy. The move would be retroactive, the people said, meaning that automakers could be reimbursed for such tariffs already paid. The 25% tariff on finished foreign-made cars went into effect early this month.

The administration will also modify its tariffs on foreign auto parts—slated to be 25% and effective May 3—allowing automakers to be reimbursed for those tariffs up to an amount equal to 3.75% of the value of a U.S.-made car for one year. The reimbursement would fall to 2.75% of the car’s value in a second year, and then be phased out altogether.

Trump is expected to take the actions ahead of a trip to Michigan for a rally outside Detroit on Tuesday evening, marking 100 days since he took office. …”

——

Automakers would have to apply to the government for reimbursements, and it wasn’t immediately clear where those funds would come from.“

Mulberry Heel

Inconceivable Member

- Messages

- 4,000

Oh, I'm sure that will make everything better! So Trump 2.0 has already reached the stage of "trying to put financial band aids over the gaping wounds our own administration has cut into our economy." Their whole (at least public) rationale for DOGE cuts was to save the government money and help fix the budget deficit, but now they're going to spend vastly more than they've "saved" (which in itself is a dubious claim) to bail out everyone from the damage their own trade wars have caused. It's insanity, pure insanity, and yet there are still plenty of people arguing that everything is perfectly fine and normal and Dear Leader is still a smashing success.Trump to Soften Blow of Automotive Tariffs

Companies paying Trump’s car tariffs won’t also be charged for other levies

“President Trump is expected to soften the impact of his automotive tariffs, preventing duties on foreign-made cars from stacking on top of other tariffs he has imposed and easing some levies on foreign parts used to manufacture cars in the U.S., according to people familiar with the matter.

The decision will mean that automakers paying Trump’s automotive tariffs won’t also be charged for other duties, such as those on steel and aluminum, according to people familiar with the policy. The move would be retroactive, the people said, meaning that automakers could be reimbursed for such tariffs already paid. The 25% tariff on finished foreign-made cars went into effect early this month.

The administration will also modify its tariffs on foreign auto parts—slated to be 25% and effective May 3—allowing automakers to be reimbursed for those tariffs up to an amount equal to 3.75% of the value of a U.S.-made car for one year. The reimbursement would fall to 2.75% of the car’s value in a second year, and then be phased out altogether.

Trump is expected to take the actions ahead of a trip to Michigan for a rally outside Detroit on Tuesday evening, marking 100 days since he took office. …”

——

evrheel

Esteemed Member

- Messages

- 587

Easier said, than done“… The steps are meant to provide automakers time to move supply chains for parts back to the U.S., and would likely be a significant boost to automakers in the short term, said one person familiar with the plan.

Automakers would have to apply to the government for reimbursements, and it wasn’t immediately clear where those funds would come from.“

ChapelHillSooner

Iconic Member

- Messages

- 1,370

So I did a little investigation into the number of SPY call contracts that were 0 day to expiration and 3-5% out of money on 4/8/25 and 4/9/25 with 15 minute intervals.

