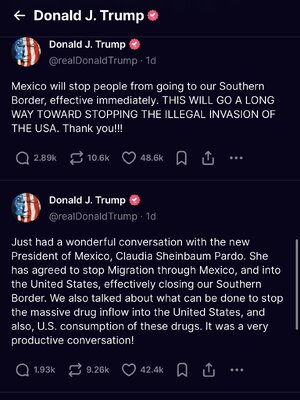

President-elect Donald Trump said Wednesday that he had a “productive conversation” with Mexican President Claudia Sheinbaum, their first talks since Trump announced tariffs against the US’ southern neighbor.

amp.cnn.com

Mexico’s president denies Trump’s claim that she agreed to shut down the US-Mexico border

“Mexican President Claudia Sheinbaum denied proposing to US President-elect Donald Trump that Mexico will close its border with the United States as he claimed in a post on Truth Social.

“Everyone has their own way of communicating, but I can assure you, I give you the certainty that we would never — and we would be incapable of it — propose that we would close the border,” Sheinbaum said during her regular morning news conference Thursday.

“It has never been our approach and of course we don’t agree with that.”

…In her own statement about the conversation, Sheinbaum said she shared Mexico’s immigration strategy with the president-elect and stressed that her country’s “position is not to close borders.”

“In our conversation with President Trump, I explained to him the comprehensive strategy that Mexico has followed to address the migration phenomenon, respecting human rights,”

Sheinbaum said Wednesday on X. Thanks to this, migrants and caravans are assisted before they arrive at the border. We reiterate that Mexico’s position is not to close borders but to build bridges between governments and between peoples.”

Sheinbaum had previously said that Mexico has worked with the Biden administration to address the flow of migrants through the country, leading to a 75% reduction in US border crossings over the past year.

And after the call with Trump on Wednesday, she did not outline any new policies she planned to put in place in order to avoid tariffs, focusing instead on how her country had already acted to address the crisis. …”