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 09:30:00: 14943

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 09:45:00: 13931

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 10:00:00: 15885

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 10:15:00: 9212

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 10:30:00: 6919

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 10:45:00: 17603

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 11:00:00: 7516

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 11:15:00: 4133

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 11:30:00: 1668

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 11:45:00: 1944

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 12:00:00: 681

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 12:15:00: 2404

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 12:30:00: 1283

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 12:45:00: 1223

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 13:00:00: 1477

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 13:15:00: 834

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 13:30:00: 745

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 13:45:00: 702

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 14:00:00: 795

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 14:15:00: 96

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 14:30:00: 161

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 14:45:00: 114

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 15:00:00: 47

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 15:15:00: 515

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 15:30:00: 535

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 15:45:00: 193

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 16:00:00: 68

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 09:30:00: 30069

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 09:45:00: 32191

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 10:00:00: 39518

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 10:15:00: 20807

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 10:30:00: 24962

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 10:45:00: 26113

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 11:00:00: 17208

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 11:15:00: 19535

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 11:30:00: 16069

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 11:45:00: 16586

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 12:00:00: 35942

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 12:15:00: 18114

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 12:30:00: 10787

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 12:45:00: 24442

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 13:00:00: 71422

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 13:15:00: 48368

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 13:30:00: 5879

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 13:45:00: 4430

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 14:00:00: 4415

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 14:15:00: 1970

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 14:30:00: 779

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 14:45:00: 652

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 15:00:00: 2081

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 15:15:00: 1517

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 15:30:00: 1185

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 15:45:00: 3037

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 16:00:00: 732

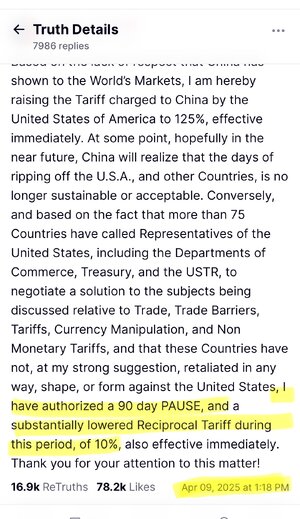

The number of far OOM calls made on 4/9 were significantly higher than on 4/8. That would be expected because Trump posted it was a good time to buy early in the day on 4/9. However, the spike from 12:45-13:15 is significant. I can't get a timestamp on Trump's post to delay tariffs but it appears the S&P didn't take off until about 13:18-13:19 which means the aforementioned spike happened before the post was made.

So, it definitely seems to me that someone reacted right before the post was made.

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 09:30:00: 14943

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 09:45:00: 13931

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 10:00:00: 15885

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 10:15:00: 9212

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 10:30:00: 6919

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 10:45:00: 17603

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 11:00:00: 7516

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 11:15:00: 4133

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 11:30:00: 1668

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 11:45:00: 1944

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 12:00:00: 681

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 12:15:00: 2404

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 12:30:00: 1283

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 12:45:00: 1223

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 13:00:00: 1477

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 13:15:00: 834

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 13:30:00: 745

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 13:45:00: 702

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 14:00:00: 795

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 14:15:00: 96

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 14:30:00: 161

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 14:45:00: 114

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 15:00:00: 47

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 15:15:00: 515

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 15:30:00: 535

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 15:45:00: 193

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 16:00:00: 68

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 09:30:00: 30069

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 09:45:00: 32191

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 10:00:00: 39518

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 10:15:00: 20807

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 10:30:00: 24962

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 10:45:00: 26113

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 11:00:00: 17208

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 11:15:00: 19535

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 11:30:00: 16069

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 11:45:00: 16586

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 12:00:00: 35942

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 12:15:00: 18114

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 12:30:00: 10787

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 12:45:00: 24442

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 13:00:00: 71422

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 13:15:00: 48368

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 13:30:00: 5879

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 13:45:00: 4430

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 14:00:00: 4415

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 14:15:00: 1970

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 14:30:00: 779

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 14:45:00: 652

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 15:00:00: 2081

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 15:15:00: 1517

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 15:30:00: 1185

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 15:45:00: 3037

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 16:00:00: 732

The number of far OOM calls made on 4/9 were significantly higher than on 4/8. That would be expected because Trump posted it was a good time to buy early in the day on 4/9. However, the spike from 12:45-13:15 is significant. I can't get a timestamp on Trump's post to delay tariffs but it appears the S&P didn't take off until about 13:18-13:19 which means the aforementioned spike happened before the post was made.

So, it definitely seems to me that someone reacted right before the post was made.

- Messages

- 41,587

So I did a little investigation into the number of SPY call contracts that were 0 day to expiration and 3-5% out of money on 4/8/25 and 4/9/25 with 15 minute intervals.

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 09:30:00: 14943

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 09:45:00: 13931

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 10:00:00: 15885

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 10:15:00: 9212

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 10:30:00: 6919

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 10:45:00: 17603

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 11:00:00: 7516

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 11:15:00: 4133

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 11:30:00: 1668

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 11:45:00: 1944

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 12:00:00: 681

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 12:15:00: 2404

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 12:30:00: 1283

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 12:45:00: 1223

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 13:00:00: 1477

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 13:15:00: 834

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 13:30:00: 745

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 13:45:00: 702

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 14:00:00: 795

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 14:15:00: 96

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 14:30:00: 161

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 14:45:00: 114

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 15:00:00: 47

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 15:15:00: 515

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 15:30:00: 535

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 15:45:00: 193

CALL CONTRACTS (OOM 3%-5%) at 2025-04-08 16:00:00: 68

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 09:30:00: 30069

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 09:45:00: 32191

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 10:00:00: 39518

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 10:15:00: 20807

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 10:30:00: 24962

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 10:45:00: 26113

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 11:00:00: 17208

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 11:15:00: 19535

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 11:30:00: 16069

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 11:45:00: 16586

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 12:00:00: 35942

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 12:15:00: 18114

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 12:30:00: 10787

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 12:45:00: 24442

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 13:00:00: 71422

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 13:15:00: 48368

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 13:30:00: 5879

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 13:45:00: 4430

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 14:00:00: 4415

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 14:15:00: 1970

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 14:30:00: 779

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 14:45:00: 652

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 15:00:00: 2081

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 15:15:00: 1517

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 15:30:00: 1185

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 15:45:00: 3037

CALL CONTRACTS (OOM 3%-5%) at 2025-04-09 16:00:00: 732

The number of far OOM calls made on 4/9 were significantly higher than on 4/8. That would be expected because Trump posted it was a good time to buy early in the day on 4/9. However, the spike from 12:45-13:15 is significant. I can't get a timestamp on Trump's post to delay tariffs but it appears the S&P didn't take off until about 13:18-13:19 which means the aforementioned spike happened before the post was made.

So, it definitely seems to me that someone reacted right before the post was made.

ChapelHillSooner

Iconic Member

- Messages

- 1,370

I take back my previous post. I wasn't yet able to figure out how to get the SPY price at the time the option was bought to figure out whether the option was 3-5% OOM so I used the price at the start of the day. I was able to figure out how to get the more granular prices, and while the price didn't move significantly before 1 PM that day, it moved enough to skew the results.

superrific

Master of the ZZLverse

- Messages

- 12,447

Like my dad always used to say, never bring a knife to an escalation letter fight

superrific

Master of the ZZLverse

- Messages

- 12,447

What Bessent said there might well be the wussiest quote ever from any American cabinet member. "Very anxious not to have to use it?"

- Messages

- 5,217

Apollo Global Management forecasts a severe U.S. recession triggered by recent tariffs, which will lead to widespread layoffs in the trucking and retail sectors amid rising economic uncertainty.

The report, available on Apollo’s website, paints a grim scenario:

The trucking industry, critical to U.S. logistics, faces significant challenges as tariffs disrupt trade, particularly with China. A sharp decline in container ship voyages from China is expected to reduce freight volumes, thereby lowering demand for trucking services. Imports account for an estimated 20% of U.S. trucking volumes, so a decline in imports will have a significant impact on the industry. With fewer goods to transport, carriers will face reduced workloads and underutilized fleets, forcing them to cut labor costs.

Apollo predicts that domestic freight activity will sharply slow by mid-May, with mass layoffs likely to follow as firms strive to maintain financial stability. The slowdown in trucking will put a lot of pressure on trucking companies that have been dealing with the Great Freight Recession, one of the longest and deepest downturns in history.

- Messages

- 5,217

Well it's not like a tariff caused farm crisis is imminent or anything.

coloradosun.com

coloradosun.com

Colorado farmers just lost their most important mental health lifeline

Farmers and ranchers, with a suicide rate twice as high as the average population, will no longer have access to AgWell mental health program.

coloradosun.com

coloradosun.com

- Messages

- 5,217

related: JD Vance Funded AcreTrader. Here’s Why That Matters.Well it's not like a tariff caused farm crisis is imminent or anything.

Colorado farmers just lost their most important mental health lifeline

Farmers and ranchers, with a suicide rate twice as high as the average population, will no longer have access to AgWell mental health program.coloradosun.com

ZenMode

Legend of ZZL

- Messages

- 6,375

I suspect the pain from Trump's tariff games is en route.

Trans-Pacific blank sailings soar as ocean shipments plunge

Tariffs hammer China export container volumes

www.freightwaves.com

www.freightwaves.com

Trans-Pacific blank sailings soar as ocean shipments plunge

Tariffs hammer China export container volumes

Trans-Pacific blank sailings soar as ocean shipments plunge

Container shipping capacity on the Asia-U.S. trade route has sharply declined as carriers ramp up blank sailings.

www.freightwaves.com

www.freightwaves.com

Last edited:

bassydude77

Distinguished Member

- Messages

- 282

Just posted this on the markets thread, but probably fits better here.

It certainly "feels" like we are already in a recession. We've had the slowest start to the year in the 11yrs we've been in business. May tends to be when things pick up, so we'll see what happens. I'm trying to not be too pessimistic as I know my feelings toward the current administration are largely driving my feelings around the economy. I assume there are plenty of MAGA still dancing around thinking it is the best economy in history and somehow "feel" that their groceries are now costing less....

It certainly "feels" like we are already in a recession. We've had the slowest start to the year in the 11yrs we've been in business. May tends to be when things pick up, so we'll see what happens. I'm trying to not be too pessimistic as I know my feelings toward the current administration are largely driving my feelings around the economy. I assume there are plenty of MAGA still dancing around thinking it is the best economy in history and somehow "feel" that their groceries are now costing less....

- Messages

- 41,587

GM Pulls Profit Guidance, Citing ‘Significant’ Tariff Impact

Detroit automaker’s net income slid 6.6% in the first quarter on weaker sales of highly profitable trucks and SUVs

“…

“Given the evolving nature of the situation, we believe the future impact of tariffs could be significant,” Jacobson told reporters on a call Monday evening.

GM reported quarterly earnings Tuesday morning but said it would delay its analysts call until Thursday, an unusual move that underscores the rapidly shifting trade environment.

Trump is expected to soften the impact of auto tariffs, actions that will be taken ahead of a trip to Michigan for a rally Tuesday evening, The Wall Street Journal reported late Monday. …”

——

The base incompetence of the Trump tariff decisions cannot be overstated.

- Messages

- 41,587

Also a lot of weird blips in GM’s TTM data … recovery from the UAW strike last year and a pre-tariff bump in auto purchases in the first quarter this year makes for some unusual events buffeting what would usually be hailed as a strong report …GM Pulls Profit Guidance, Citing ‘Significant’ Tariff Impact

Detroit automaker’s net income slid 6.6% in the first quarter on weaker sales of highly profitable trucks and SUVs

—> https://www.wsj.com/business/autos/...80?st=prEvjt&reflink=mobilewebshare_permalink

“…

“Given the evolving nature of the situation, we believe the future impact of tariffs could be significant,” Jacobson told reporters on a call Monday evening.

GM reported quarterly earnings Tuesday morning but said it would delay its analysts call until Thursday, an unusual move that underscores the rapidly shifting trade environment.

Trump is expected to soften the impact of auto tariffs, actions that will be taken ahead of a trip to Michigan for a rally Tuesday evening, The Wall Street Journal reported late Monday. …”

——

The base incompetence of the Trump tariff decisions cannot be overstated.

Share: